6/29/2022

Jun 29, 2022

Trade worked toward some final positioning ahead of tomorrow's stocks and acres reports. Corn saw a relatively modest 10-11 cent range throughout the day to mostly lower. Today was first notice for July contracts which had July corn around 20 higher at one time in what appeared to be a short squeeze. Soybeans tried to trade lower but wound up extending this week's rally another day. Corrective buying has come in quick following a $2/bu fall from the contract highs set a couple weeks back, lifting August and November soybeans around 80 cents above their recent lows. June lows for corn and soybeans are likely what we trade against for the remainder of the growing season into harvest. Weekly ethanol data showed declines in production and stocks with output off 4,000 barrels/day to 1.05 mln bpd and stocks off 730,000 barrels to 22.75 mln bbls. For tomorrow's report, trade is expecting grain stocks to be a year-over-year increase and a 500k acre bump in 2022 corn acres with that balance being taken away from soybean plantings. June 30th Report tidbits: Corn stocks have been higher than trade expectation 7 out of the last 11 years. 11 of out of the past 12 years, whichever direction December corn closes the day of the report, it carries through that direction the following day. 7 out of the last 11 years soybean stocks have been lower than estimates, price action in November beans the day after the report is 50/50 on following through with the report day close.

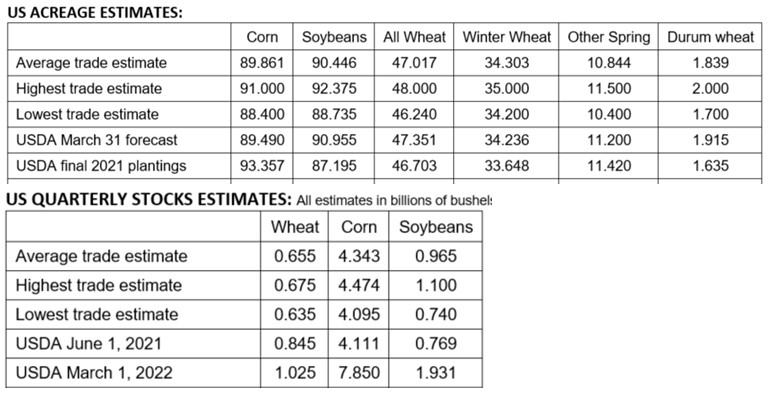

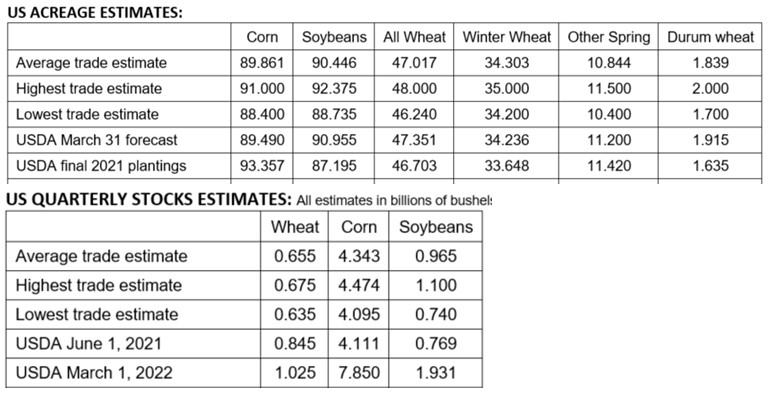

Estimates for tomorrow’s reports.

Estimates for tomorrow’s reports.