7/12/2023

Jul 12, 2023

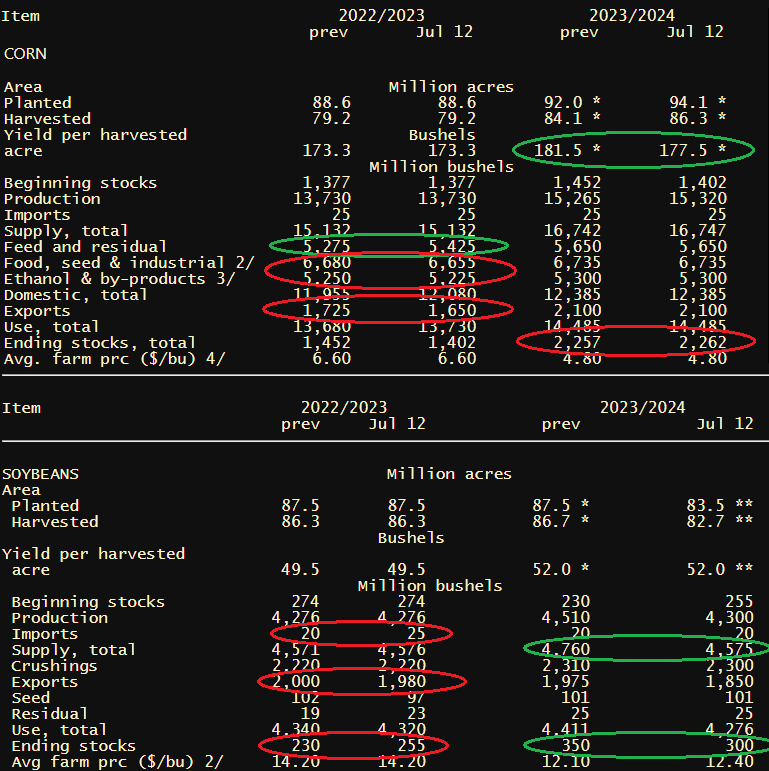

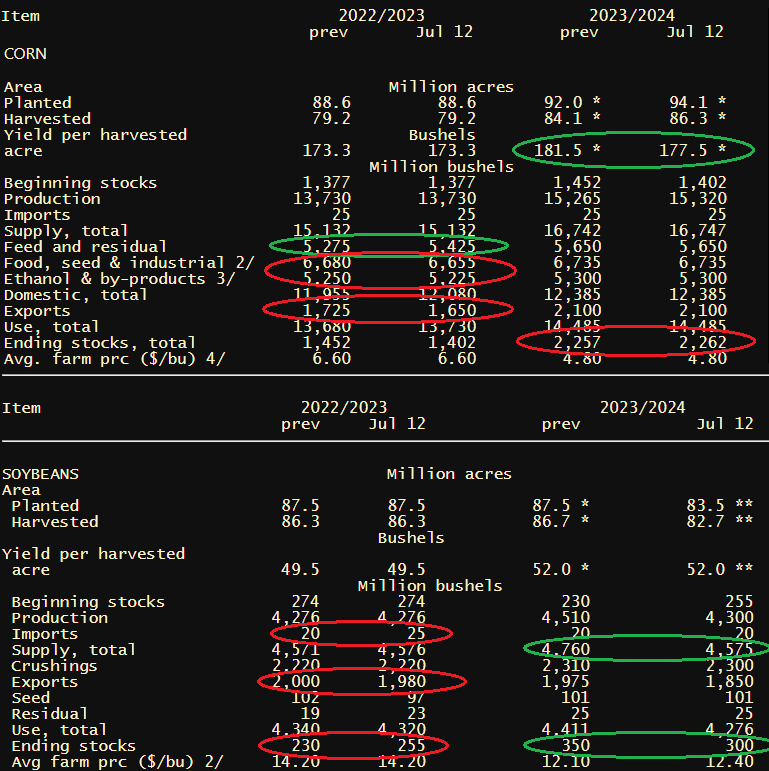

WASDE RECAP: The USDA printed numbers that mostly followed trade expectations. Corn yield was cut by 4 bu/ac from 181.5 to 177.5 but analysts were looking for 176. Looking at the current forecasts, there is big potential here that this is the lowest yield number we will see for the 2023 crop. The 22/23 corn ending stocks at 1.402 was close to the 1.420 avg guess which was down from 1.452 in June. The USDA cut corn exports and ethanol use by a combined 150 million bushels. Everything nets out to a 5 million bushel increase to the 2023/24 corn ending stocks. On the soybean side, 2022/23 ending stocks increased by 25 million bushels with a bump in imports and a cut in exports. The fresh acres number of 83.5 million acres gives a net change of -50 million bushels to the 2023/24 soybean ending stocks at 300 million bushels.