7/10/2023

Jul 10, 2023

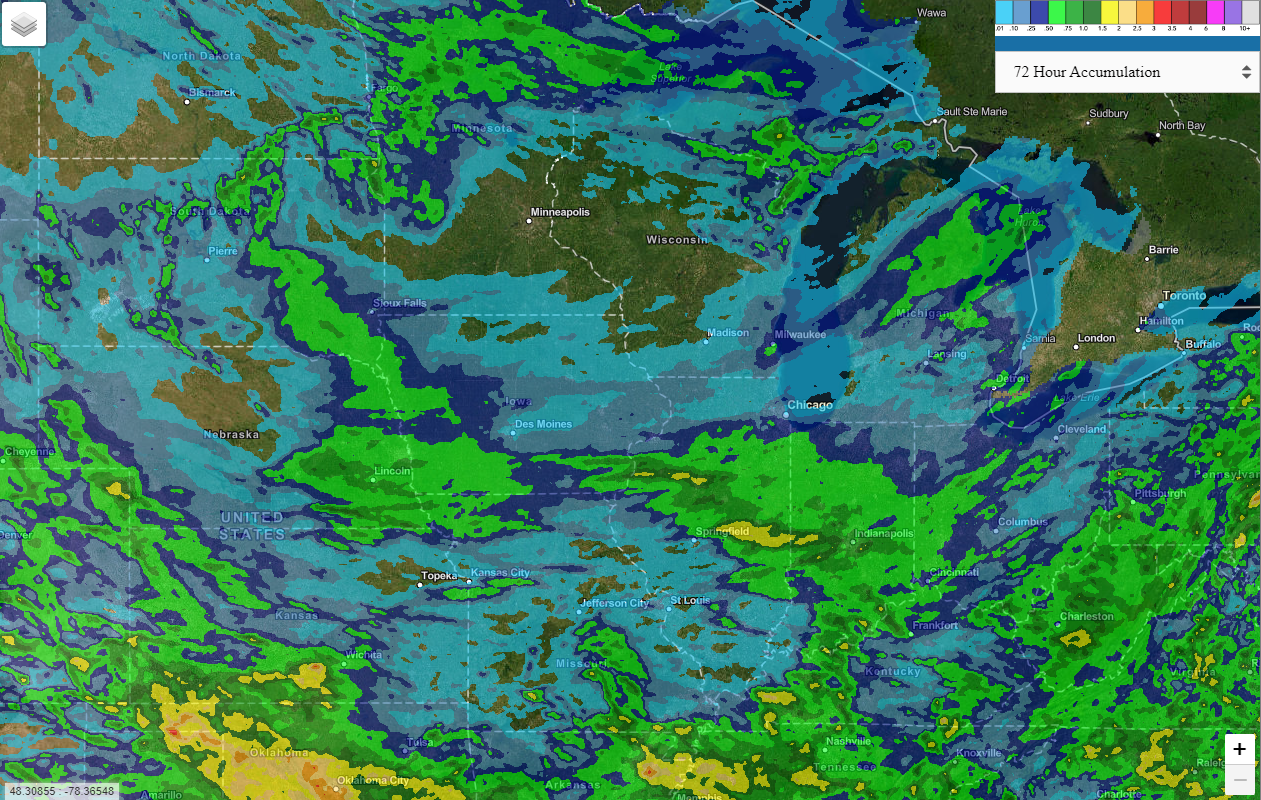

Corn was steady in the 4-5 cent higher range and soybeans trended higher throughout the session finishing with gains of 18-27 cents on Monday. Corn has been mostly sideways throughout the past 5 days while soybeans have traded around a 75-cent range. Weekly export inspections were poor for corn with 341k tonnes shipped last week. Soybeans were landed mid-range of expectations at 238k tonnes. Corn shipments are now 78 million bushels behind the pace needed to hit the USDA export target, up from 60 million bushels last week. Soybean export shipment pace is now 23 million bushels ahead of the USDA target, down from 28 million bushels last week. For the WASDE report on Wednesday, analysts’ average estimates show trade expecting the USDA to cut corn yield by about 5 bu/ac and soybean yield by 0.6 bu/ac. They also have the 2022/23 corn ending stocks decreasing by 30 million bushels which seems out of line considering how sluggish demand has been for the past 6 months. USDA will need to sharpen their demand numbers for corn exports and ethanol before the end of the marketing year.