6/13/2022

Jun 13, 2022

Corn and soybeans were higher to kick off overnight trade but flipped lower around 7 a.m. following broad sell-off in multiple market places that included commodities, stocks, and indices. The liquidation also follows a weekend of near ideal growing conditions that combined heat, humidity, and scattered rainfall across a majority of the grain belt. Trade was feeble minded in their strategy to trade weather headlines last week and were caught with fresh length into soybean contract highs and a corn market that has found resistance on futures' charts in multiple contracts at their 50-day moving averages and (according to the USDA last week) now has 50 million more bushels available for domestic use. Weekly export inspections were on target for corn and soybeans with 1.2 mln tonnes of corn and 605k tonnes of soybeans shipped last week. Based off of the fresh export forecasts in last week's WASDE report, current corn shipments exceed the pace needed to meet the USDA forecast by 101 million bushels and soybean shipment pace falls short by 45 million bushels. For the remainder of the marketing year for old crop, we will be a cash-driven market with values set by local end-users. Once they feel they have enough coverage to bridge to harvest, bids will evaporate. Pay attention to futures and basis levels and what it might mean to you.

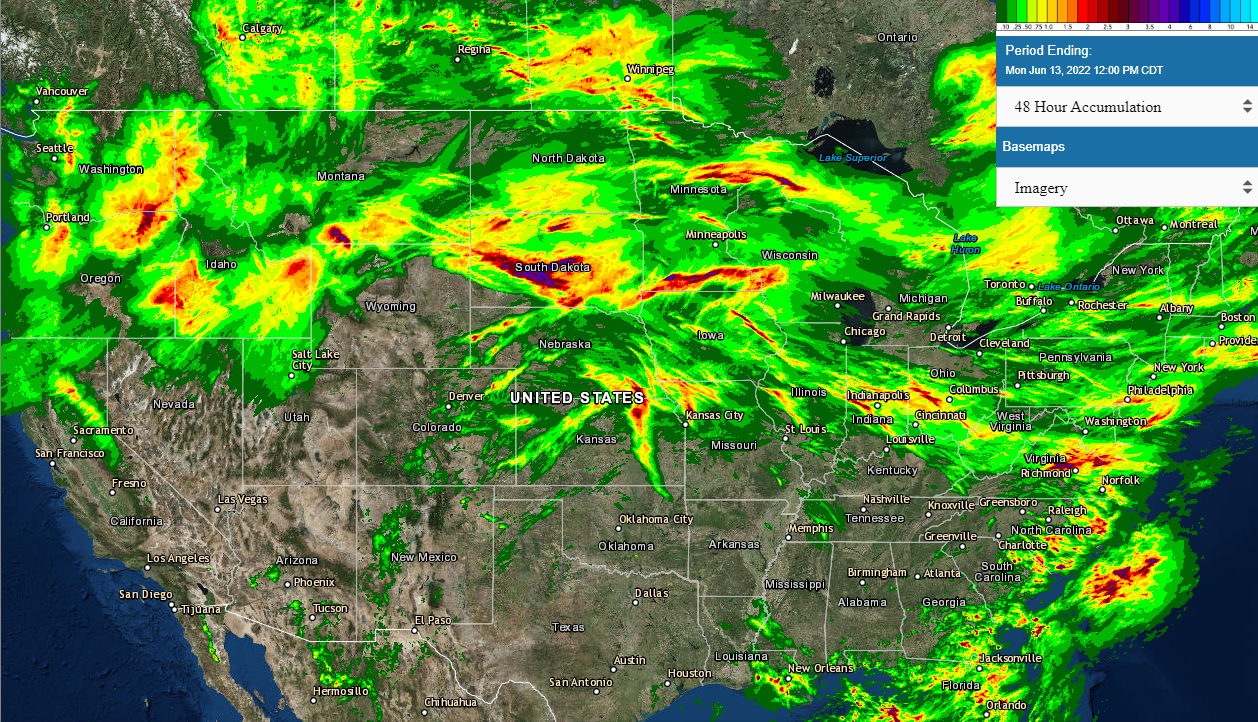

Estimated weekend rainfall

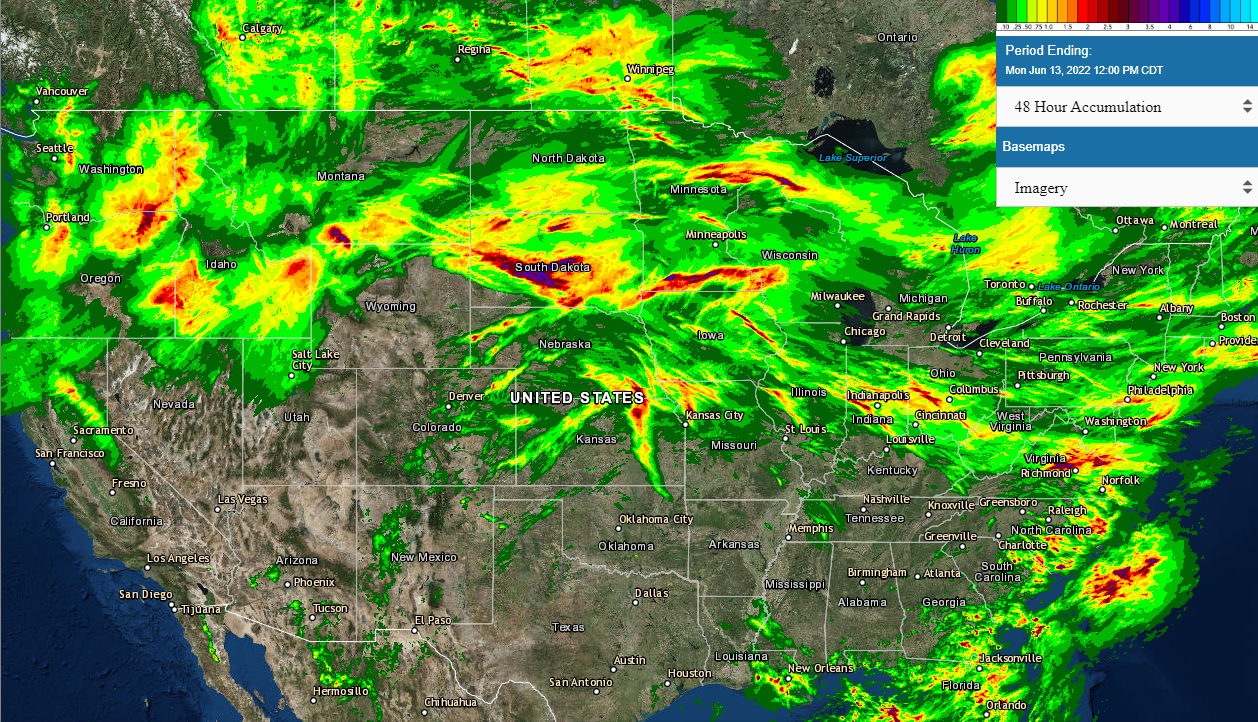

Estimated weekend rainfall