8/4/2022

Aug 04, 2022

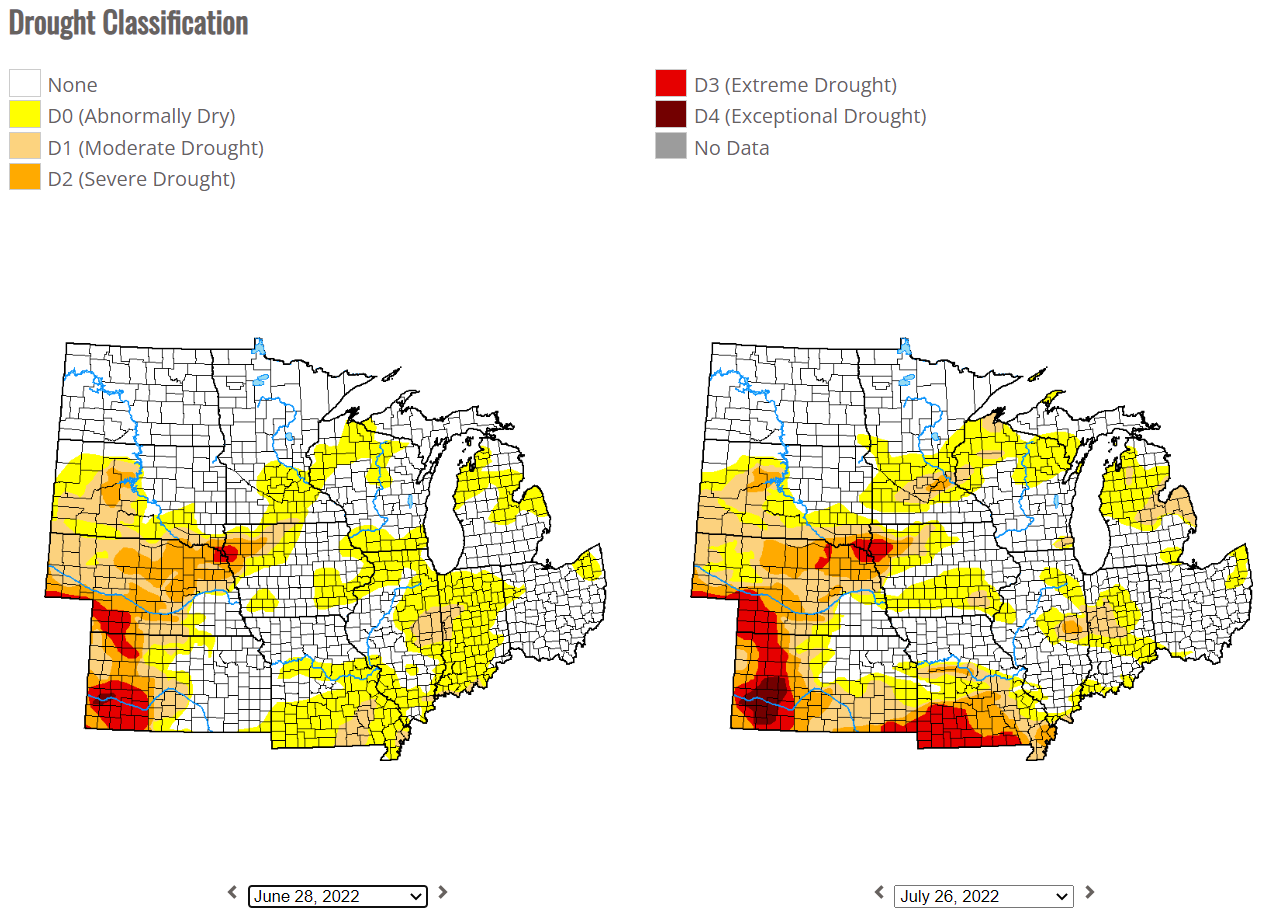

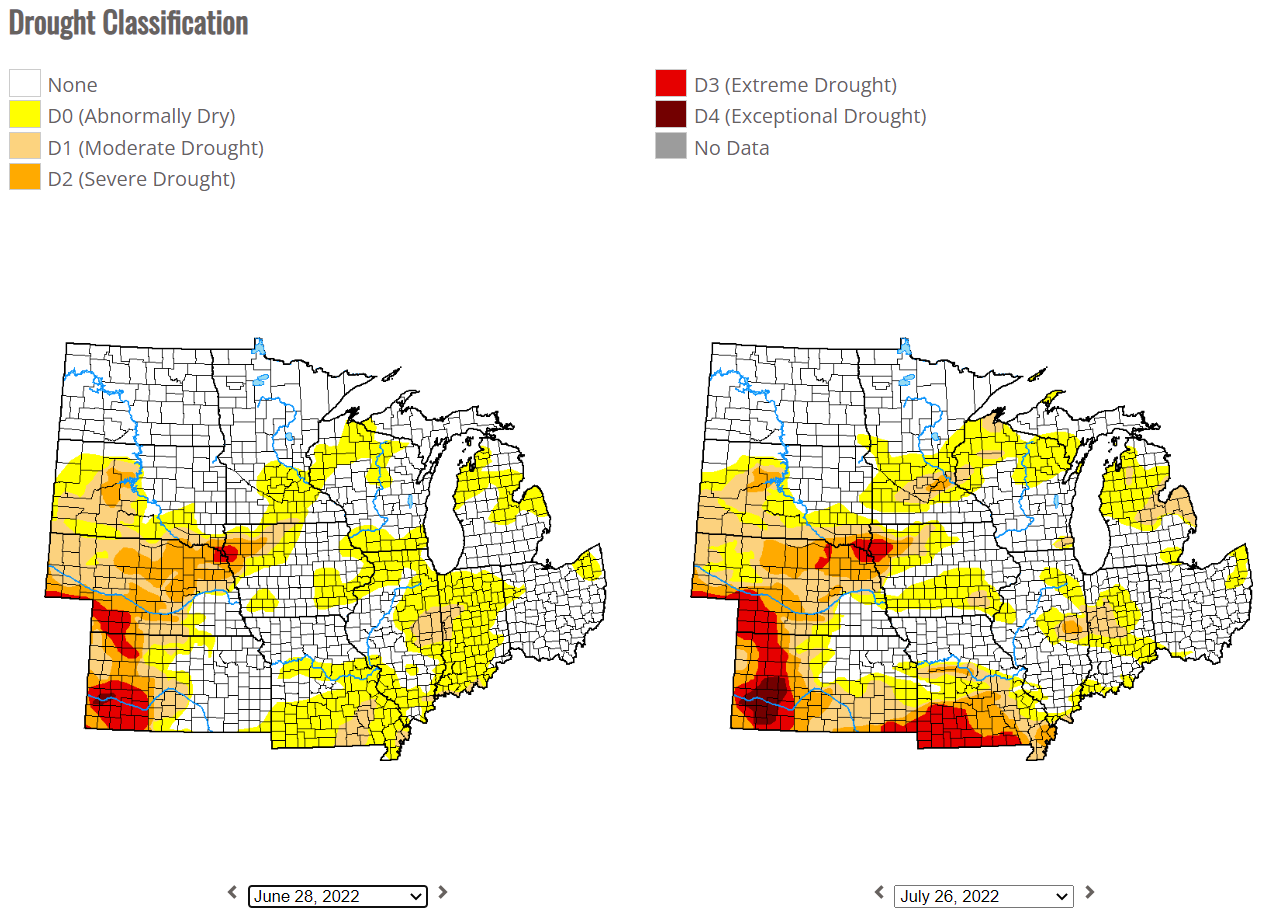

The soybean market bounces back in a large way with trade buying weather, pulling corn and wheat higher with it. The soy crop is made in August and going only 72 hours into the month with little-to-no moisture across soybean growing areas was enough for the computer trade algorithms to chase the board higher by more than 50 cents, closing within reaching distance of the daily highs. The past couple weeks has also been more about corrective trade, rather than fundamentals, with one week of steep liquidation followed by a week-long sharp rally. Weekly export sales were within expectations but below the weekly pace needed to reach the USDA targets. Corn saw 58k tonnes sold of old crop and 257k tonnes of new crop sold. Soybeans had net cancellations of 11k tonnes of old crop and new crop was reported as 411k tonnes net sold. For total sold to date, new crop soybean sales run well ahead of last year's pace and new crop corn is lagging badly, sitting near 50% of last year's total on this week. At some point, diminished demand due to high prices will be reflected in our ending stocks/beginning stocks, will it be in August or January? There's real potential it will wash out any production setbacks on this year's crop. Once again, the market is giving those holding out another opportunity to sell out of old crop. If the rain forecasted for this weekend is realized, this is probably a short rally.