9/20/2022

Sep 20, 2022

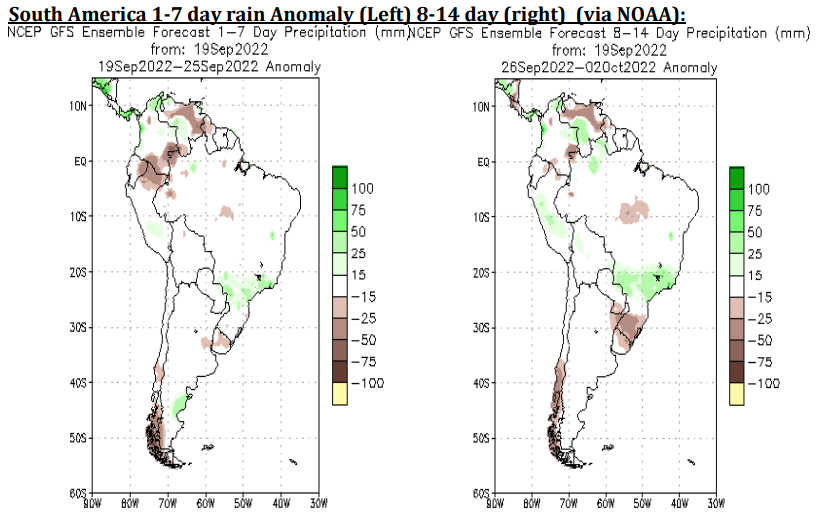

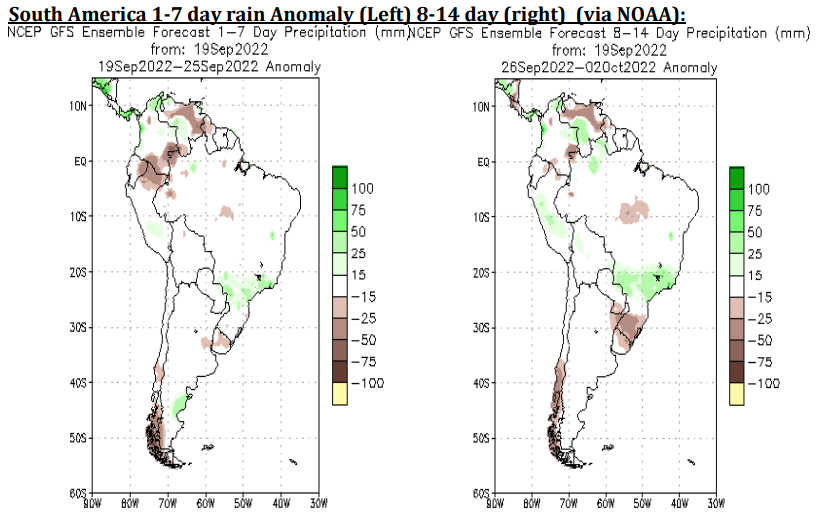

Corn and soybeans capture double-digit gains on the day, with money eagerly buying most commodities in anticipation of the Fed meeting today (interest rates and inflation). December corn set its high mark for the day shortly before the close and soybeans saw some profit taking in the final 90 minutes of the session. Some exciting price action if you are on the production side but with U.S. corn already the most expensive globally and a U.S. corn export program that is still running only about 50% of last year's sale totals at this time, you need to ask yourself if corn truly needs to be priced this high. At some point, the negative effect from a record corn crop in South America and a strong U.S. dollar will be felt in corn demand. A strong dollar will also be unfriendly for soybean and wheat exports. Brazil is a little dry but has been catching some random showers across different regions, soybean seeding for their first crop started on time and planters are rolling south of the equator. Corn basis continues sideways with indicators showing a possibility of strengthening. Soybean basis continues to show signs of cracking after a huge volume of Argentine soybeans have flooded the global market. For those planning to deliver on their November HTAs during the new crop period, consider locking in basis at current levels.