6/5/2023

Jun 05, 2023

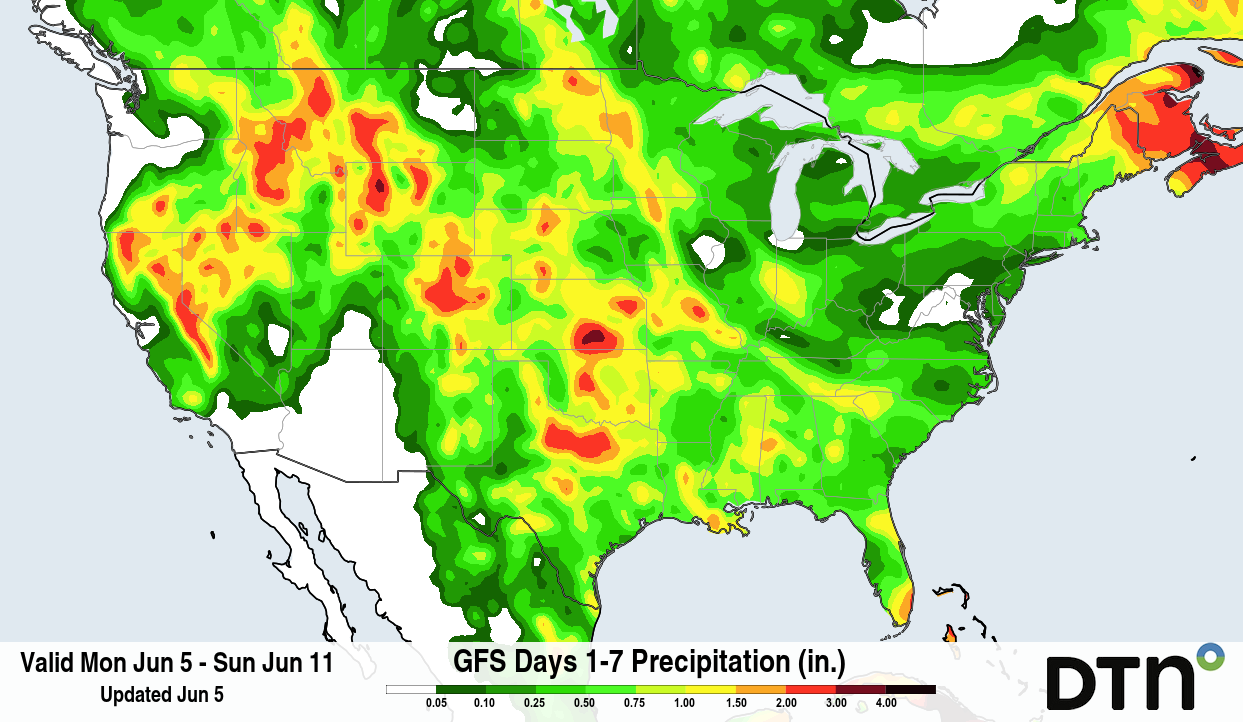

It is safe to say that we have fully submersed ourselves into a weather market! Following Friday's largely bullish reversals and higher trade Sunday night, corn and soybeans flipped to the red shortly after the 8:30am open. These funds and algorithms are trading updated weather forecasts by the hour! Just like we mentioned a few times over these past couple weeks, these rallies can happen fast with larger moves than what is expected. These rallies can also be done just as quickly, leaving some feeling like they missed out. Using sell orders going forward is key to maintaining a strong average and capitalizing on higher trade when it’s there. Weekly export inspections for corn and soybeans both came within their expected ranges with 1.181 mln tonnes of corn and 214k tonnes of soybeans shipped last week. For the year, corn shipment pace shrinks its deficit from 92 million to 80 million bushels behind the USDA target. Soybean shipment pace falls back by 5 million bushels to 42 million bushels ahead of the USDA target. Trade expects the USDA to lower crop ratings in this week's update which could lend some support and help stabilize trade.