6/23/2023

Jun 23, 2023

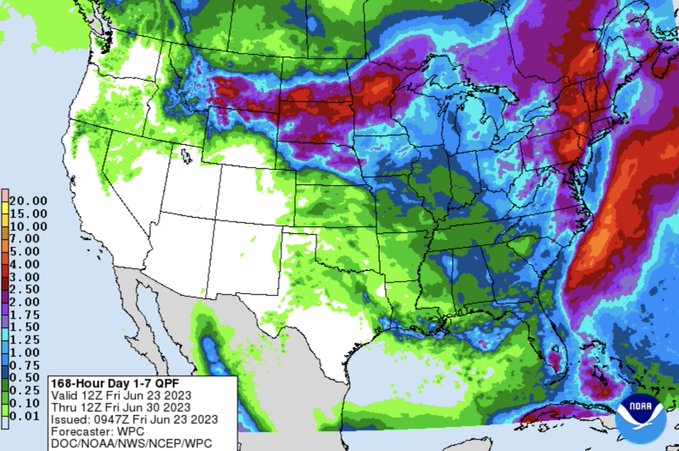

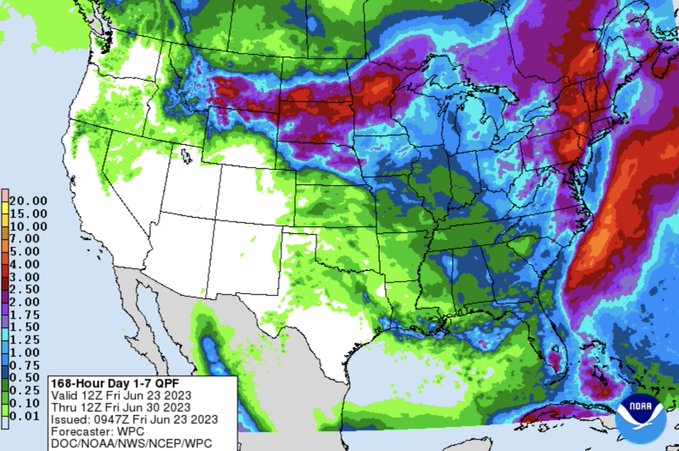

Major risk-off to end the week following some big changes in the weekend forecasts and extended weather models showing high probabilities of much needed moisture across the grain belt. December corn settled well below the $6.00 level and November soybeans managed to hang on above $13. Weather markets can be extremely volatile and there has been no shortage of volatility over the past week. The weekly export sales report offered no support and the figures for corn were very poor, coming in at the bottom side of estimates with 36k tonnes sold. Soybean sales were decent for this week with net sales of 457.5k tonnes. The report shouldn't be a surprise considering how fast the board priced the U.S. out of the global market starting last week Thursday. The funds are able to move the market but it doesn't mean the funds are right, real fundamentals still need to be part driver of the market direction. To date, export sales pace for corn is now 123 million bushels behind the USDA target versus 107 million last week. Soybean export sales pace is currently 82 million bushels behind the USDA target, improving from an 88-million-bushel deficit last week.