6/6/2022

Jun 06, 2022

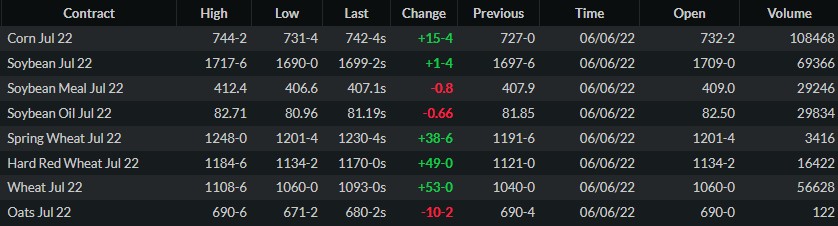

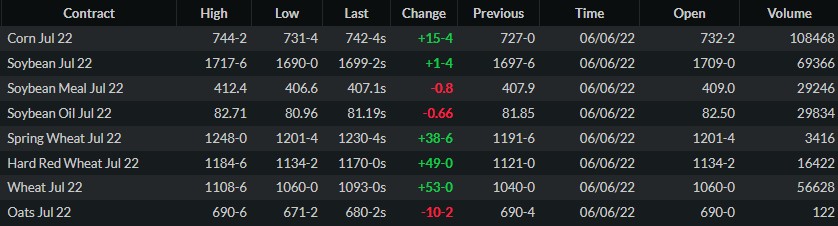

Trade was all about headlines today. Corn picked up double-digits out to July 2023 and soybeans finished 1-7 higher after a day of mixed trade. Wheat was sharply higher from the start last night, carrying corn and soybeans with it during the overnight session after it was reported that Russia had executed a targeted strike on a major Ukrainian grain export terminal. Soybeans had cooled off by sunrise but corn continued to trade strong through the day. Weekly export inspections were on the high end of estimates for corn at 1.435 million tonnes inspected last week. Soybeans were a miss at 350k tonnes inspected compared to the 400-600k tonne range of estimates. The current corn shipment pace exceeds the pace necessary to meet the USDA target by 98 million bushels, compared to 99 million bushels last week. Soybean shipments to date fall short of the pace needed to meet the USDA target by 27 million bushels versus 26 million bushels last week. The USDA is expected to release the first condition ratings for corn this afternoon alongside the planting progress. Trade averaged a 68% good/excellent rating on corn and 93% planting completed. Soybeans are expected to be 80% planted. Current weather forecasts are extremely favorable to help planting and crop development and will likely keep some pressure on the markets now.