9/19/2022

Sep 19, 2022

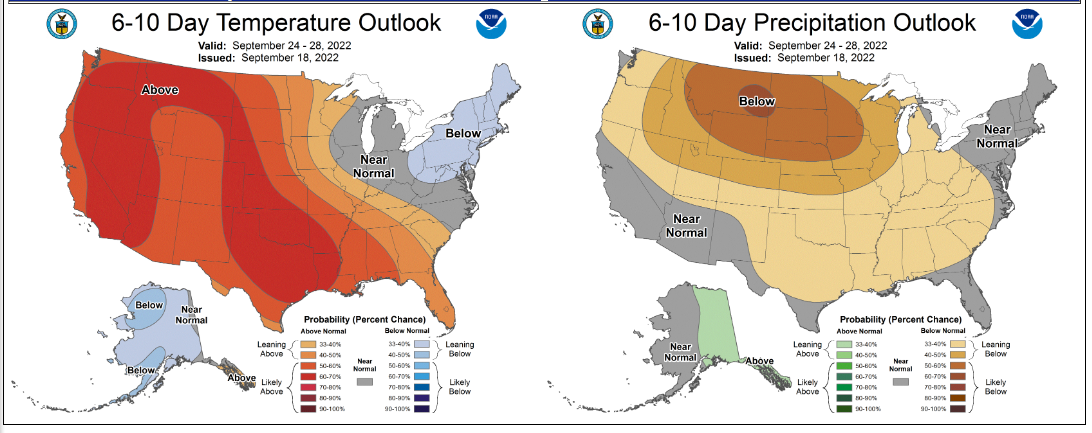

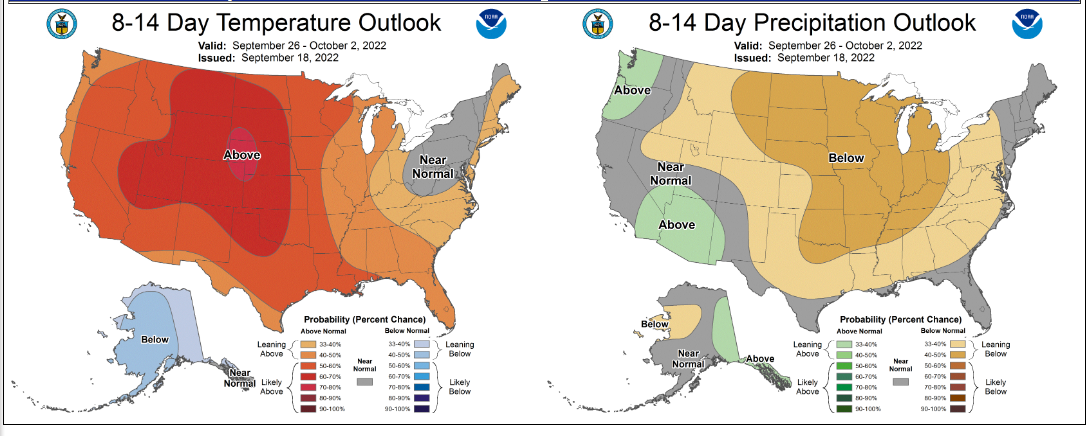

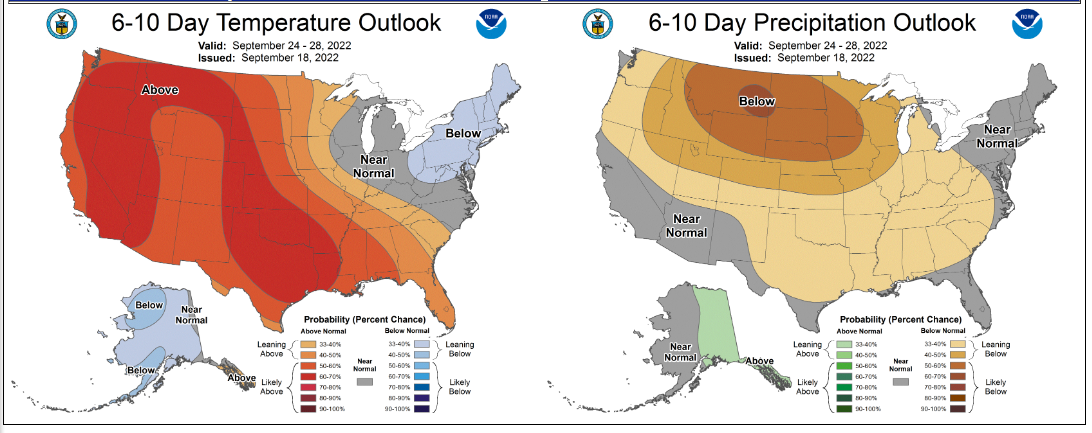

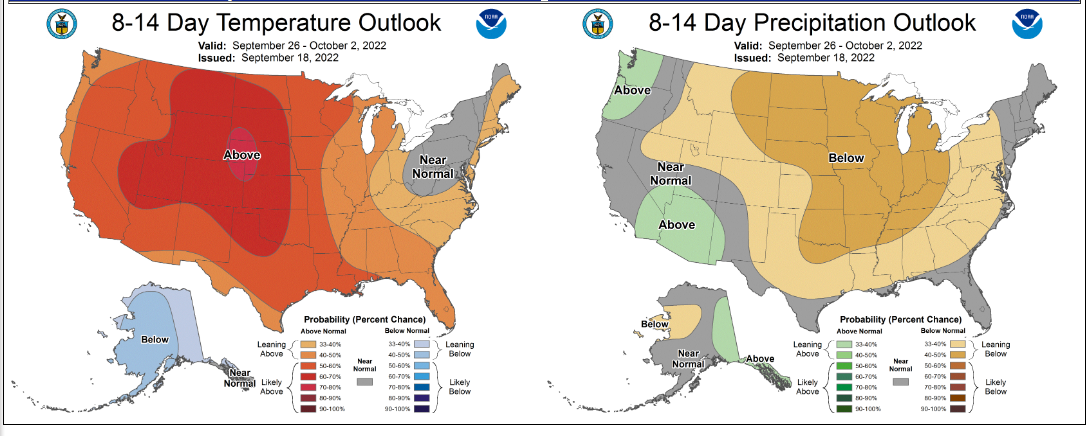

Trade was lower overnight, pressured by ideal harvest weather forecasts with chances of any early frost almost zero across the grain belt. This creates a very good situation for a North Dakota crop that was planted late. Corn found a bid down near Friday's low mark on the December contract and built enough momentum to finish around 1 cent higher on the day. November soybeans saw around a 27-cent range on the day, able to rebound from some early session pressure. This morning, the USDA announced the sale of 136,000 tonnes of soybeans to China for delivery in the 2022/23 marketing year. Seeing a China sale announced allowed the market let out a collective sigh of relief after a weekend that featured President Biden making some comments that have the potential to start WW3. Early harvest reports around the country have been highly variable but, so far, no evidence of any type of complete crop disasters that some in the market wanted others to believe. Argentina incentivized farmers to sell soybeans last week, pumping a lot of Argentine soybeans into the global market. Soybean basis has been somewhat erratic over the past week as a result. China was rumored to have come in as a large buyer. Weekly export inspections were on target for corn and soybeans with 549k tonnes of corn and 519k tonnes of soybeans shipped. With the large number of soybeans on the books to ship, it is important we get a strong start to the marketing year. Both were well short of the weekly pace needed but we are early, yet.