7/17/2023

Jul 17, 2023

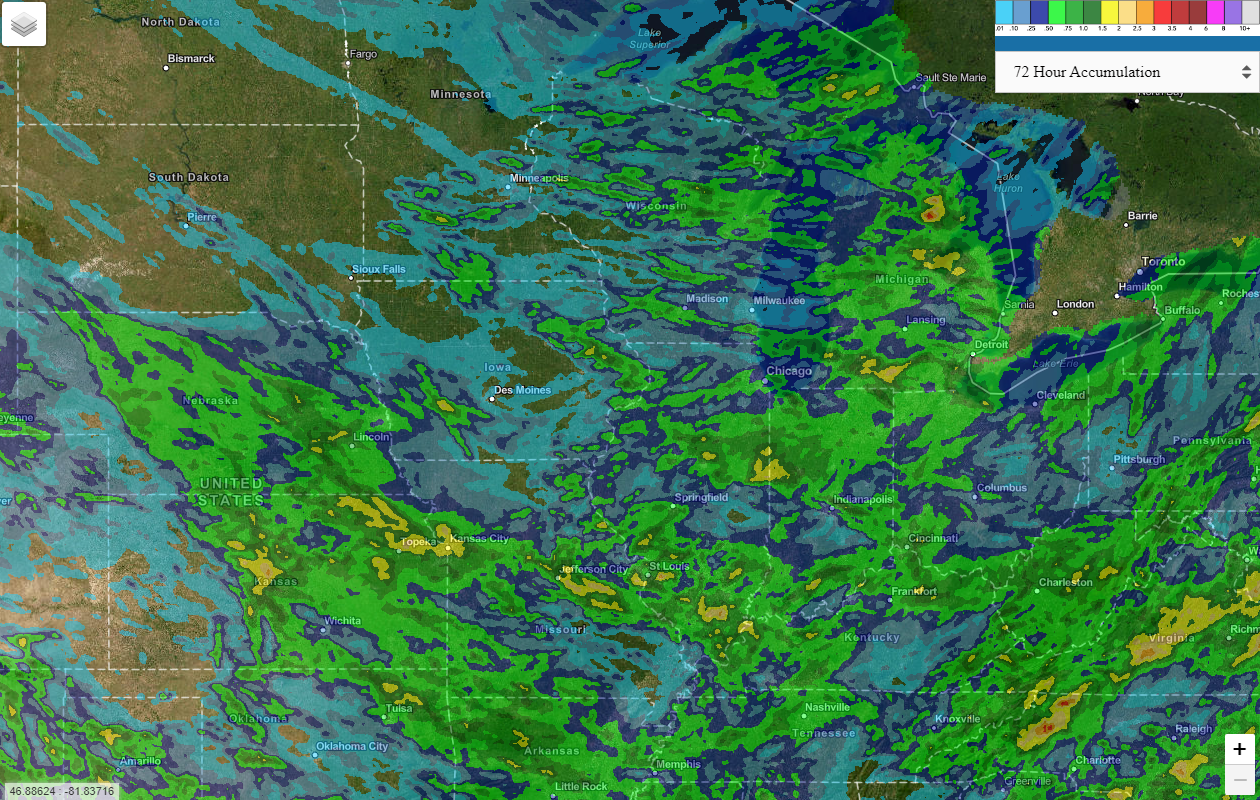

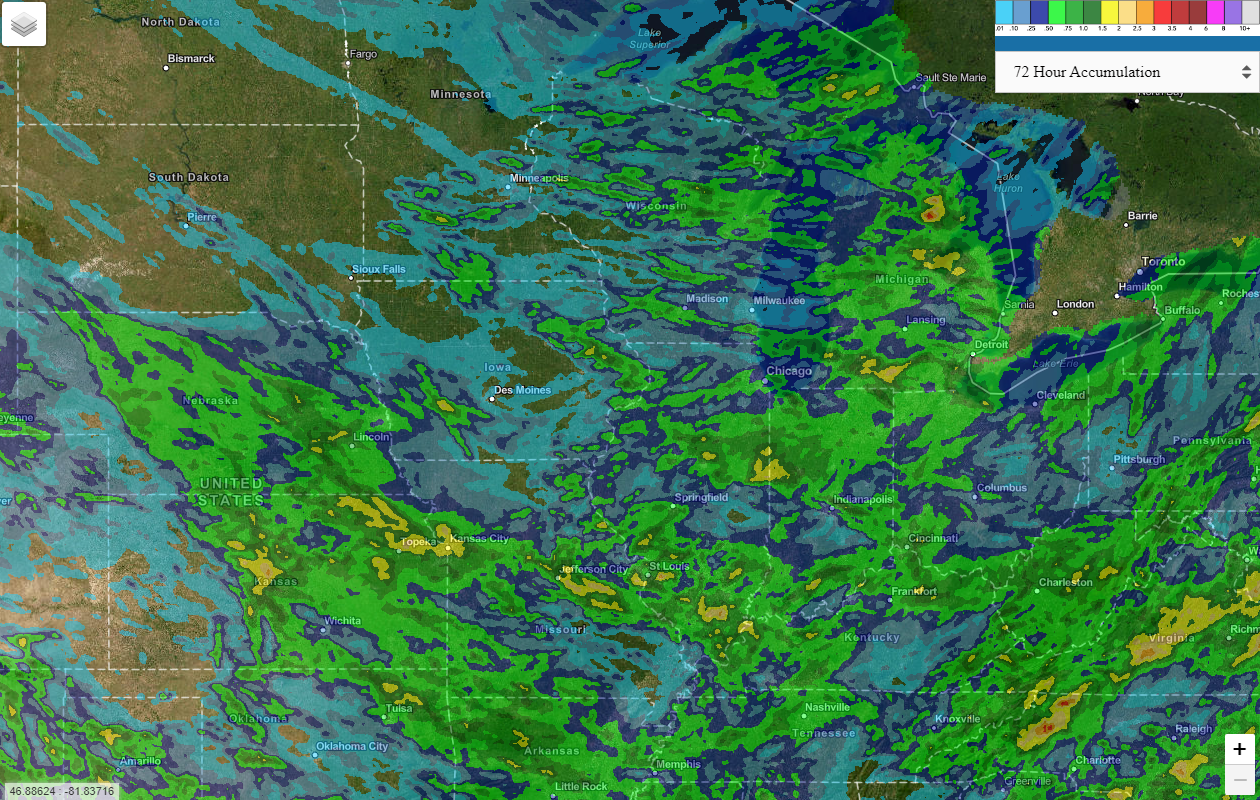

Corn and soybeans both gapped higher on the Sunday night open and it looked like we were going to be off to the races to start the week. Analysts were leaning heavy on higher opening calls based on weather forecasts featuring hot and dry biases but the market drifted back towards unchanged and corn was trading around a nickel lower about one hour into the day session. Soybeans were able to hold roughly half of their gains, finishing in 5-9 cent higher range. Also deflating the bulls was a light weekly export inspections report. Corn shipments were on the lower end of expectations at 364k tonnes and soybeans missed low with 156k tonnes shipped last week. Shipment paces still slowed despite USDA's recent cut to export forecasts for corn and soybeans. Corn export shipments are currently 35 million bushels behind the pace vs 18 million bushels the week prior. Soybean shipments are now 35 million bushels ahead, down from 41 million bushels ahead the previous week.