6/6/2023

Jun 06, 2023

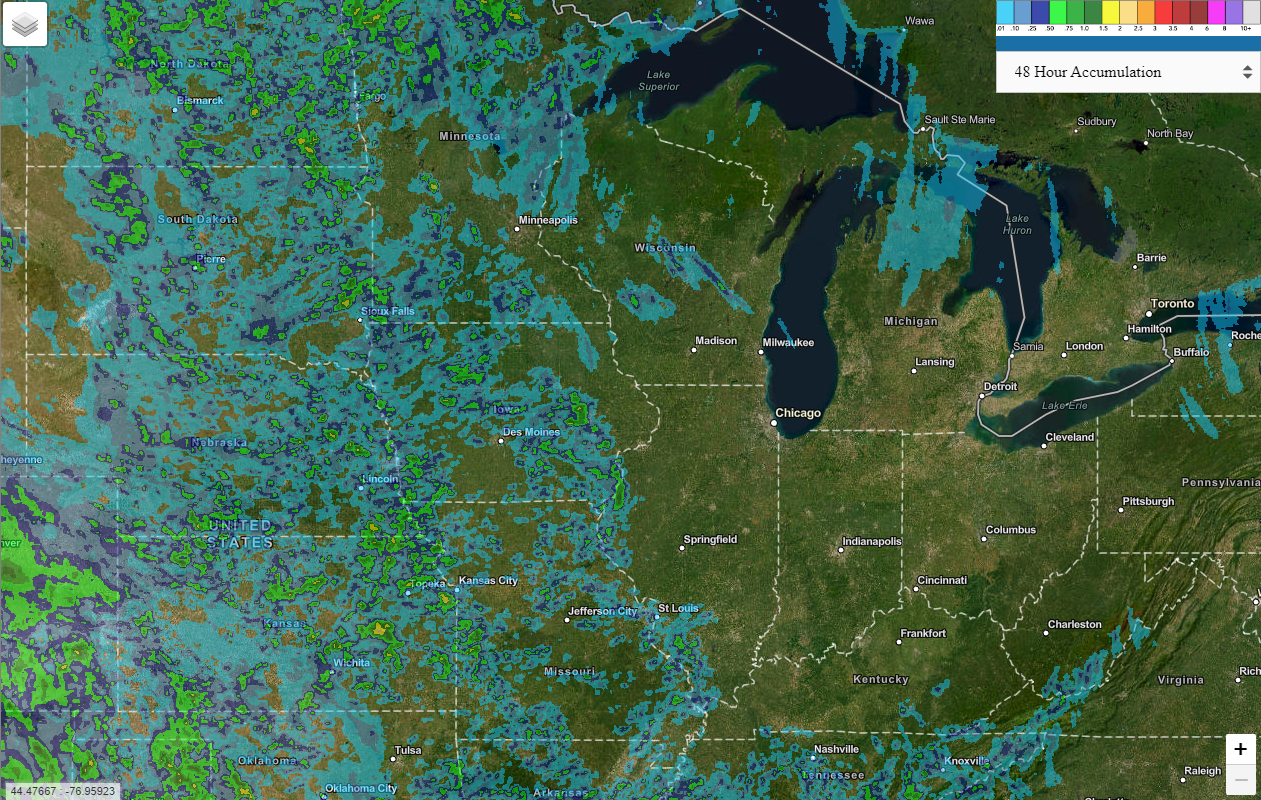

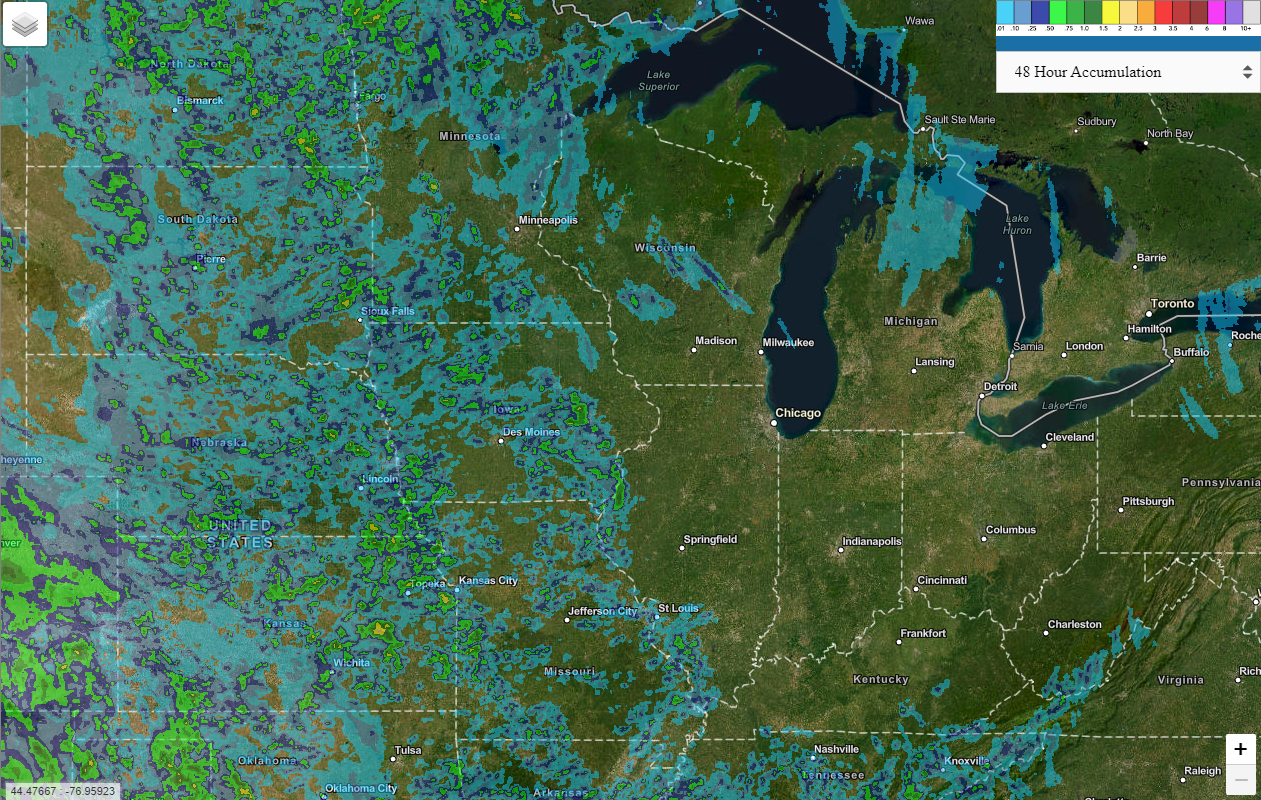

Corn and soybeans began overnight trade immediately higher, triggered by the USDA putting out some lower-than-expected crop ratings. The U.S. corn crop is currently rated at 64% good/excellent, trade was looking for a 67% rating (69% last week, 73% year ago). Probably the most notable drop in conditions was across the I-states with Illinois -19% g/e, Indiana -10% g/e, and Iowa -5%. The initial rating for the soybean crop came in at 62% good/excellent with trade expecting a 65% rating. Corn and soybeans did flip back and forth between higher and lower a couple times throughout the session before finding solid footing in 3-5 cent higher trade shortly after the mid-day point. Some strong spread action with July corn finishing the day up 10 cents. The USDA announced the sale of 165,000 tonnes of soybeans for delivery to Spain during the 2022/23 marketing year. Some are guessing that this could be a result of Brazil's large lineup due to shipping delays.