5/26/2022

May 26, 2022

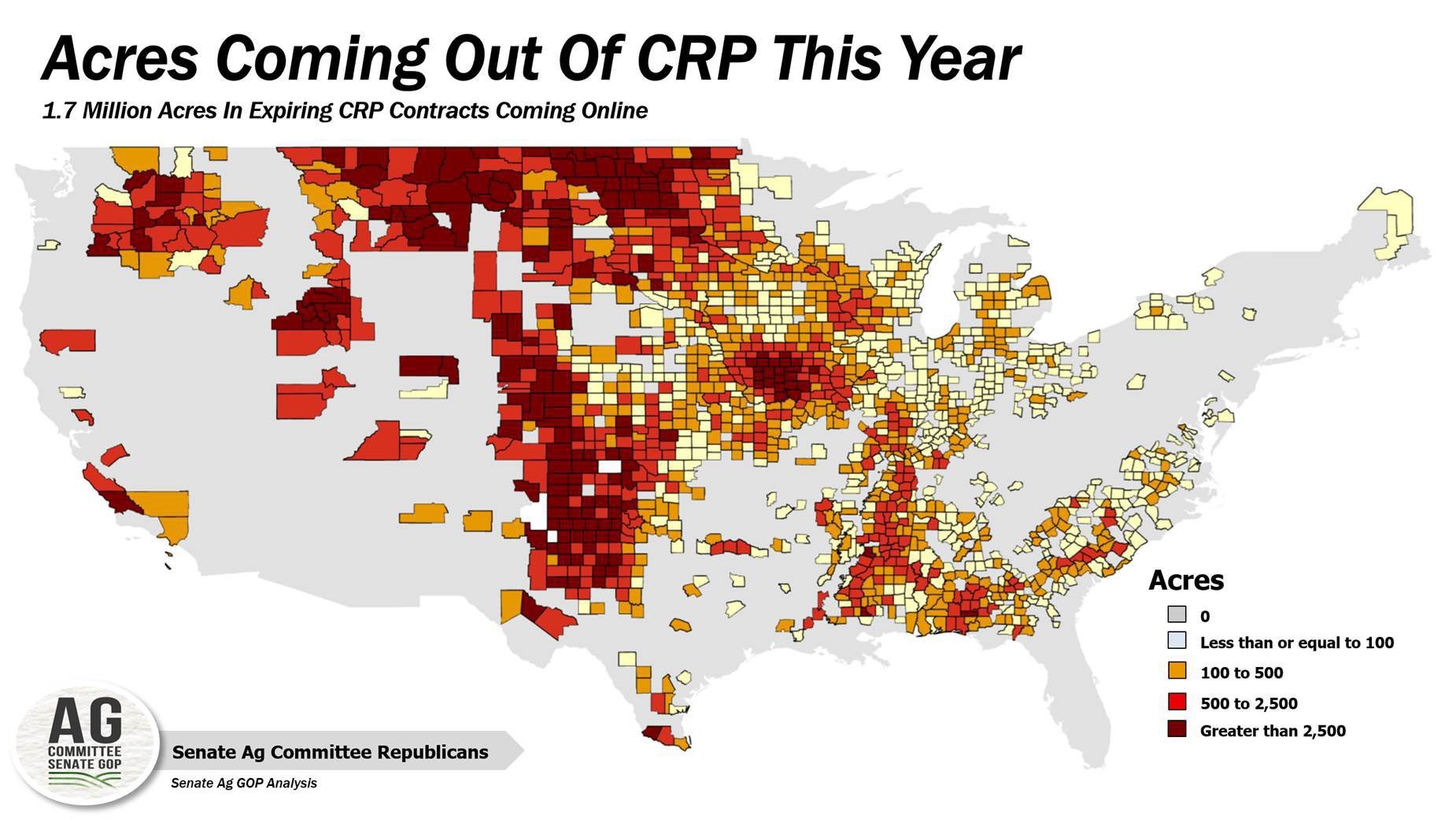

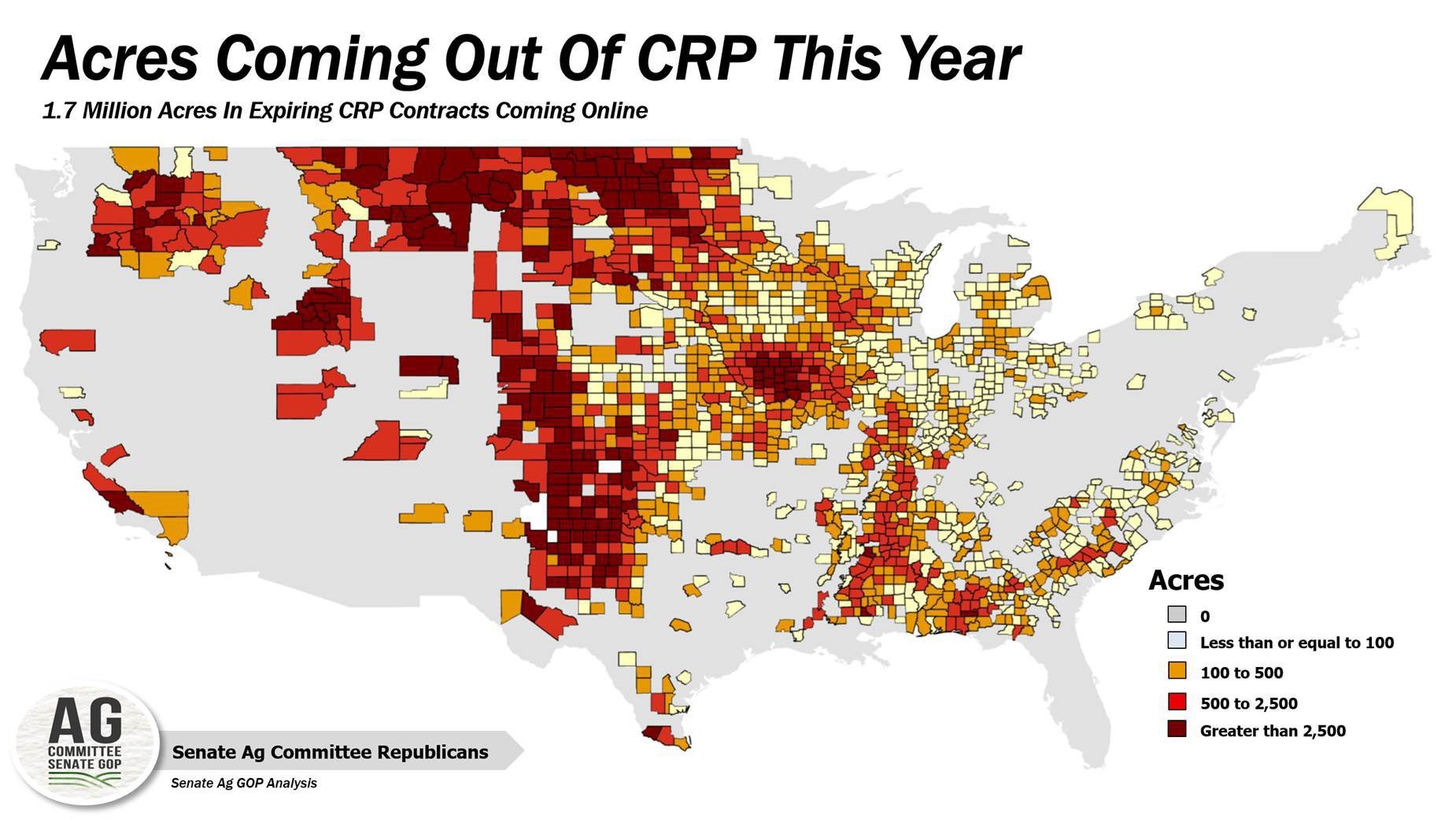

A huge buying surge in soybeans sent 2022 contracts to trade 37-56 cents higher with the board out to Sep 23 finishing in the range of 16-45 cents higher. China rumors? Crush? Russia closing the Black Sea corridor? No one seemed to have the answer. Soybeans have been keying off of the strength or weakness in crude oil. With crude nearly $4 higher on the day, that may have been part of the reason. Whatever the case may be, we feel this is definitely a marketing opportunity to unload old crop and market some new crop. This exciting price action comes on the same day the USDA announced that it will allow farmers to voluntarily terminate CRP contracts with no penalty in order to plant more acres. This offer is open to farmers who are in the final year of their CRP contract. This means potentially an additional 1.7 million acres into crop production. Corn tried to capitalize on the sharply higher trade in soybeans but was only able to trade back to unchanged momentarily, finishing 3-7 lower on the day. Weekly export sales for corn and soybeans left something to be desired. Both were within range of trade estimates for old crop but at the bare minimums with 151.6k tonnes of corn and 276.8k tonnes of soybeans sold.