5/25/2023

May 25, 2023

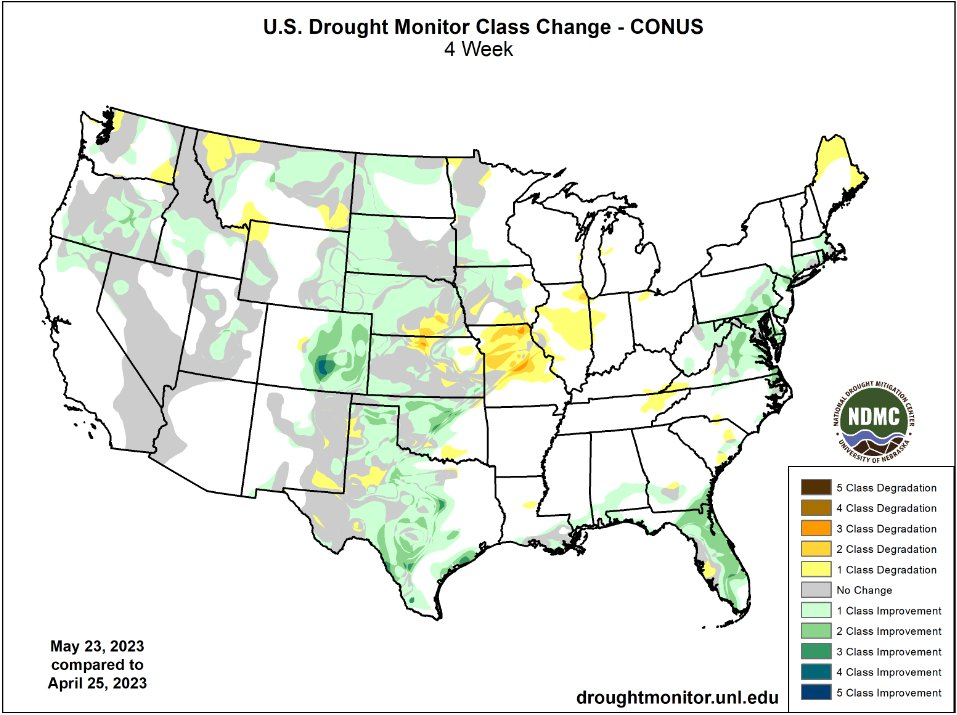

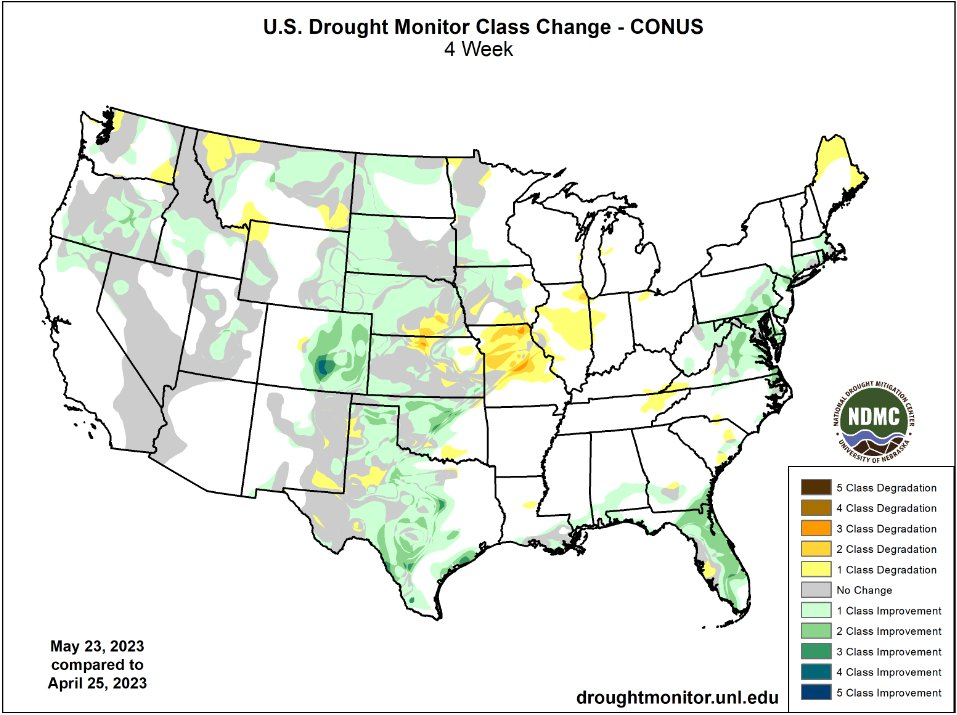

The bears and bulls struggled to maintain direction today. Corn and soybeans traded some nice ranges away from either size of unchanged, giving most a chance at positioning no matter their bias. There is finally a small buzz going around the market with some concern about moisture conditions. Funds had recently flipped short but have worked themselves closer to a neutral position as we are now one day out from an extended weekend. The market has built a slightly bullish sentiment based solely on weather as domestic and export demand for corn continues to dwindle away. Weekly export sales were within expectations with net cancellations for corn (75k tonnes) and wheat (45k tonnes) and net sales of 115k tonnes of soybeans. There was a nice bump in bean meal sales with last week's sale announcement to Poland. Marketing year to date, corn sales are short of the pace needed to hit the USDA target by 132 million bushels versus 108 million last week. Soybean sales are short by 100 million bushels versus 71 million last week. Actual shipment pace for corn is short by 107 mln bushels and soybean shipments are 50 million bushels ahead but the gap is shrinking.