5/3/2022

May 03, 2022

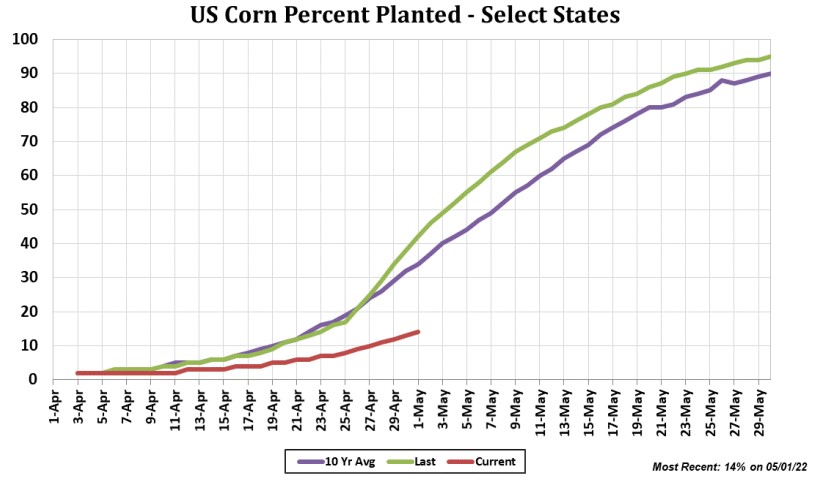

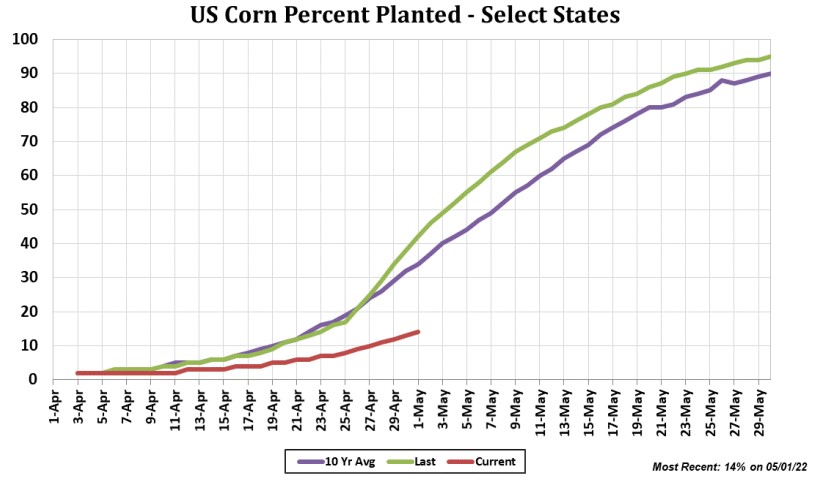

After a day of strongly lower trade, corn and soybeans received a bump of support from the weekly crop progress report and managed to trade double digits higher during the overnight session. The market strength faded as the sun rose and the sell-off resumed shortly after the morning break. Corn planting was viewed as 14% complete as of Sunday, which is 19% behind the 5-year average. Soybean planting was seen at 8% complete versus a 5-year average of 13% for this week. If corn planting progress proceeds at the average pace this week, 2022 would be the third slowest planting season in more than 25 years but 60–90-foot planters can now go 10 mph or more for nearly 24 hours/day and weather forecasts continue to improve. Staying at the current pace is extremely unlikely and pressure over the market will continue to build this week as more and more acres are covered. Also hanging over the corn bulls' heads is a potentially huge second corn crop in Brazil, which is currently seen at 92% good/excellent (on a record number of acres). So far this week, the USDA has not made an 8 a.m. export sale announcement.