9/16/2022

Sep 16, 2022

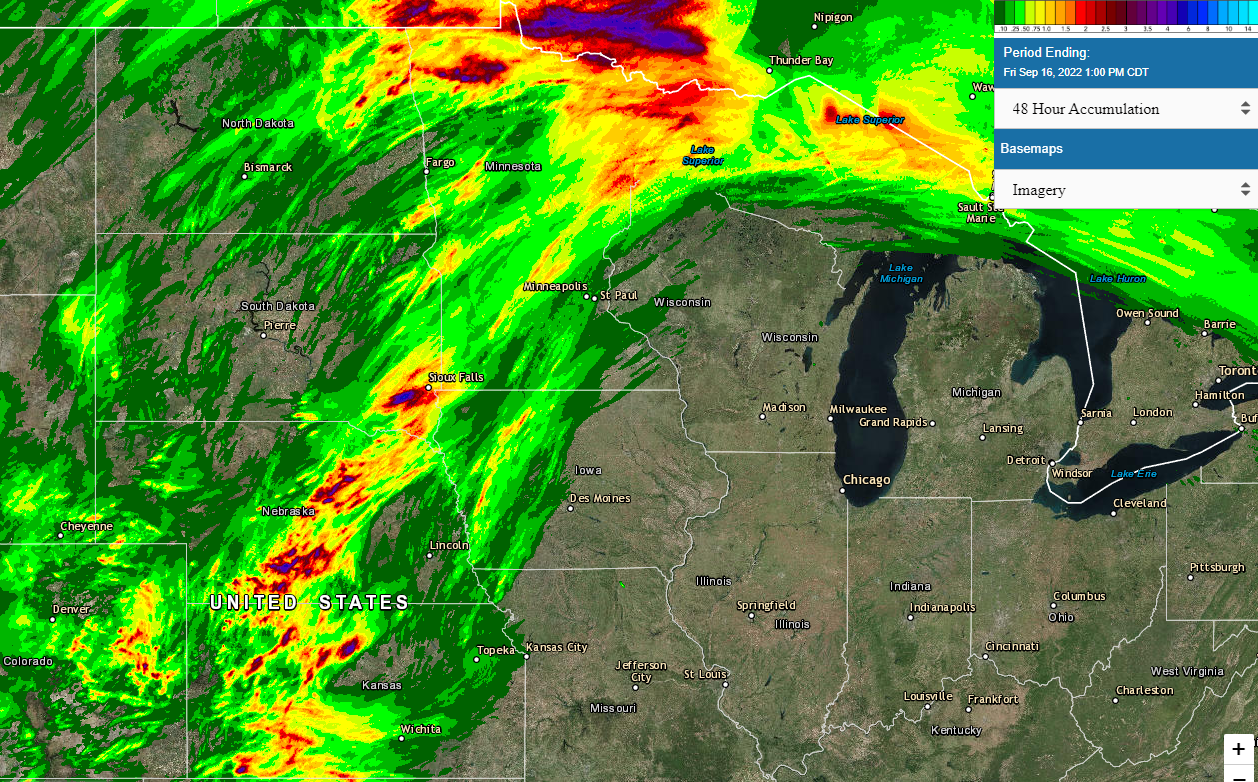

Corn and soybeans spent the overnight session in the red but found a bid at their 20-day moving averages shortly after the 8:30 re-open. Markets were somewhat steady after the mid-day point, making for a quiet second half of the session. News was very limited today and we had no USDA announcements or reports. Early soybean harvest has started in Iowa/Southern Minnesota and crushers have become somewhat erratic with their cash bids, backing off once a day or more, as more combines begin to roll. Soybean board prices faded through the rest of the week from Monday's high, likely some early harvest pressure on the market. This pressure will increase as the new crop supply increases and weather forecasts look encouraging to continue pushing our crop towards full maturity. NOPA members reported 165.54 million bushels of soybeans processed during August. This was down from 170.22 in July and slightly below the average trade guess. Week-to-week, December corn is down 7 cents and November soybeans gained 36 cents.