8/1/2022

Aug 01, 2022

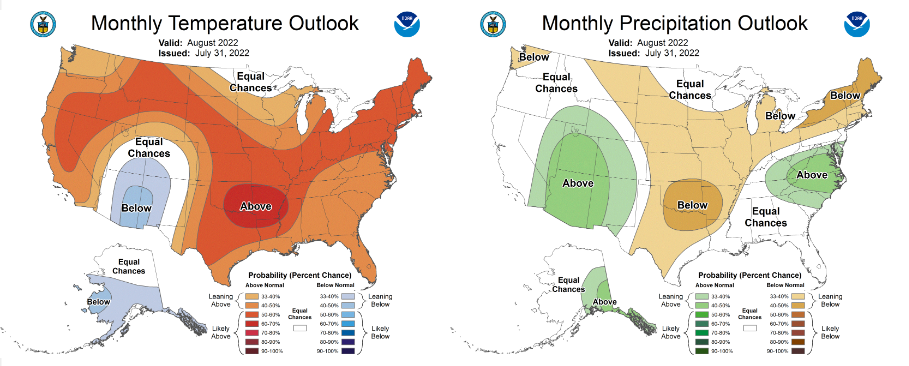

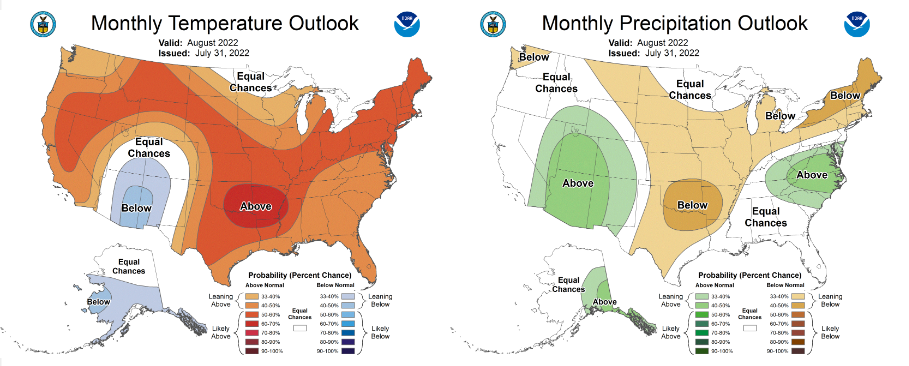

Major pressure on the market from multiple angles geared trade towards risk-off early into the overnight session. Updated weather models showed relief from previously forecasted high temps along with increased probabilities of rain across the growing regions. The Oklahoma/Texas panhandles and Southwestern Kansas also received good amounts of much needed moisture over the weekend. Crude oil traded $5-6/barrel lower early this morning but did recover slightly. A vessel loaded with corn departed from Ukraine for the first time since late February and it is reported there are an additional 16 vessels loaded and ready to sail. A lot of negativities to start the week and a prime set up for a turnaround Tuesday after corn and soybeans both finished well off of their lows on the day and trade is expecting another decline in crop conditions in this week's progress report. Weekly export inspections were decent for corn and soybeans with 857k tonnes of corn and 555k tonnes of soybeans inspected for shipment. With one month to go, corn exceeds the pace needed to hit the USDA export target by 74 million bushels and soybean pace falls short by 49 million bushels. Early crop tours are starting this week and we will keep you up to date with those results.