6/28/2023

Jun 28, 2023

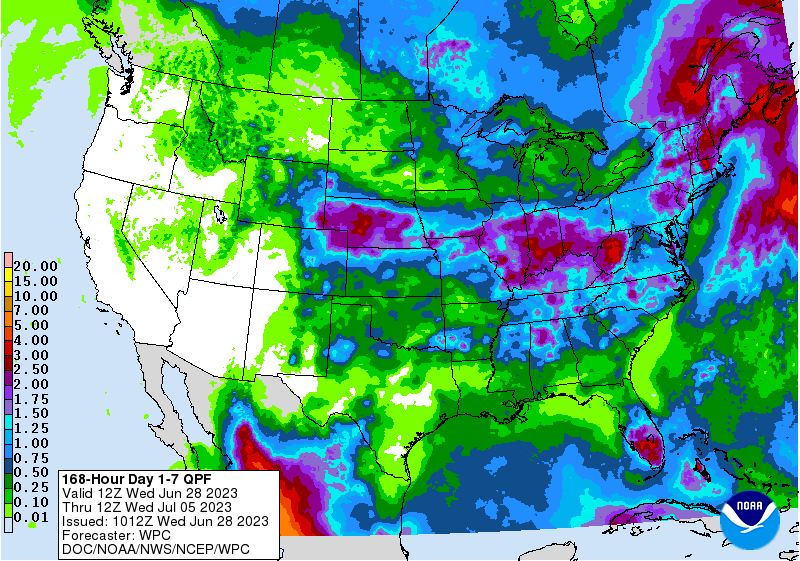

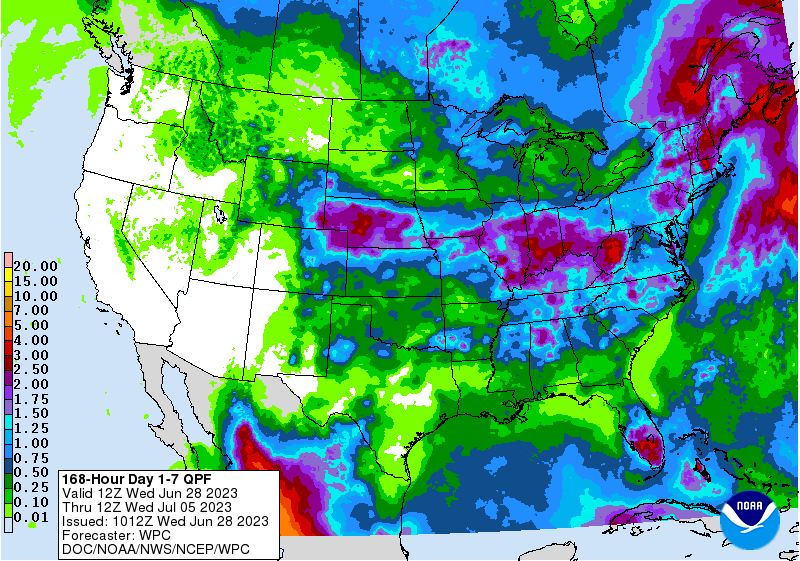

Another day of hard liquidation as rain and extended weather forecasts continue to pressure the markets. It is probably safe to assume that funds have now flipped themselves from long to short. We had a good rally that provided opportunity at profitable levels for the 2023 crop and think our customers did a great job making cash new crop sales and placing hedges. In total, we handled slightly over one million bushels of 2023/24 crop during the 4-day rally. What became evident with basis, regardless of delivery period, is that trade was more focused on supply and had almost completely forgotten about demand. The USDA did announce the sale of 170.7k tonnes of corn for delivery to Mexico this morning with 21k tonnes to be delivered in 2022/23 and 149k delivered in 2023/24. This was the first flash sale of corn since mid-May. Weekly ethanol data showed production unchanged at 1.05 million barrels/day and stocks increasing by 175,000 barrels to 22.98 mln bbls. With just two months remaining in the marketing year, corn use for ethanol trails the pace to meet the USDA number by 47 million bushels. With the sharp sell-off in futures this week, we now have room on the board for a friendly reaction to Friday's reports.