7/12/2022

Jul 12, 2022

Selling was the theme across the broad market space today and the USDA gave money no reason to come back in. Grains, crude oil, and other commodities were deep in the red today. Funds have put into motion an interesting strategy: looking to flip their position short while most of the world is convinced there will be a food shortage. With South America having a huge corn crop and likely a lot more soybeans than we were ever really told along with wheat crops around the globe far exceeding expected yields, the market is realizing that our issues are not crop production and our real issues are in the logistics of getting crops where they are needed. Also, the USDA reports are finally acknowledging that high U.S. prices have hurt demand.

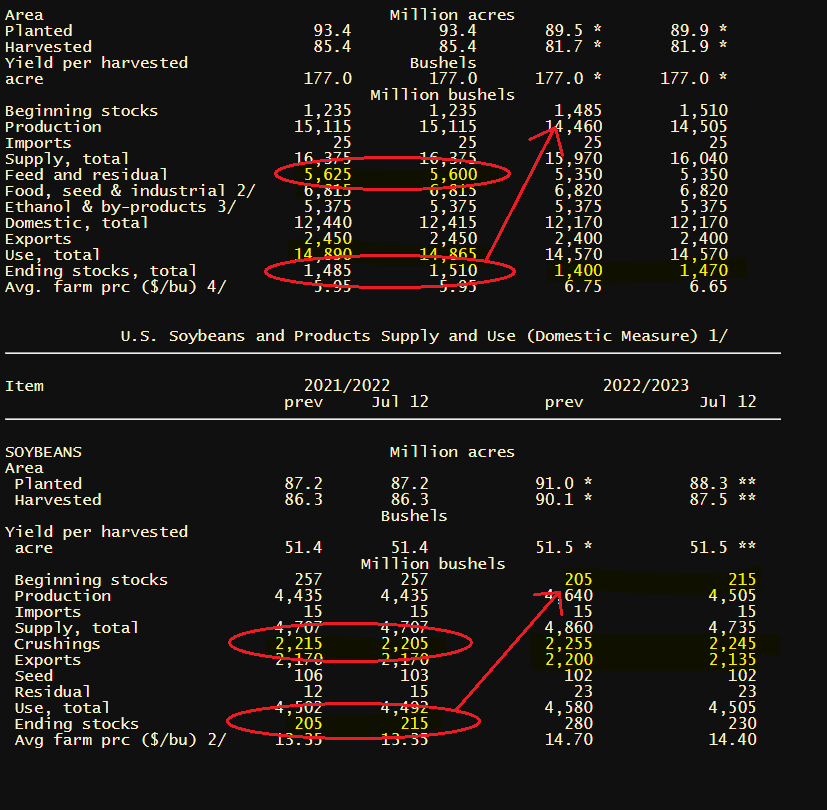

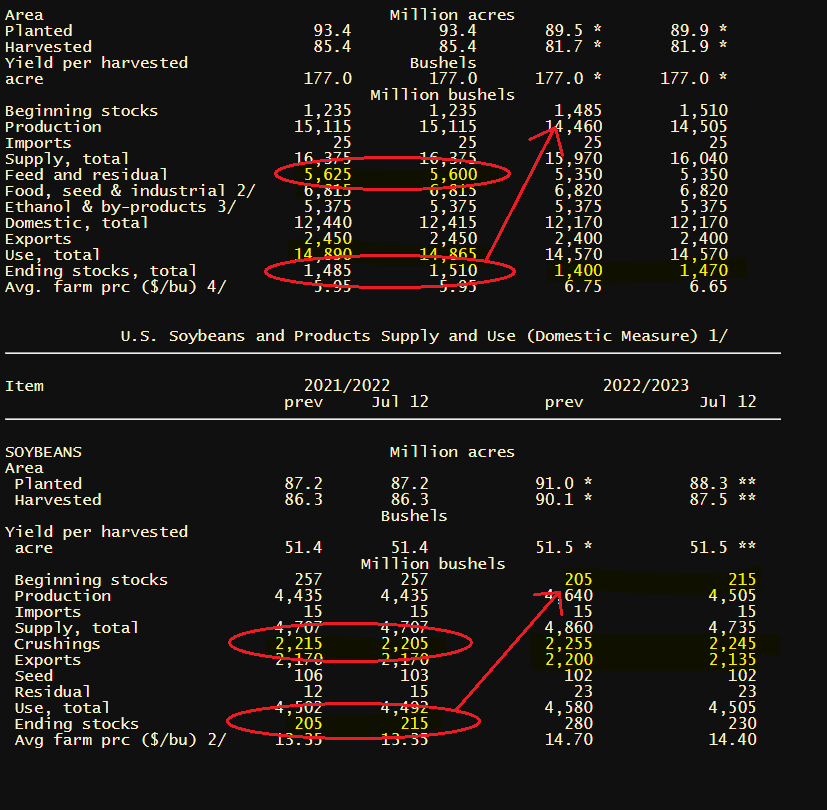

July WASDE; Decrease in feed and residual for corn which netted a 25 million bushel increase in ending stocks. 2021/22 soybean crushings cut 10 million bushels with that change reflected ending stocks.

July WASDE; Decrease in feed and residual for corn which netted a 25 million bushel increase in ending stocks. 2021/22 soybean crushings cut 10 million bushels with that change reflected ending stocks.