6/27/2022

Jun 27, 2022

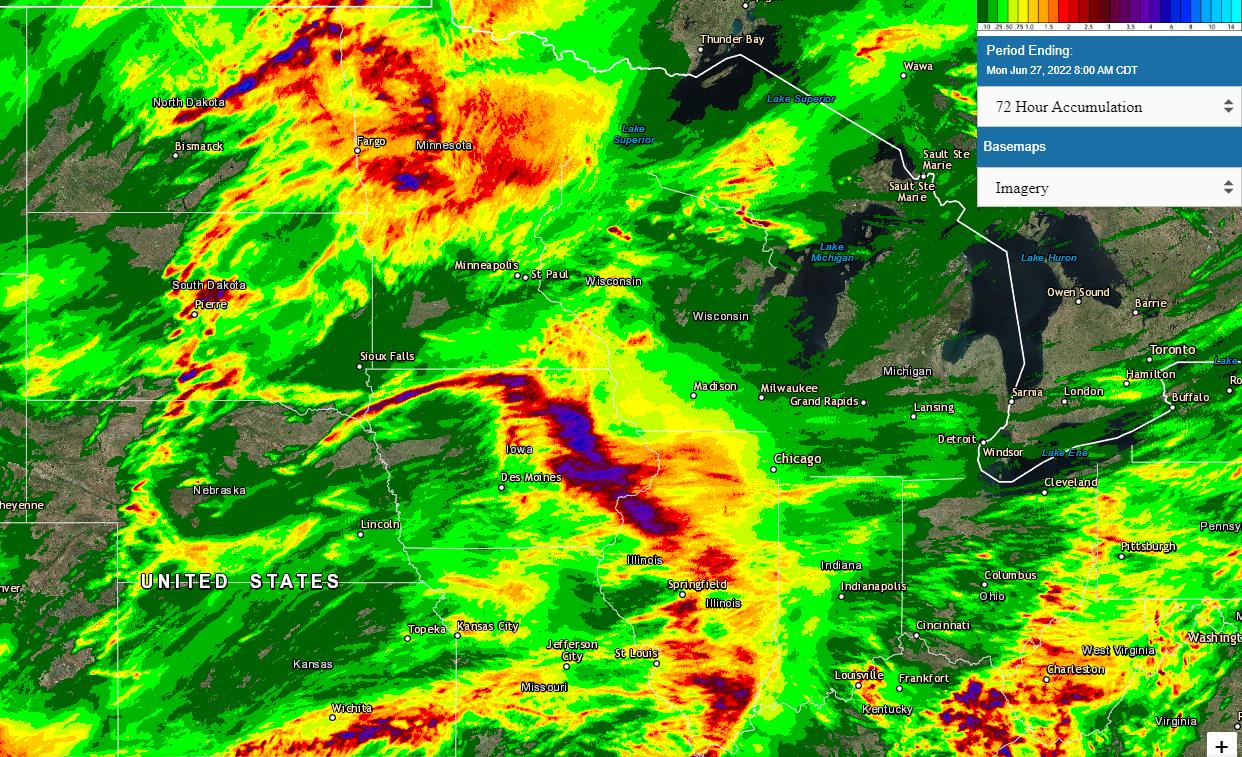

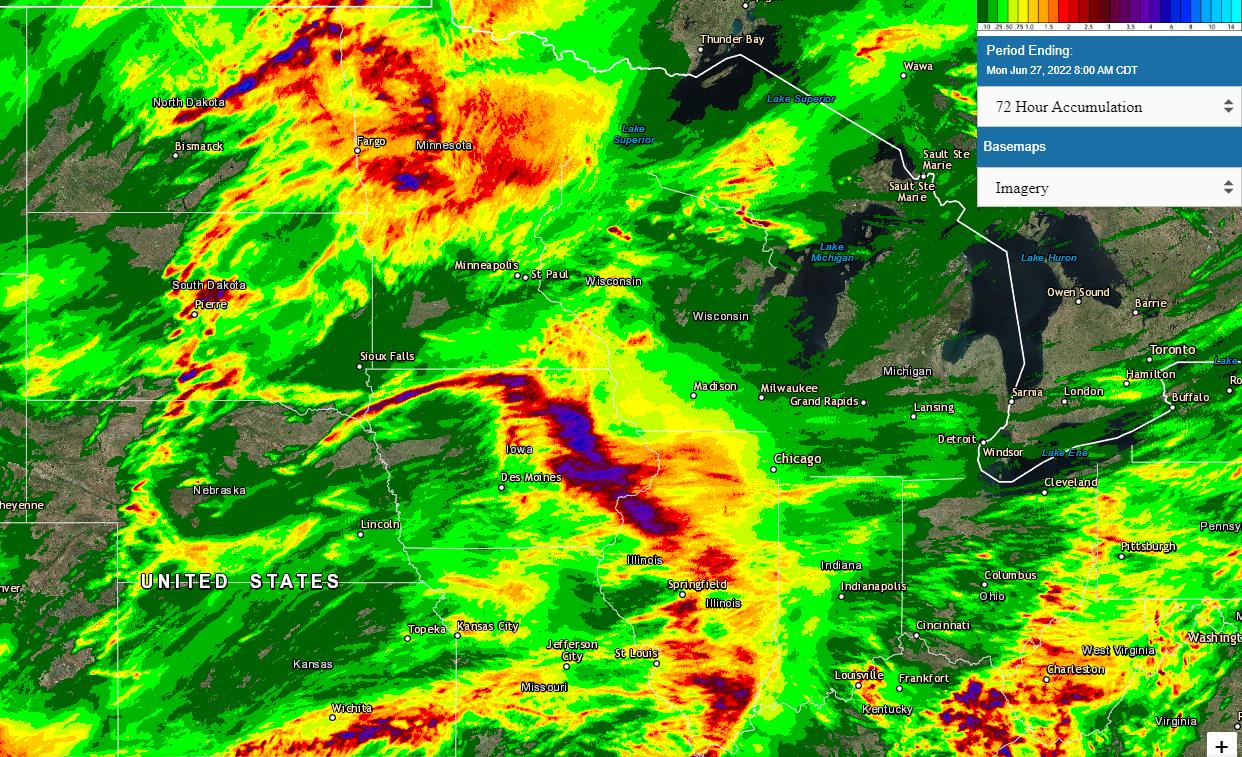

More risk-off in corn and wheat following a weekend that saw much needed precipitation in major growing areas with some totals in Iowa and Illinois estimated between 4-5" or more. Crude oil bounced back following two weeks of lower trade. This was supportive to the soy crush and soy oil, lifting soybeans with it. Forecast outlooks are turning more "greenhouse" than drought, calling for above average temperatures and precipitation into mid-July. Weekly export inspections were on the higher end of trade expectations for corn and soybeans this week with 1.246 million tonnes of corn and 468k tonnes of soybeans inspected for shipment. Year to date shipment pace for corn exceeds the USDA target by 101 million bushels and may be stuck short of target for soybeans with Brazil set to become the world grain supplier for the next couple months. The USDA just increased soybean exports in this month's WASDE report and it is very possible that they will have to reverse that change. U.S. crop conditions are expected to be steady with last week's report. Brazil corn production estimates are seeing another round of increases and the 8 a.m. sale announcements from the USDA have become non-existent. This is concerning considering the large price break we've seen on the board, recently.

Weekend rainfall

Weekend rainfall