8/24/2022

Aug 24, 2022

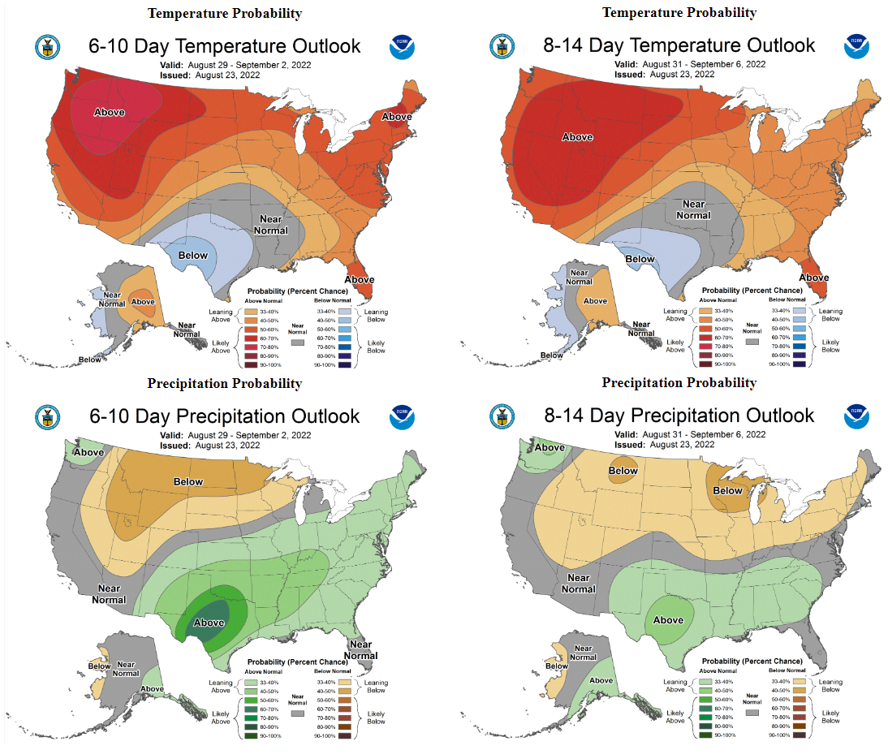

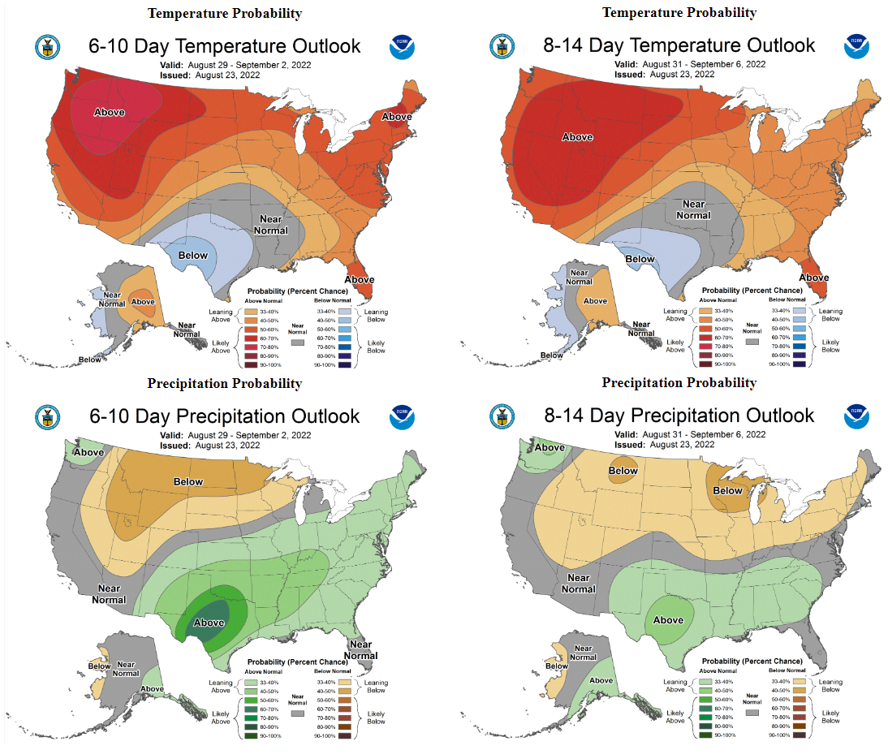

Corn and soybeans were hot from the start of overnight trade with both seeing 10 cent gains within the first two hours. Prices remained relatively sideways from that point into the morning break and daily highs were set almost immediately after the 8:30 open when Dec corn spiked to 16 cents higher and Nov soybeans trading a high mark close to 24 cents above the previous day's close. Buying turned into some heavy selling, flipping corn to 10 lower and soybeans around 15 cents down, both spent the rest of the day working back towards unchanged. This week's rumor has been a large sale of US soybeans to China and part of that was confirmed yesterday. This morning the USDA announced another 517,000 tonnes of soybeans for delivery to China during the 2022/23 marketing year. ProFarmer tour suggests an average crop in Indiana and well below average production in Nebraska. Weekly ethanol data showed both output and stocks up with a 4,000 barrel/day production increase from the previous week and stocks rising 361,000 barrels to a total of 23.81 mln bbls. The extended weather outlooks show a dry/warmer bias for the end of August/beginning of September across the growing regions. In my opinion, that is exactly what we need to get the most out of a late planted crop.