8/17/2022

Aug 17, 2022

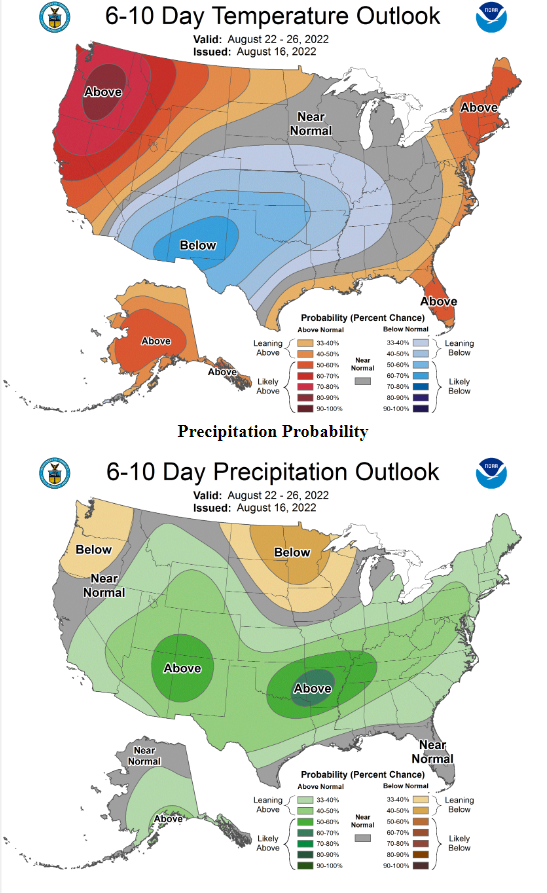

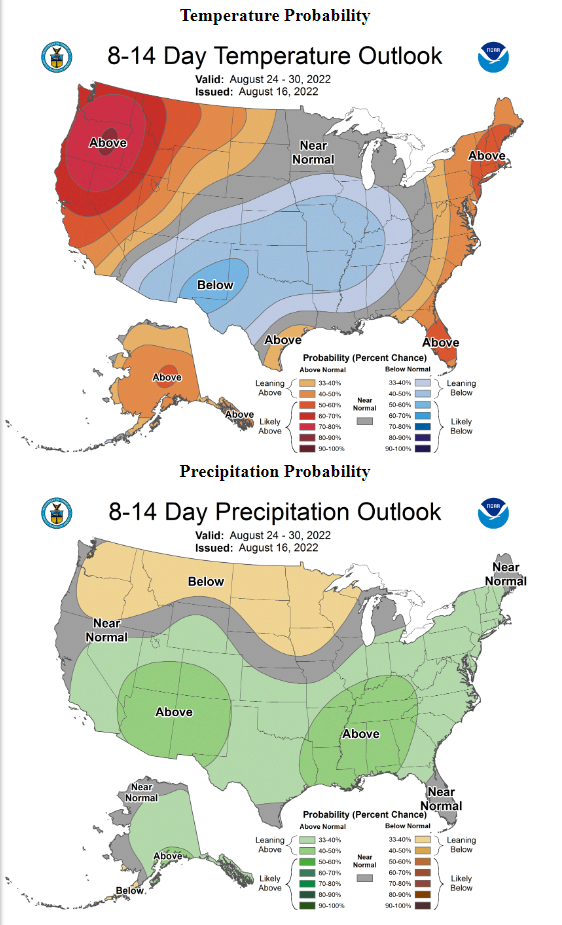

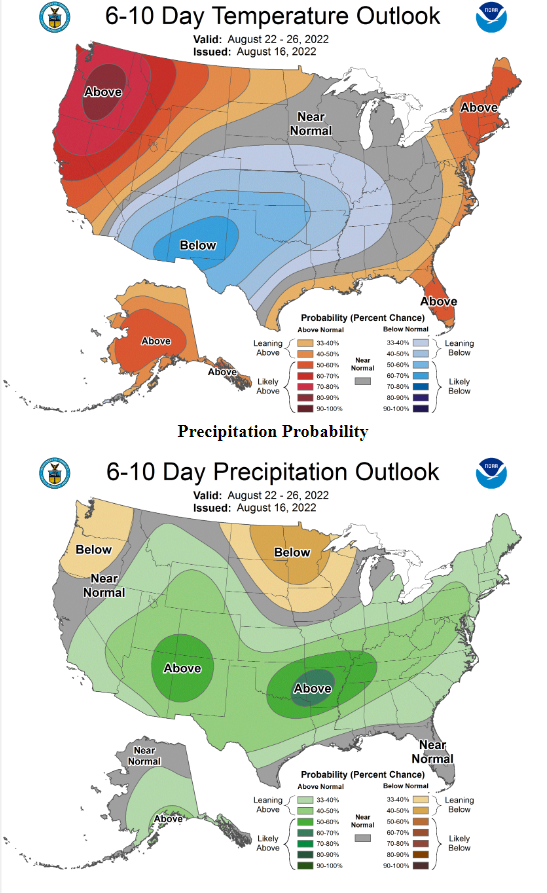

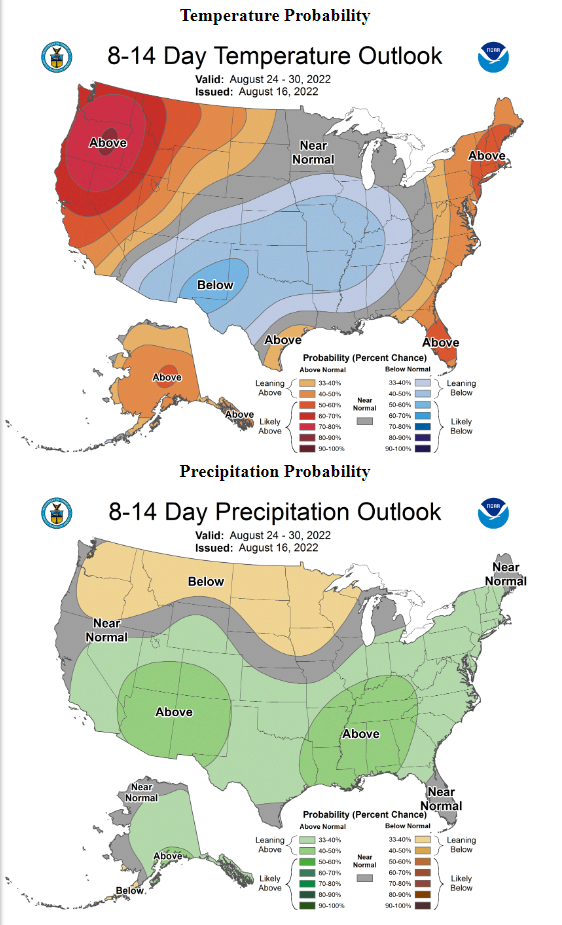

Corn and soybeans were able to find a bid in some slightly lower trade overnight and hold onto modest gains on the day. November soybeans touched the 1400'0 level twice and was sold off quickly on both trips. Following two days of sharply lower trade to start our week, trade looked like corrective action more than anything else for Wednesday. Soybean meal was supportive to beans but double-digit lower trade across wheat acted as an anchor towards corn and soybeans, limiting gains on the day. December corn appears to be consolidating between the 20 and 50-day moving averages and November soybeans are once again trading below most major moving averages. Weekly ethanol numbers implied lower demand with a cut in daily production of 39,000 barrels/day down to 983,000 bpd and stocks increasing 190,000 barrels to 23.446 million barrels. Corn use for ethanol for 2021/22 is on pace to exceed the previous year by 170 million bushels but is also roughly 30 million bushels short of meeting the USDA number at the same time. There were no export sale announcements this morning. Extended weather outlooks continue to favor crop finishing into September. As long as those weather models stay consistent, price gains will remain limited.