7/20/2023

Jul 20, 2023

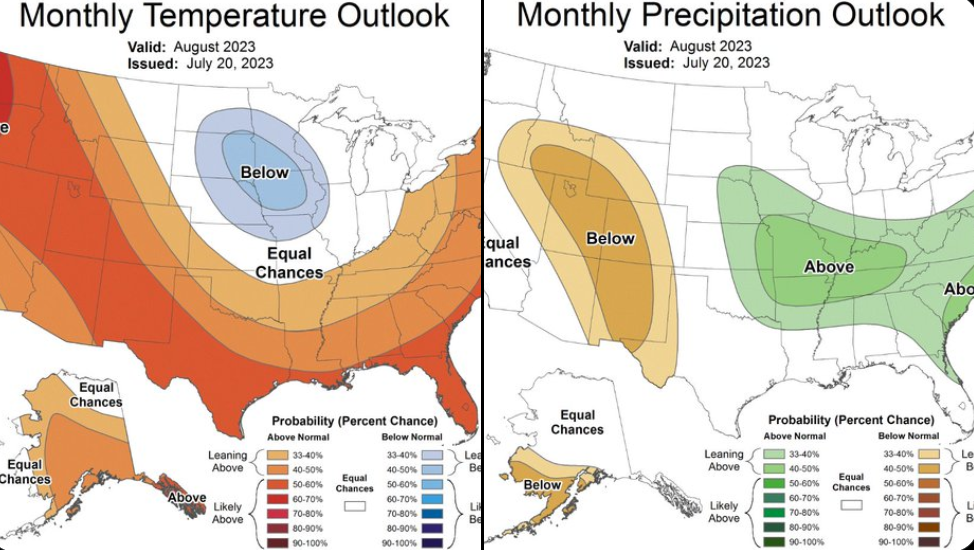

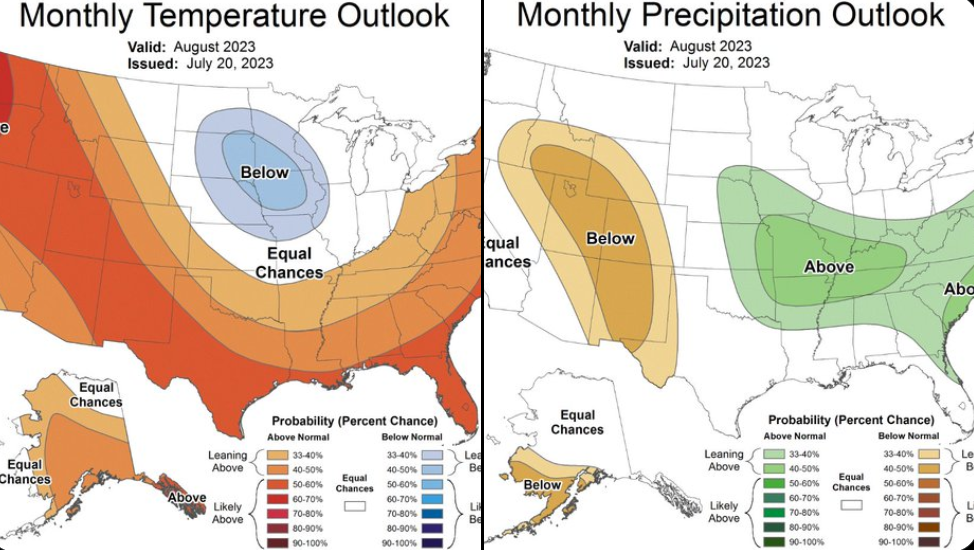

Mixed action throughout the day on Thursday ends with corn 4-6 cents lower and soybeans spotted around from 3 higher to 5 lower. The rally over the past week has been fueled by Russia headlines and weather forecasts. Given the back-and-forth action today, we can assume trade feels that the proper amount weather risk premium is currently priced into the market. Forecasts will need to either continue to extend the hot/dry bias or turn towards more mild temps with moisture for the market to fluctuate. As always, the market also loves to trade any headline that includes Russia or Ukraine so any type of fresh story will have some weight on the market. Weekly export sales were on the low end of expectations for old crop corn and soybeans with 237k tonnes of corn and 127k tonnes of soybeans sold last week. New crop sales had a nice week with corn at the upper end of expectations at 495k tonnes and soybeans out-performing their expected volume at 760k tonnes.