6/26/2023

Jun 26, 2023

There's quite a bit to unpack after a weekend that delivered some much needed rain in good quanitity across most of the grain belt. Minnesota, Iowa, Eastern Nebraska, and the Dakotas all received good general rains that should carry the crop well into July, especially with temps moderating over the next week. The market was chomping at the bit following a headline that a military coup was taking place in Russia but was apparently started and done in about the time it took me to mow my lawn Saturday afternoon. Big picture: a few years of historically high prices have now created sluggish demand and a trade space dead-set on pricing the US out of the global grain space doesn't help. Some weather risk premium in the market is fine considering no one knows what the final yield number will be but sustained trade inside the top 25% of all-time values does not make sense at this point in time. Weekly export inspections missed low for corn with 543k tonnes shipped last week. Soybeans were on the low-side of expectations at 141k tonnes shipped. Shipments paces are 52 million bushels behind for corn and 33 million bushels ahead for soybeans.

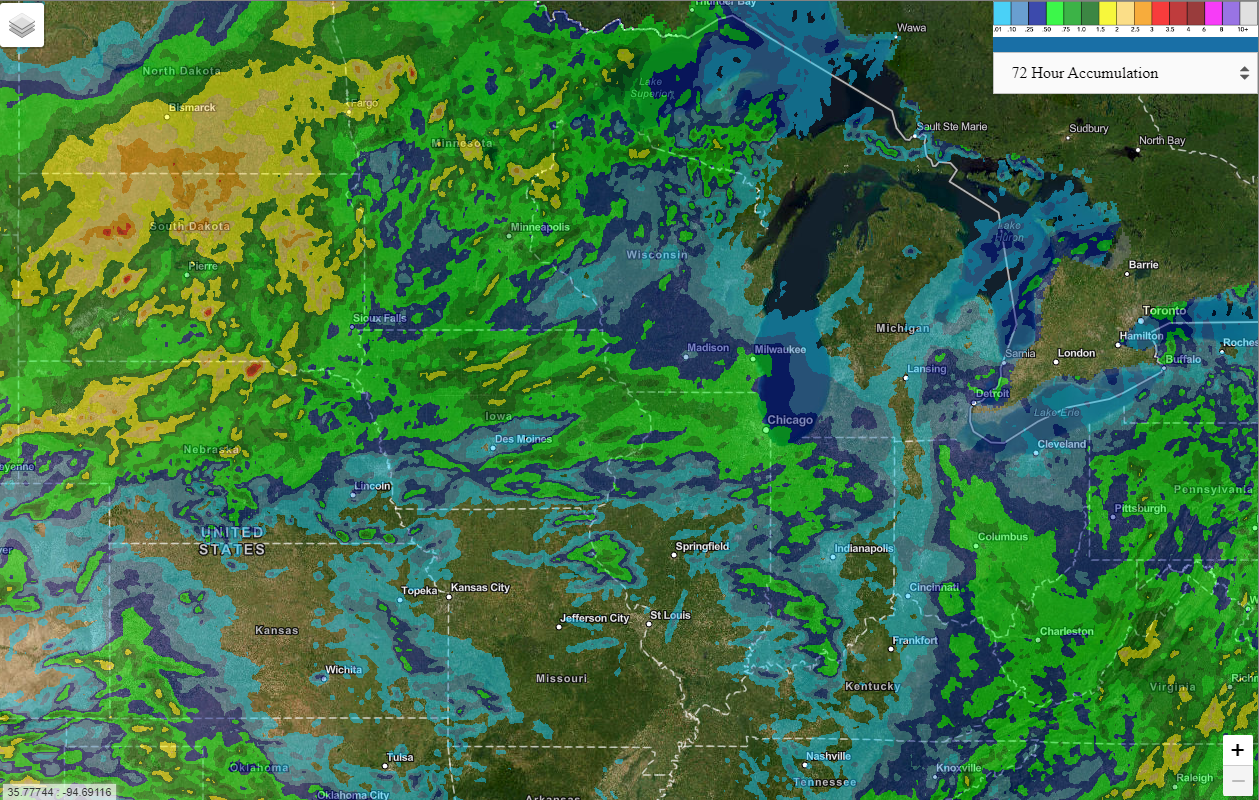

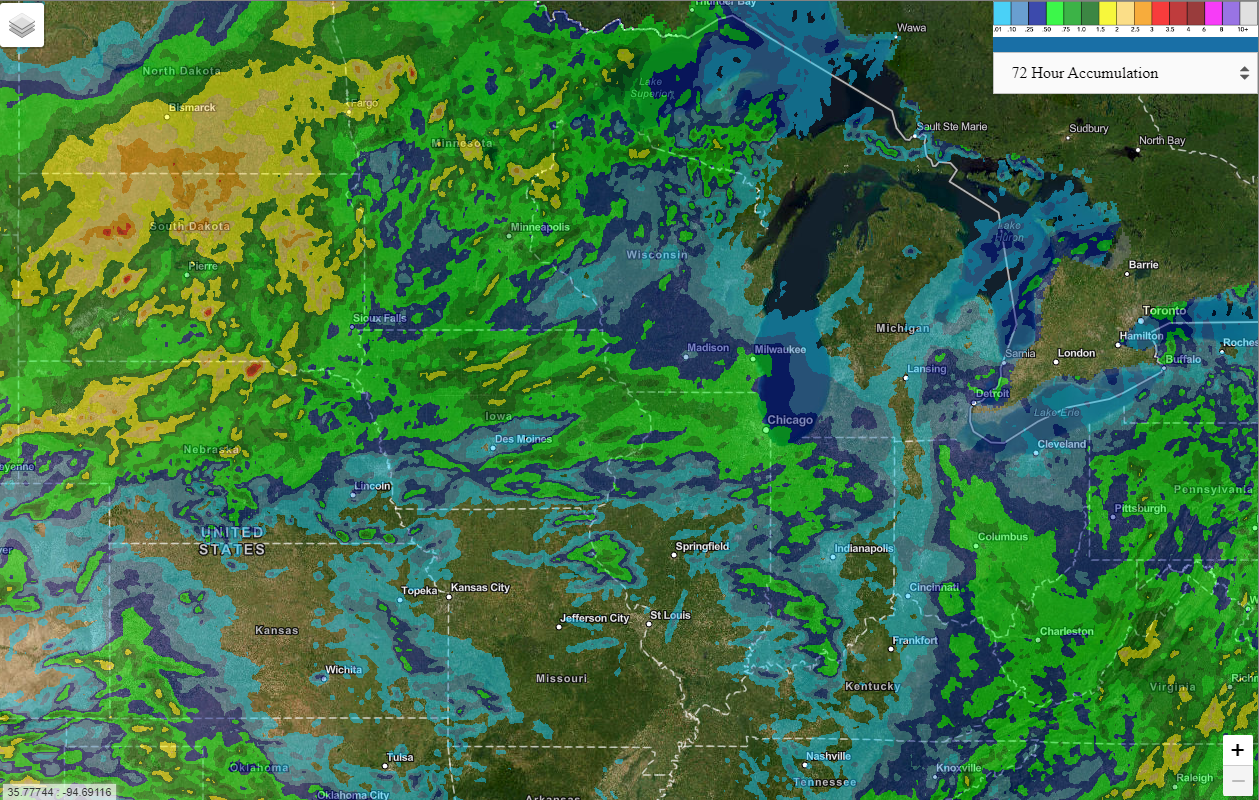

Estimated weekend rainfall

Estimated weekend rainfall