6/22/2023

Jun 22, 2023

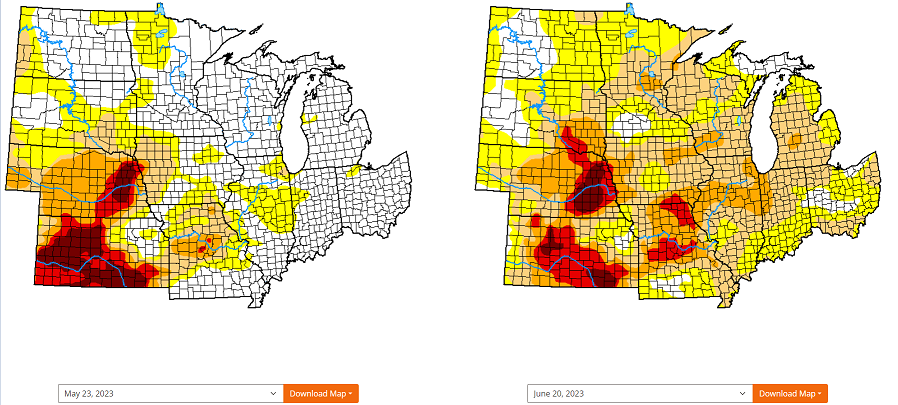

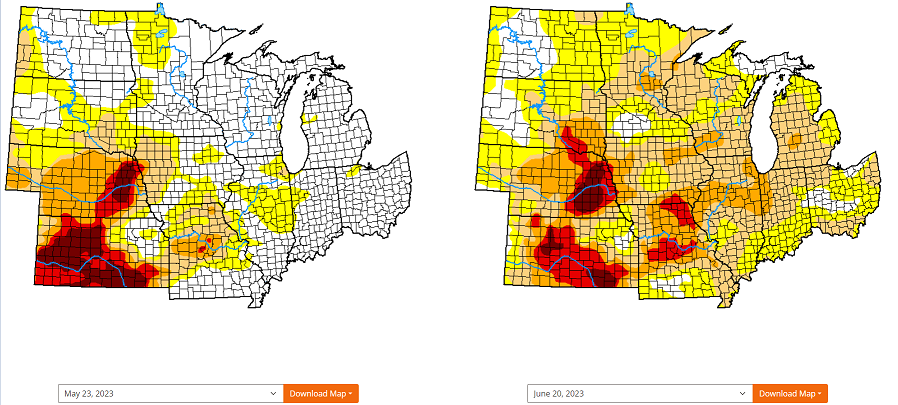

Corn and soybeans were lower on Thursday following four consecutive days of large gains on the board. December corn traded as much as 15 cents down but had recovered to near 5 lower by mid-day. Soybeans weren't able to shake the weakness off quite as easily. The November contract was down as far as 55 cents but was able to make some of that back as the session progressed, ending the day 37 cents lower. Weekly ethanol data showed production increased by 34,000 barrels/day to 1.05 mln bpd and stocks up 578,000 barrels to 22.8 million bbls. Today's weaker price action is healthy and the start of a much-needed correction if we want the trend higher to continue. On the cash basis side, it's not hard to imagine that end-users are well covered well into August (or further) at this point. It is going to take some time for the market to absorb this large influx of old crop corn and for the end-user to figure out what their needs are to bridge the gap to new crop. We are also probably not going to see any impressive export sales until we can verify that there are areas inside the U.S. where this corn crop truly does have some drought issues.