8/26/2022

Aug 26, 2022

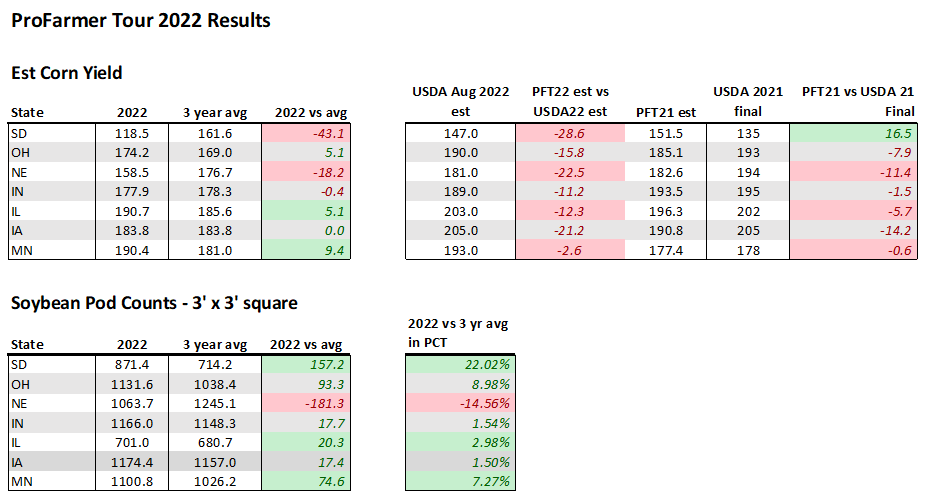

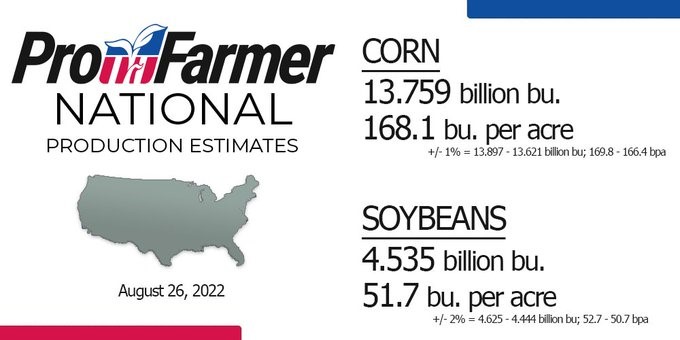

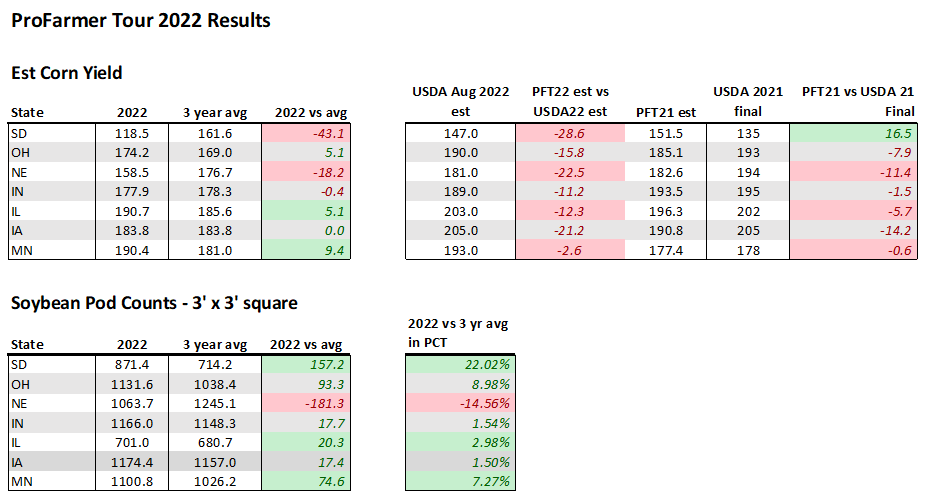

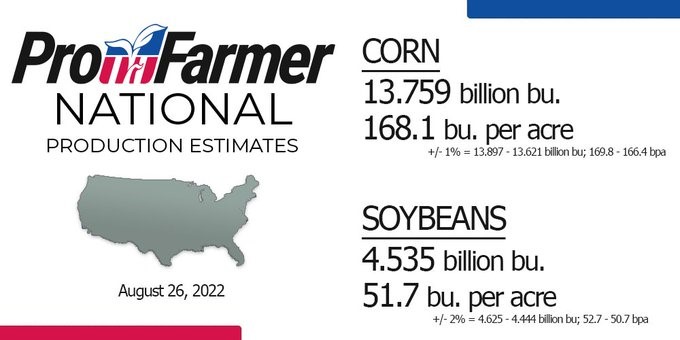

A quick rebound after yesterday's weak close. Grains saw their session lows upon the opening of overnight trade and had worked their way towards 7 higher on corn and 17 higher on soybeans before the coffee break. The 8:30 am opening bell saw another round of sharp sell-off but prices recovered beyond their previous levels and were firmly trading double-digits higher, including some 30 higher trade in soybeans. With little else going on, trade was about positioning ahead of ProFarmer's release of their crop tour final results this afternoon. Their data from yesterday's surveying revealed Minnesota as the garden state this year and Iowa hanging on to a respectable average crop. The USDA made another export sale announcement this morning of 146,000 tonnes of soybeans for delivery to unknown during the 2022/23 marketing year. That's a total of 773,000 tonnes (about 28.3 million bushels) of soybeans announced this week with all but today's sale assigned to China. It's always exciting for the market to see China on export sales but corn sales need to start picking their pace. Today's action in grains may have also been slightly supported by money leaving Wall Street following Fed Chairman Jerome Powell's speech today. Originally slated to last up to one half hour, Powell only needed 8 minutes to warn what most have been expecting for over a year now: full economic recession.