5/4/2023

May 04, 2023

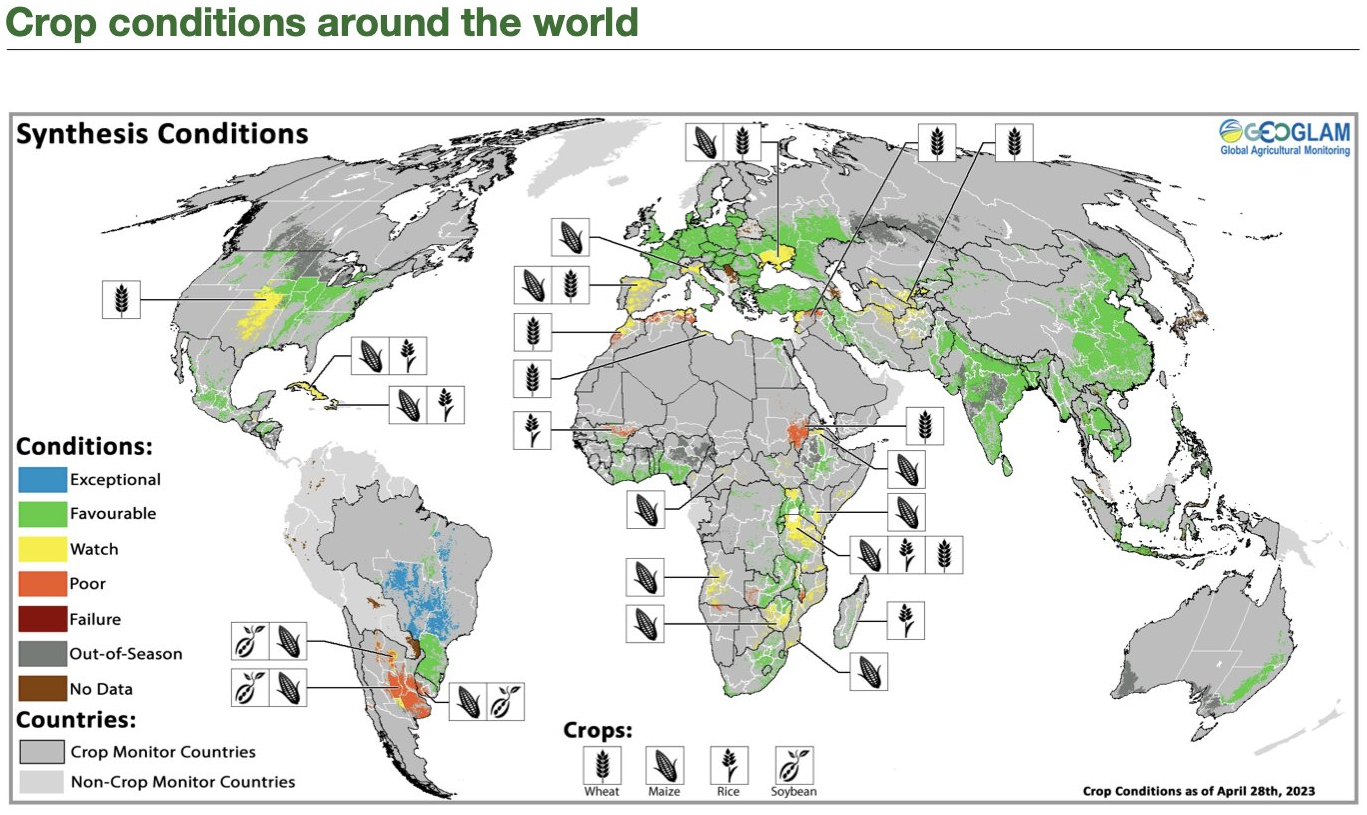

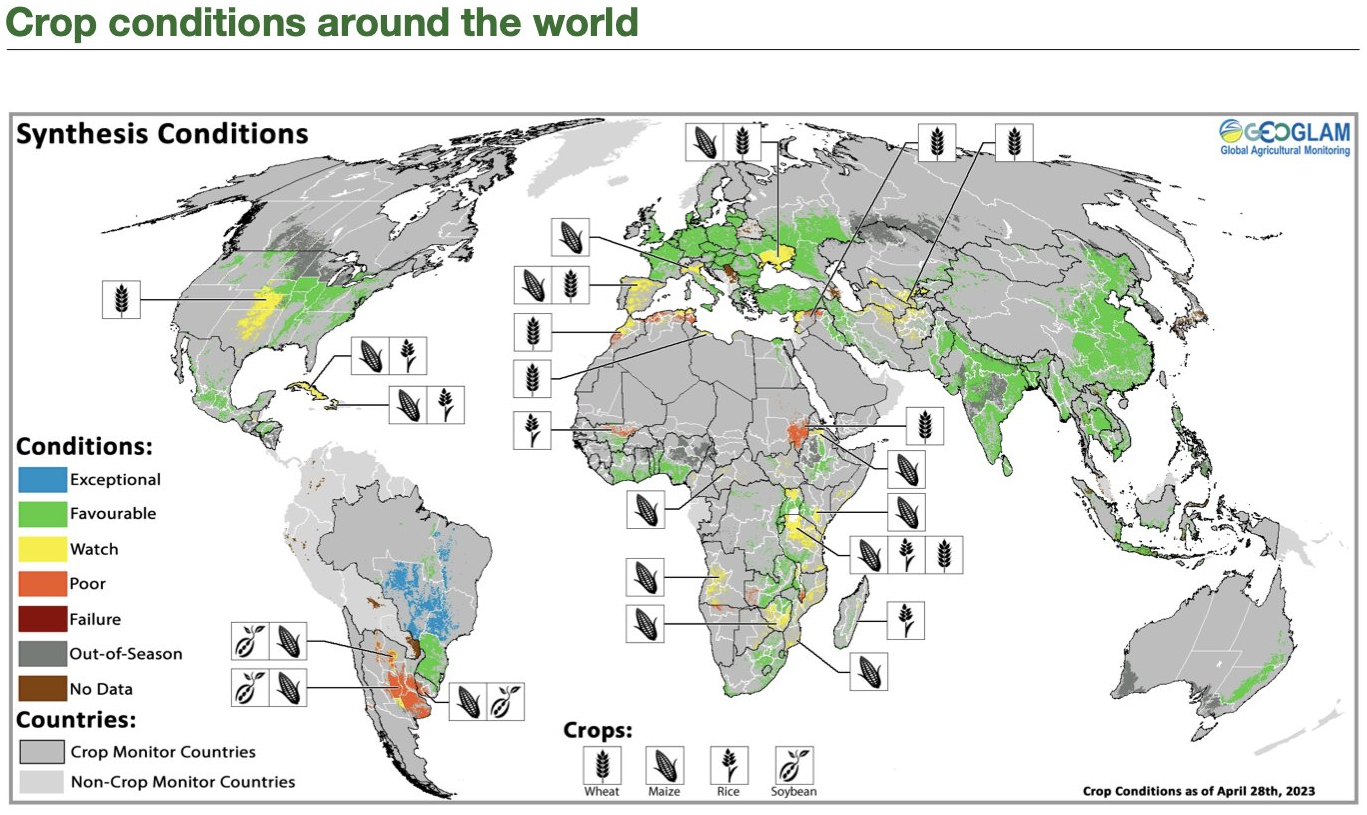

While today's trade may look negative on the surface, the lower price action in corn and soybeans was a healthy pull back after Wednesday's solid gains. Wheat enjoyed modest gains while corn and soybeans made nice recoveries off of their lows and then traded steady. We did see a couple of the front contracts flip green later in the session. The weekly export sales report gave us another warning shot on corn demand. For the first time in over 20 years, the month of April had a week of net cancellations for corn with 316k tonnes net canceled last week. Soybean sales were within expectations at 290k tonnes sold. With the May installment of the USDA WASDE due out next Friday, it will be interesting to see how the USDA handles the current state of corn demand. It's no secret China is purchasing corn from Brazil who has a readily available supply. The current state of Brazil's safrinha crop also remains a non-issue with conditions mostly ideal for the past 5 months. In terms of marketing advice, the Dec:Mar corn spread has been giving us opportunities to roll at 10 cent premiums. If you have HTAs on for December, not a bad place to start!