7/26/2022

Jul 26, 2022

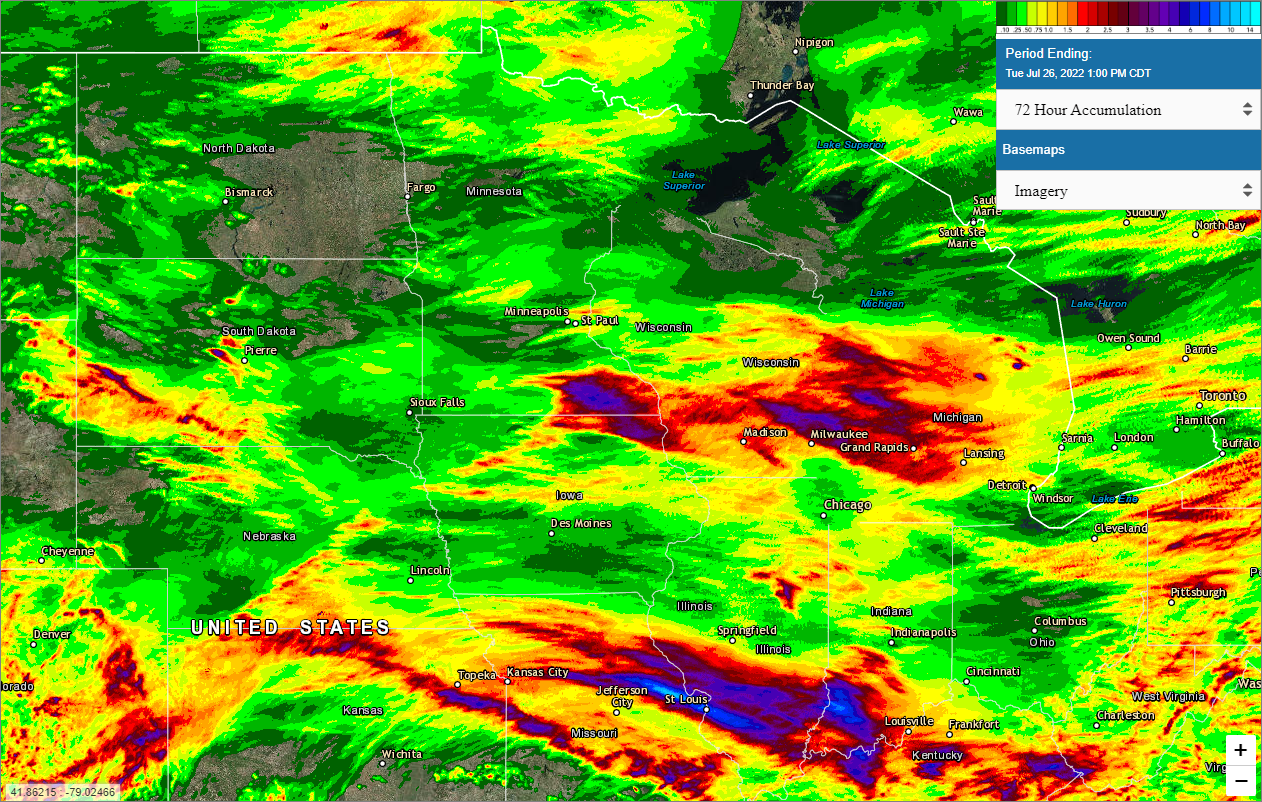

Large gap higher on the overnight open after lower-than-expected crop ratings from the USDA in this week's progress report. Buying followed through and gaps remained unfilled, supported with reports of Russia conducting new military strikes on export terminals in Ukraine and weather outlooks forecasting a hot start to August (once again, heat in the summer is a surprise?). The USDA rating the corn crop at 61% good/excellent, trade was expecting 63% (64% last week, 64% year ago). Soybeans were viewed at 59% good/excellent, trade was expecting 60% (61% last week, 58% year ago). Spring wheat conditions also decline from 71% good/excellent to 68% (71% last week, 9% year ago). China and Brazil are in discussion again on their potential corn export relationship. The current agreement would allow exports to China next season but they are in discussions that may potentially allow 2022 corn to be shipped to China. Cash soybean basis has been largely weak during the month of July and continues to slip towards new crop value. Cash corn basis has been able to maintain its strength but is beginning to show some cracks. There is no point in holding old crop and become a victim of the cash inverse.