9/10/2021

Sep 10, 2021

Slightly higher trade for corn and soybeans overnight inside of a relatively small range leading up to the 11:00am report time. The USDA made an 8am sale announcement of 132,000 tonnes of soybeans to China for 2021/22 this morning. Overall, the WASDE report was a little more unfriendly than trade expectations but, after trending lower for 3 weeks, the market had already priced in report negativity, and then some. Weekly closes in Murdock: cash corn down 24, new crop corn 7 lower, cash and new crop beans both down 4 cents on the week.

WASDE Summary

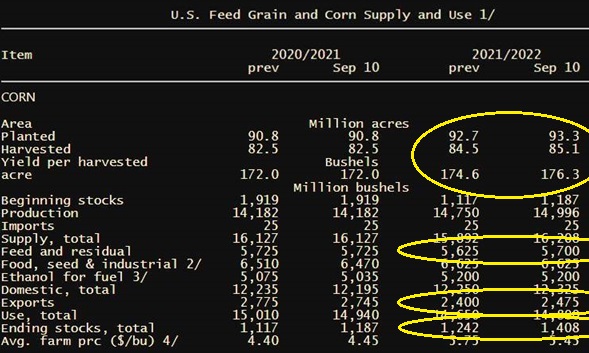

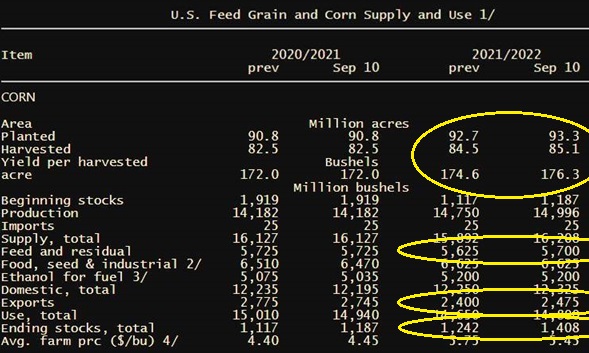

Corn: A small increase to old crop ending stocks, more acres, more yield, USDA used to some magic to offset added production with some increased exports and feed & residual numbers. 2021/22 Ending stocks still increased by 166 million bushels (an additional 700,000 acres added in is possible, yet).

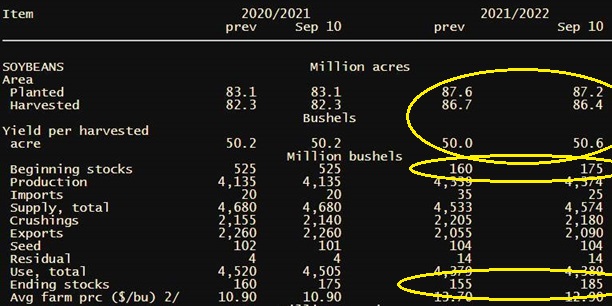

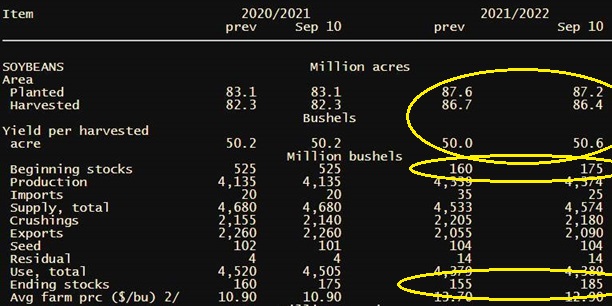

Soybeans: An interesting combination of changes, a few less acres but added yield for a net increase in production. Small net change in total use. I’m skeptical on the national soybean yield above 50. The volume of soybean acres in the Dakotas has the potential to drag that number down.

WASDE Summary

Corn: A small increase to old crop ending stocks, more acres, more yield, USDA used to some magic to offset added production with some increased exports and feed & residual numbers. 2021/22 Ending stocks still increased by 166 million bushels (an additional 700,000 acres added in is possible, yet).

Soybeans: An interesting combination of changes, a few less acres but added yield for a net increase in production. Small net change in total use. I’m skeptical on the national soybean yield above 50. The volume of soybean acres in the Dakotas has the potential to drag that number down.