8/15/2022

Aug 15, 2022

Corn and soybeans were instantaneously lower at the Sunday night open with daily highs nowhere near Friday's closing prices. We did see some impressive recoveries off the lows set shortly after the coffee break, most notable was November soybeans which traded 68 cents lower at one point and ended the day down 42 cents. December corn came back and held on to close above the 200-day average. Selling was seen in other market areas, as well, with crude oil and other commodities trading sharply lower throughout the day with general concerns over the Chinese economy. Weather forecasts also helped drive down grains with outlooks showing cool temperatures and improved chances of precipitation in dry areas. Export inspections last week were solid for soybeans and modest for corn with 538k tonnes of corn and 745k tonnes of soybeans inspected for shipment. It appears that corn shipments will meet the USDA goal for the year and soybeans, after the USDA revised its 21/22 export figures lower last week, should meet the new number. The follow-through price action from Friday's report is similar to what we saw as a reaction to last year's August report: a market friendly report that is sold off. If we see good crop finishing conditions for the remainder of this month into September, it will keep pressure on trade.

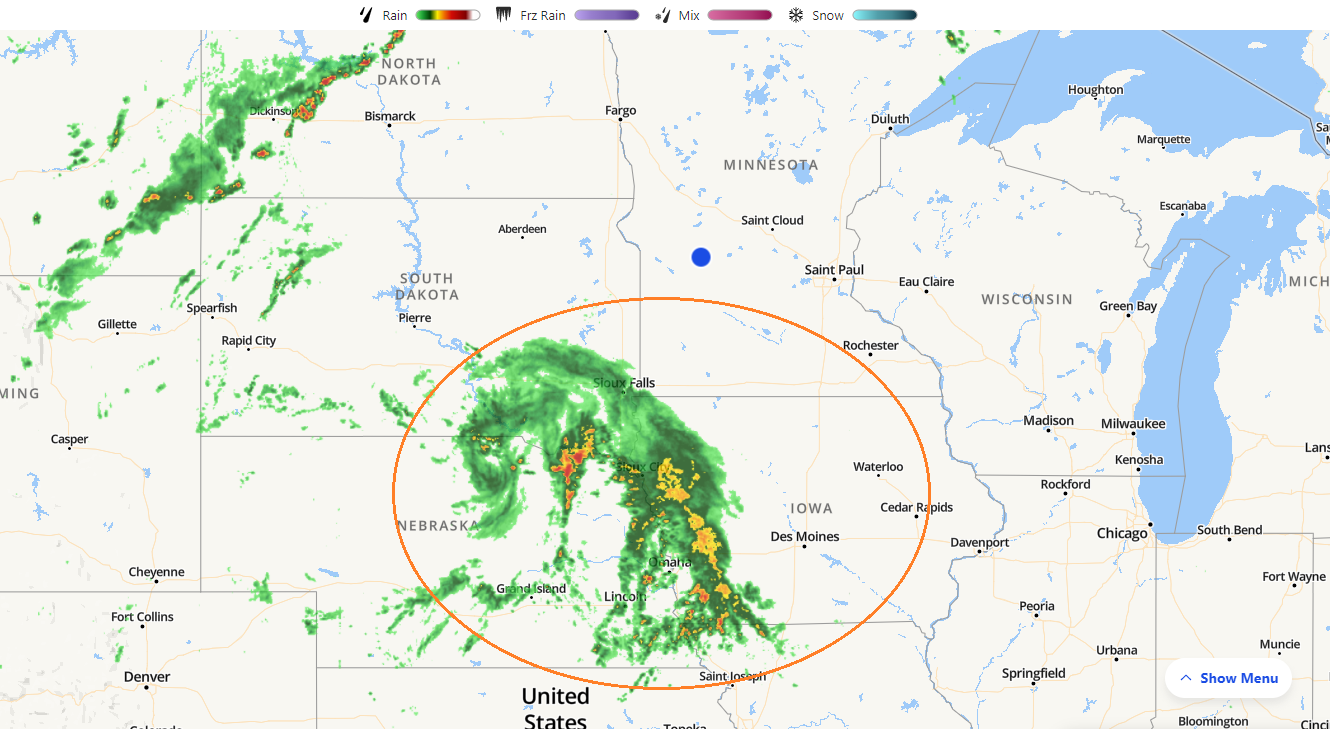

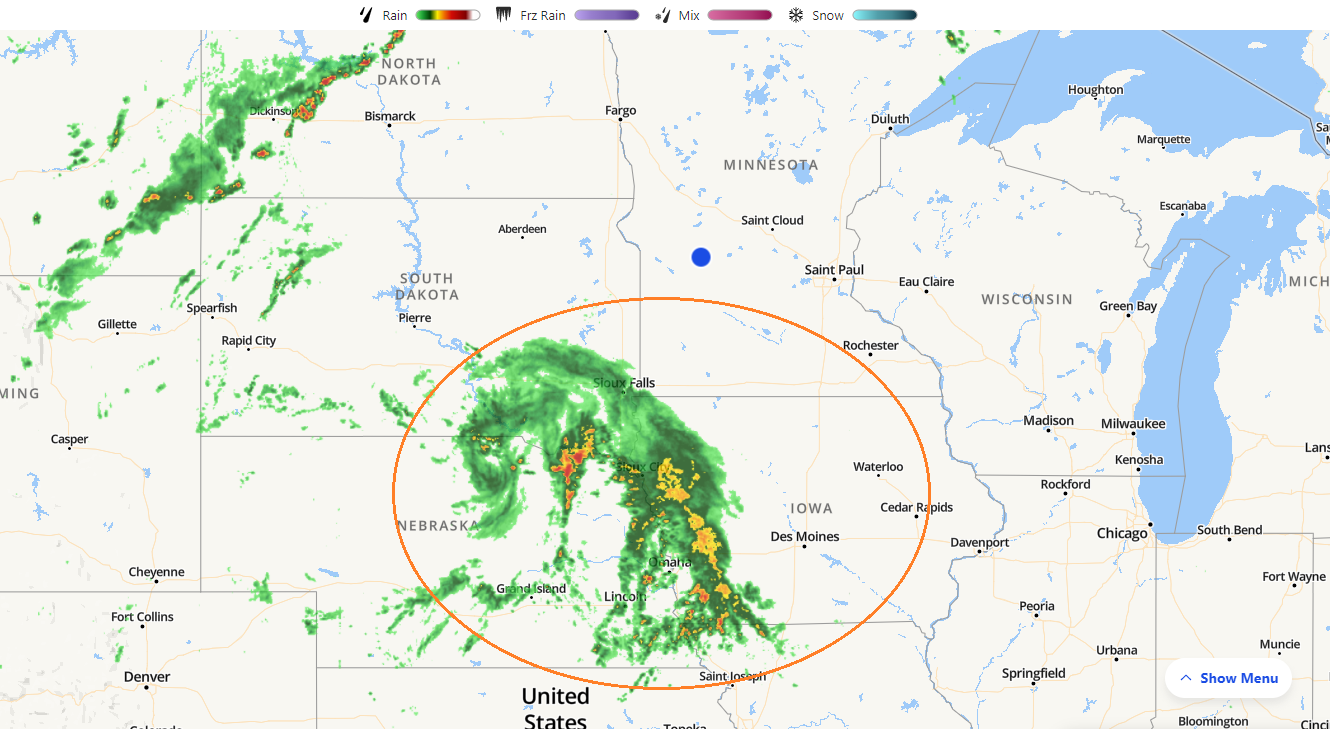

Today’s market action partially explained here. Nice rains through SE SD, NE NB, and NW IA earlier today; a general area that was in dire need of moisture.

Today’s market action partially explained here. Nice rains through SE SD, NE NB, and NW IA earlier today; a general area that was in dire need of moisture.