6/10/2022

Jun 10, 2022

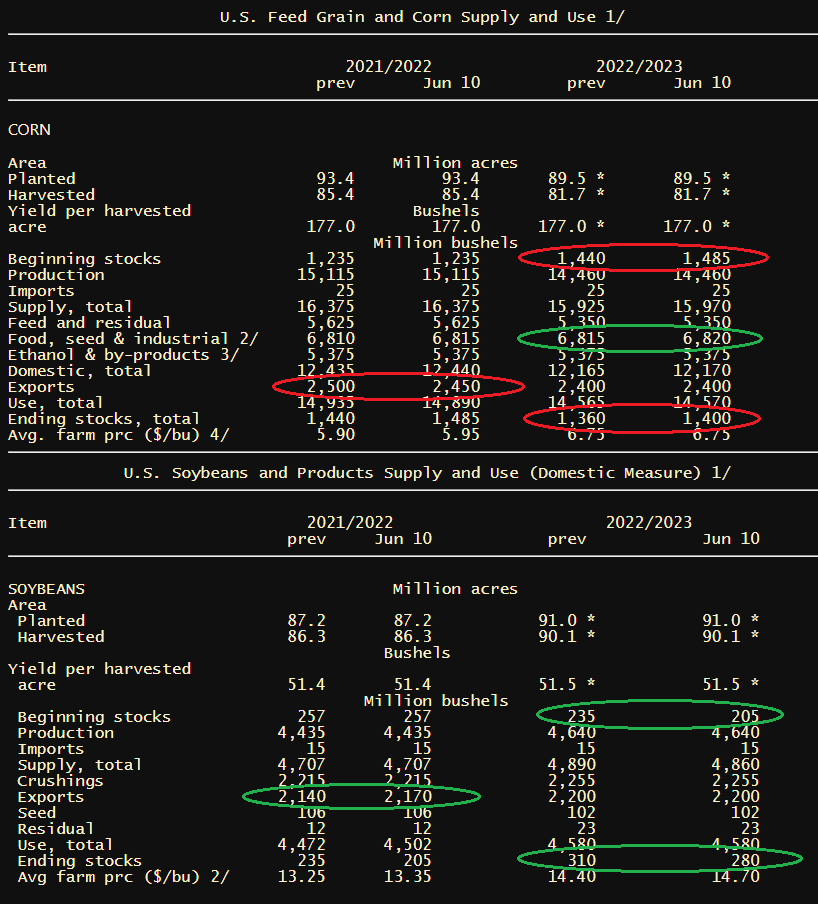

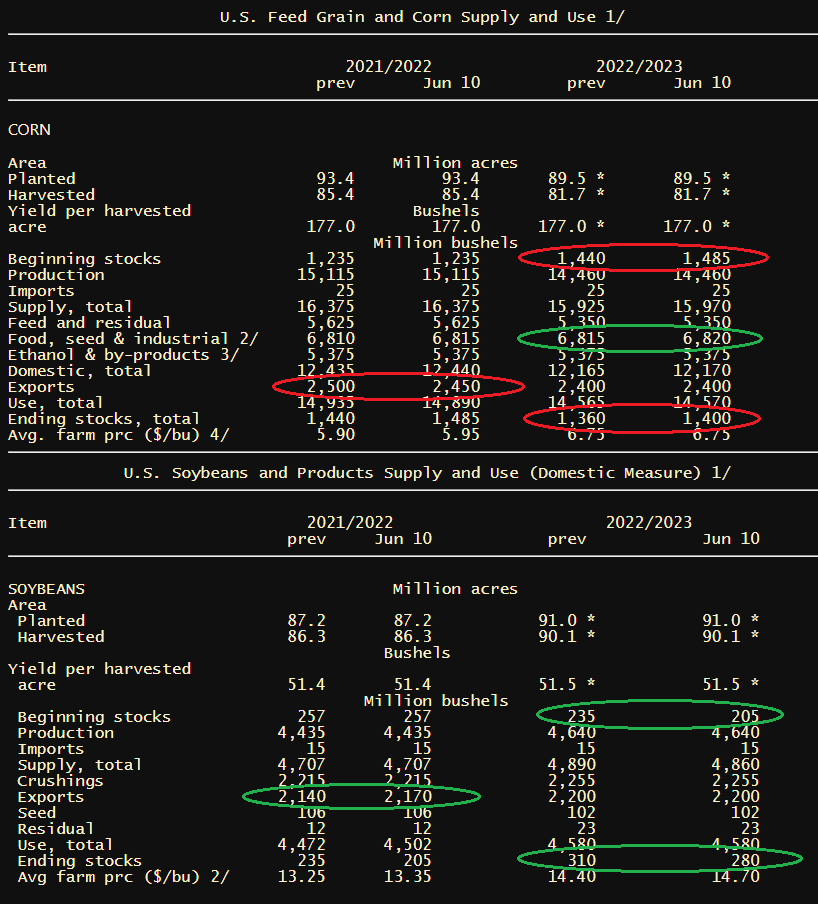

Not too much excitement in this month's WASDE report but a surprising finish on the board given the fresh information. The USDA maybe gave us the first sign of demand destruction in corn (high prices cure high prices) with a 50 million bushel cut to this year's corn export estimate. Results overall were a net increase of 45 million bushels to this year's ending stocks. Soybean exports were increased 30 million bushels which was also the net change in this year's ending stocks. This was slightly friendly compared to the pre-report trade estimates. The doom and gloom over the soybean crop in South America is all but over, the USDA added approximately 80 million bushels to their S.A. production estimates for this year.