8/8/2022

Aug 08, 2022

Corn and soybeans lower to start the week. Some buying in soybeans showed up following the coffee break and a supportive weekly export inspection report but trade was unable to hold on to gains. Soybeans saw some double-digit higher trade briefly but corn managed to trade only fractionally higher out to December 23. The USDA reported that 556k tonnes of corn and 868k tonnes soybeans were inspected last week. That was a miss for corn and well above trade expectations for soybeans. The reality of ample old crop supply, a lack of any big issue with the 2022 US crop, and loaded grain vessels steadily exiting Ukraine are keeping the market in check. Managed money and funds have liquidated a significant amount of their net long positions over the past 7 weeks and remain mostly sidelined as we look towards the Friday released of the USDA WASDE report for August. Trade bias is looking for the USDA to make reductions in the corn and soybean yields for the 2022 crop. This afternoon's crop conditions report will likely provide our market some direction between now and Friday's report. The USDA announced three separate export sales this morning with 132,000 tonnes of soybeans to China, 105,000 tonnes of corn to Italy, and 120,000 tonnes of corn to unknown. All of these were for delivery in the 2022/23 marketing year.

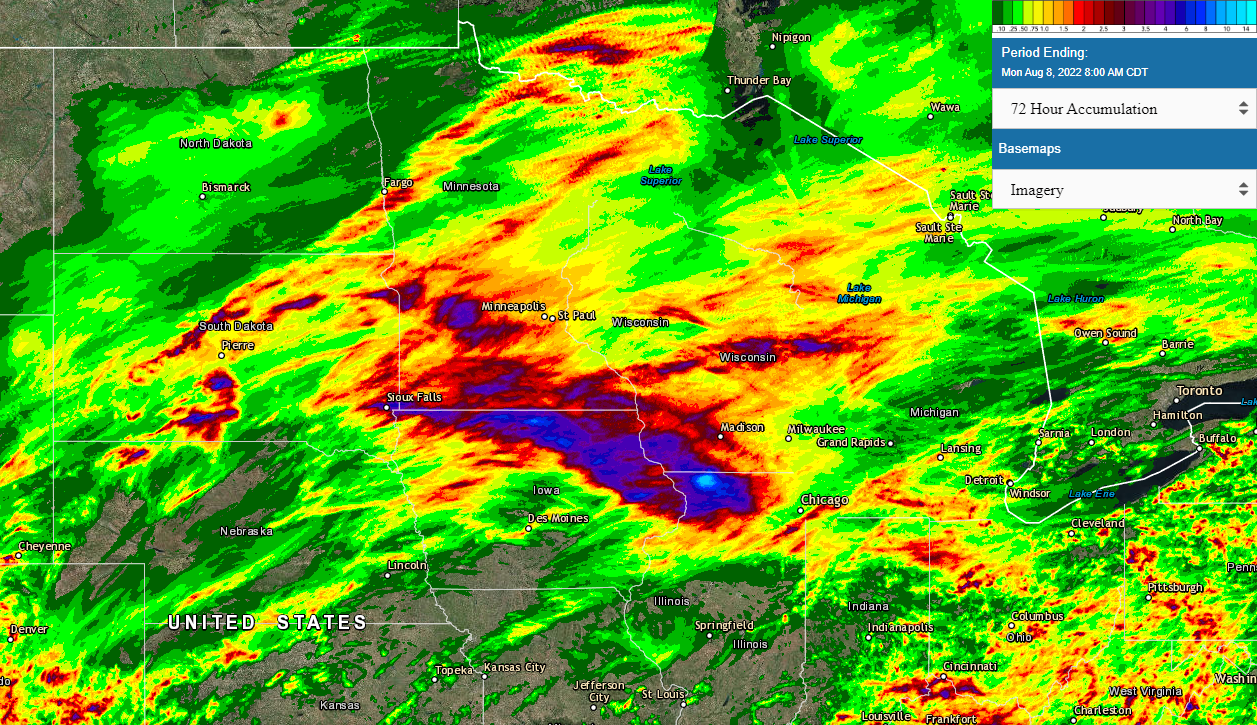

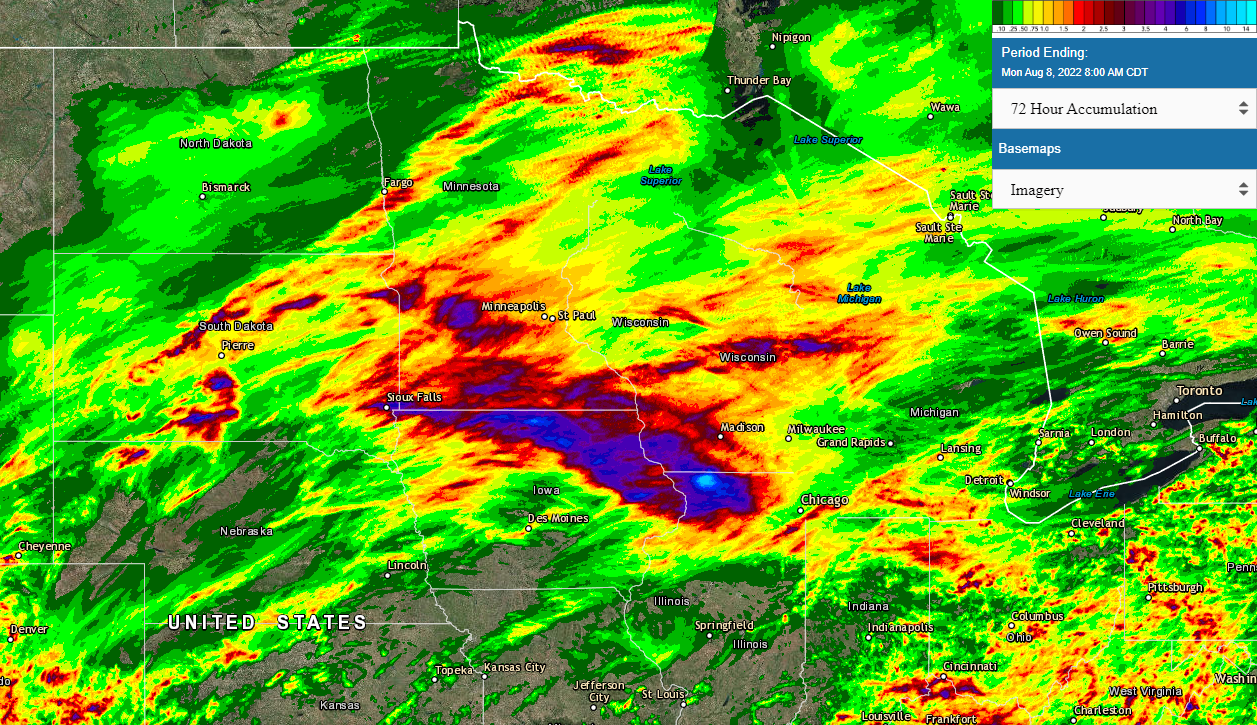

Rain makes grain. Some extremely well timed rain for our general area Friday night into Saturday and Sunday evening. A lot of reports in the 4-5" total range.

Rain makes grain. Some extremely well timed rain for our general area Friday night into Saturday and Sunday evening. A lot of reports in the 4-5" total range.