5/30/2023

May 30, 2023

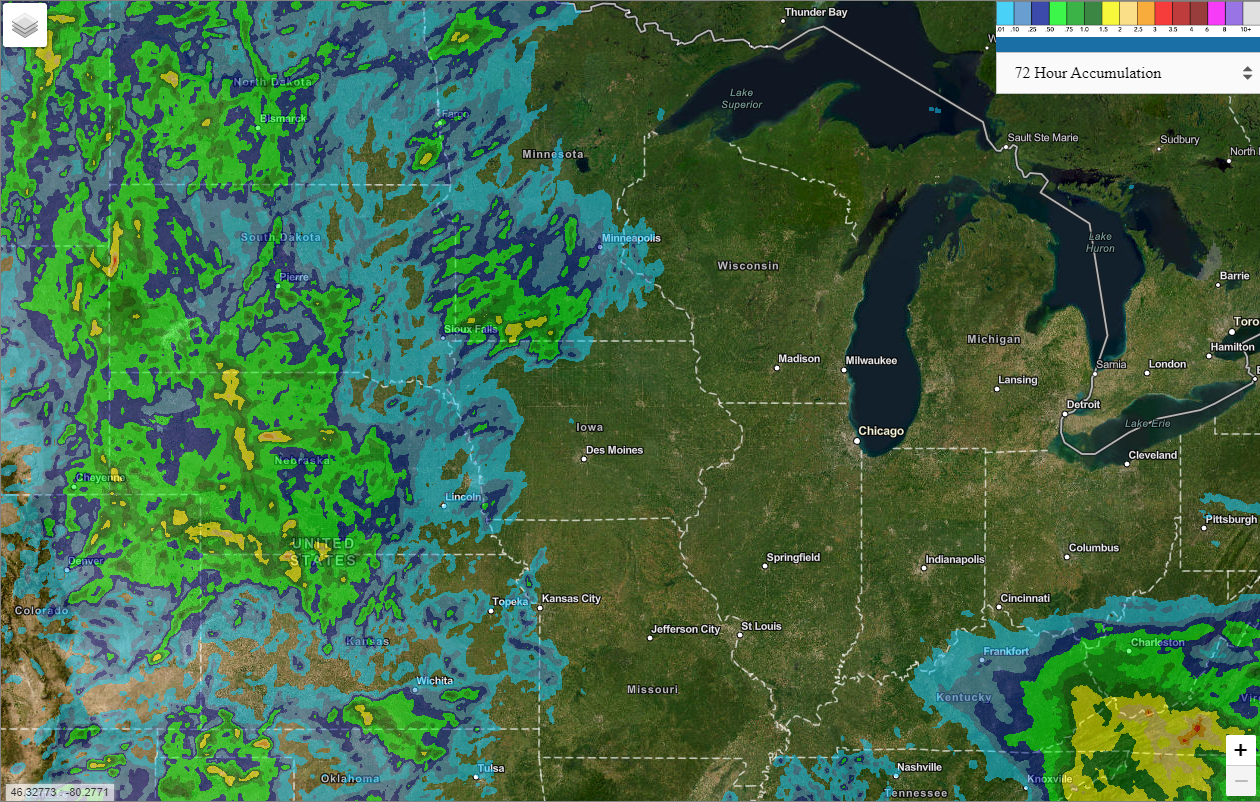

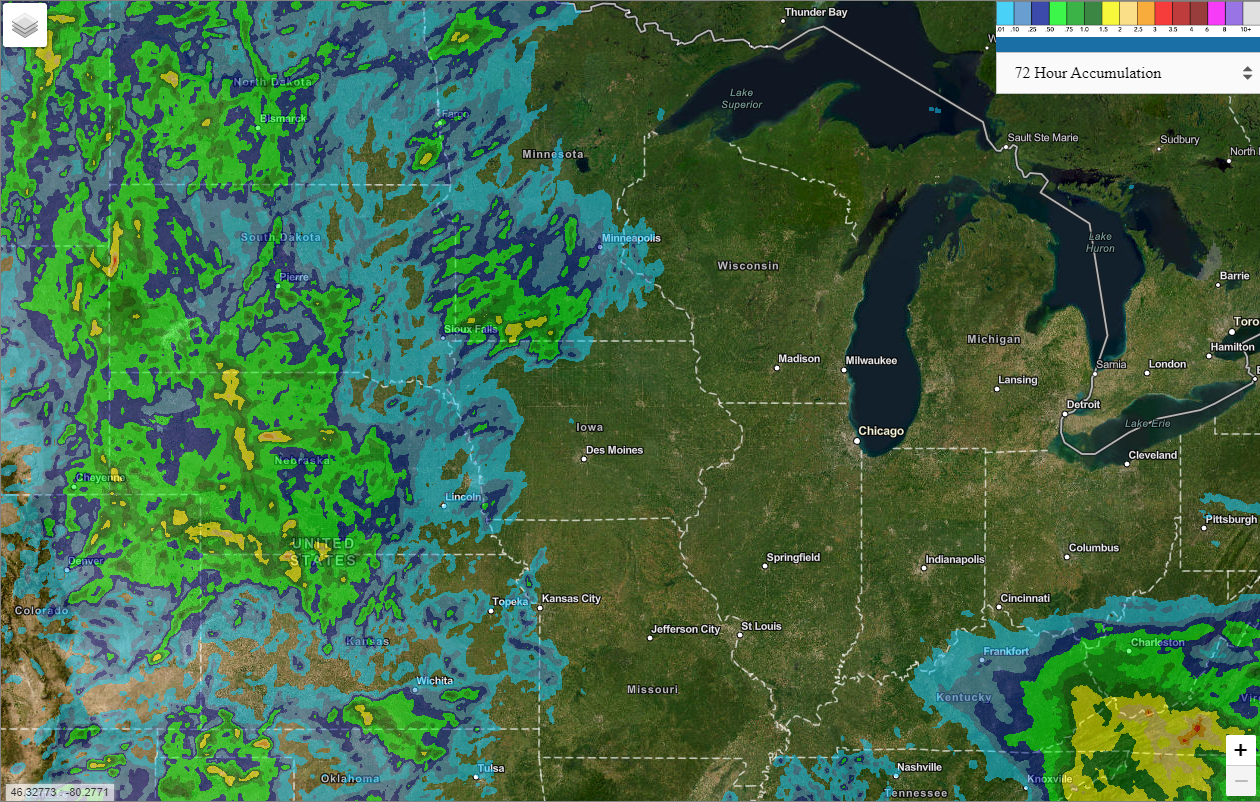

After the long weekend, corn and soybeans were in steady, two-sided trade overnight and then selling flooded in shortly after the 8:30 am opening. Trade was essentially all about weather. Rains materialized over the weekend, bringing some relief to the areas of western Nebraska and southwest Minnesota. Soybeans lead the pitfall today, trading as much as 43 cents down. The July 23 soybean contract closed below the $13 handle for the first time since January 2022. The recent rains also pressured wheat with the front-months finishing 25-35 cents lower. Almost like flipping a switch, new crop corn contracts bounced off of their lows when the latest weather models were released. U.S. export inspections were within expectations and on the upper end for corn with 1.313 mln tonnes shipped. This is the first time in our current market year that corn had consecutive weeks above 1.0 mln tonnes of inspections. Soybeans were mid-range at 240k tonnes.