9/6/2022

Sep 06, 2022

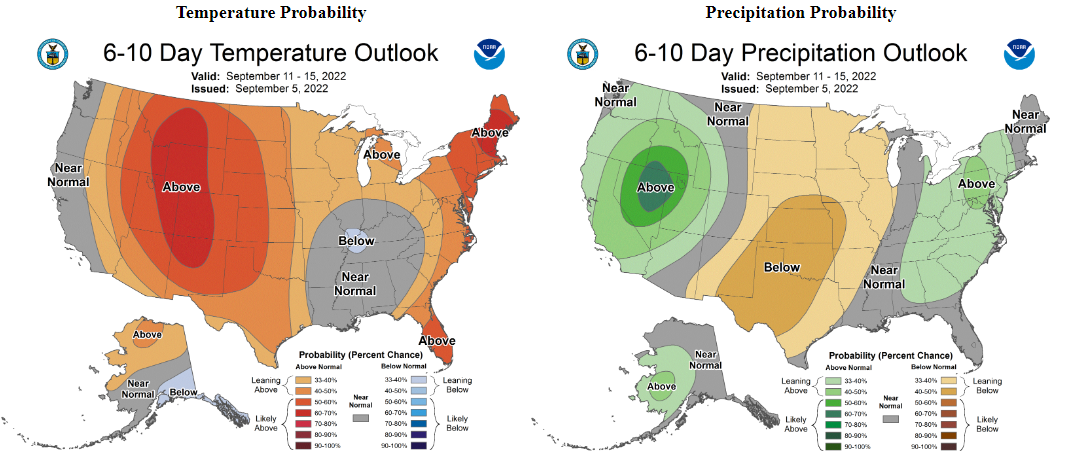

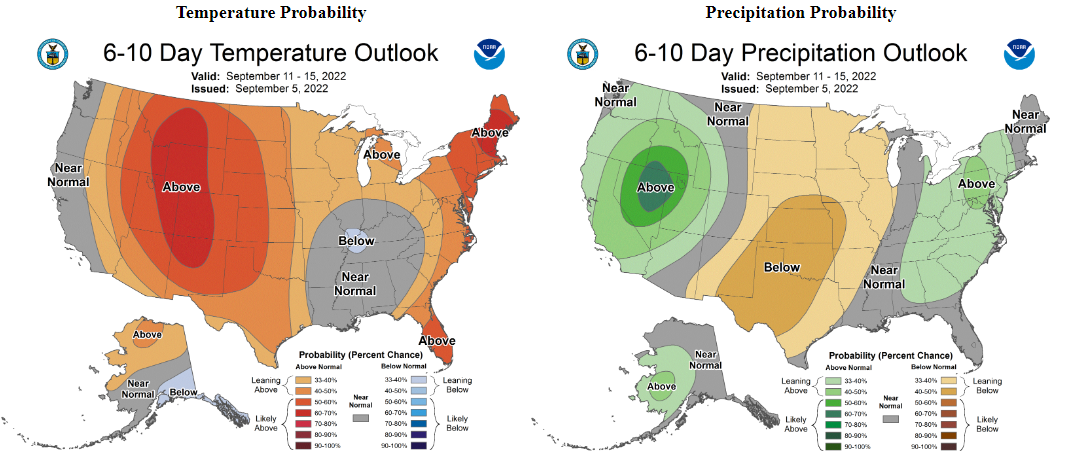

Corn was able to ignore the weakness in soybeans and traded strong through most of the day near the 10 higher mark. Export inspections for corn were as expected but on the low end of the trading range, reported at 518k tonnes shipped last week. The first 2022/23 Brazil corn crop is reported at 9% planted and the 2021/22 2nd crop has reached 98% harvested. Trade expectation for the corn crop rating in this week's crop progress report is mixed with a range of a 1% drop to a 1% improvement expected. At this point in the year, we typically see a sharp drop off in ratings with the crop reaching maturity. Spec selling hit soybeans hard today, pushing the November contract to close a couple cents below the $14.00 mark and most major moving averages. Soybean inspections for last week were on target, reported at 496k tonnes. Conditions in Brazil are conducive for soybean seeding to begin on time in roughly 10-14 days with a large increase in acres expected. Argentina's Economy Minister announced a special locked exchange rate to encourage soy exports with the value increased to 200 pesos/$1 (about a 33% increase from last year). Weather out looks for the first half of September show above average temps and below average precipitation, perfect to encourage dry down of a late planted corn crop.