5/8/2023

May 08, 2023

A mostly uneventful day for corn and soybeans. Trade was higher overnight but had faded back to two-sided by sunrise. Corn managed to finish unchanged on the July contract but ended the day 4-5 cents lower from September on out. Soybeans were down 2-8 cents. Wheat looked like it was going to enjoy some large gains today with some 20 cent higher trade but had some mixed looks by mid-day. Regardless, I think we can determine that wheat lent some support to keep corn and soybeans from drifting too far into the red today. Weekly export inspections continue to be inconsistent for corn. After last week's solid showing, corn was a miss to the low side with 963k tonnnes shipped last week. Soybean shipments were vanilla at 395k tonnes but that is average volume for this time of year. We only have about 1/3 of the marketing year remaining. With corn export inspections and sales lagging well behind the pace needed to meet the USDA's forecast, how will they approach their demand numbers? Corn use for ethanol is also well behind its forecasted number. We may get some answers in Friday's report.

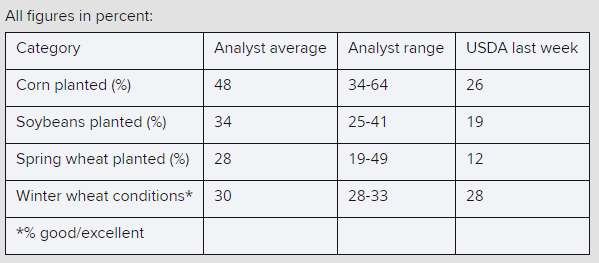

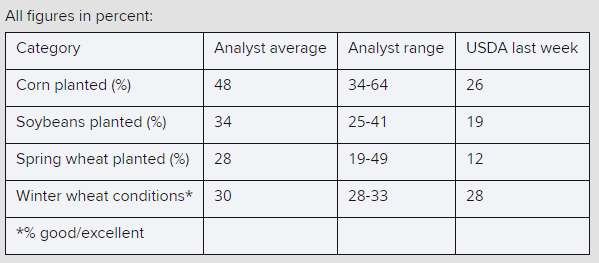

Trade estimates for this week’s crop progress report.

Trade estimates for this week’s crop progress report.