6/24/2022

Jun 24, 2022

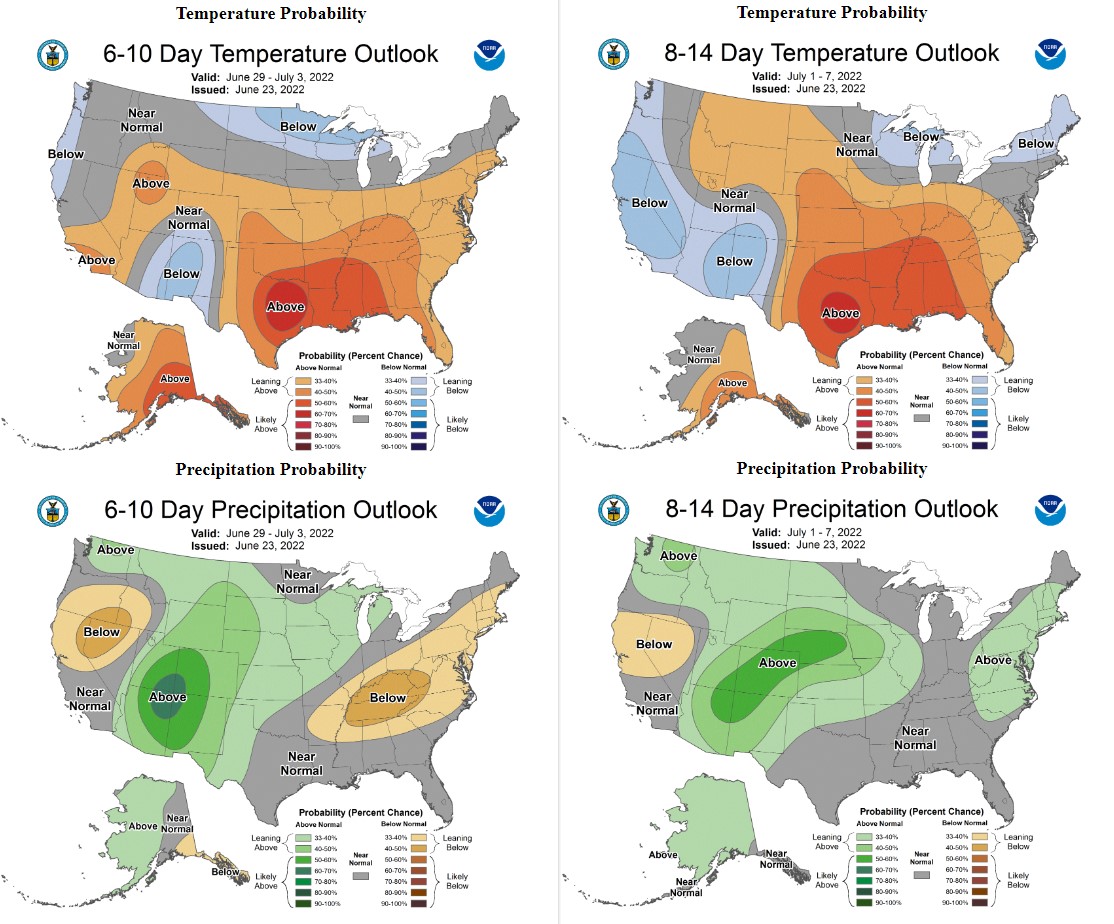

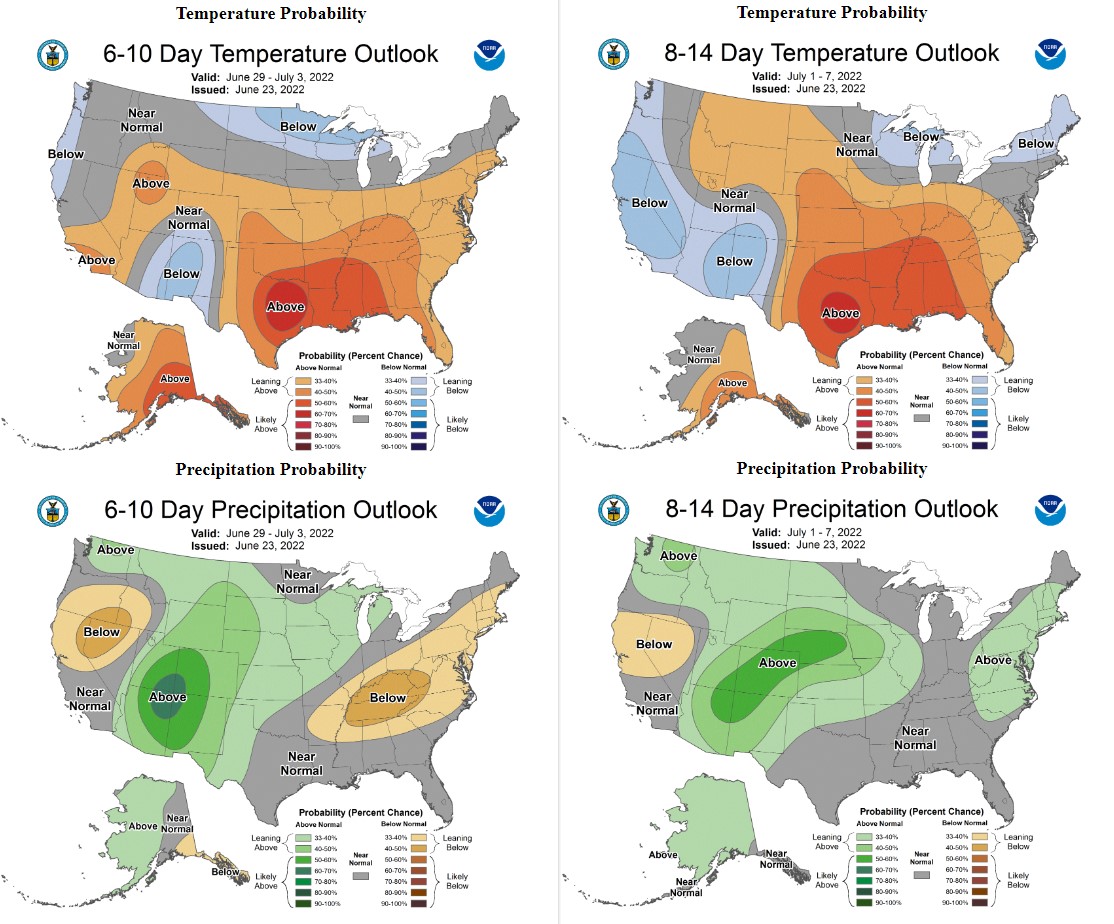

A nice recovery into the weekend after trade became quickly oversold earlier in the week. Conditions overall remain favorable for crop development but some extra heat has made its way into the extended forecast outlooks which helped support buying today. Leading up to next Thursday’s reports, I would expect the objective here is to get our futures mid-range of our most recent significant highs and lows on the charts (somewhere around the 700'0 level on September and December corn, near 1600'0 on August beans and 1480'0 on the November chart). Weekly export sales were better than expected for old crop corn with 672k tonnes sold. Old crop beans sales posted 29k tonnes of net sales. This was a marketing year low for old crop beans and we are at a point in the marketing year where some net cancellations of soybeans on any given week will not be a surprise. New crop sales were both within trade expectations with 358k tonnes of corn and 265k tonnes soybeans sold last week.