5/24/2022

May 24, 2022

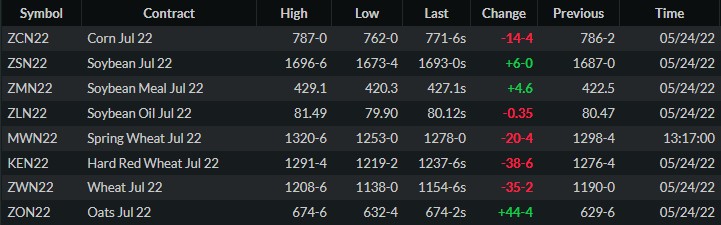

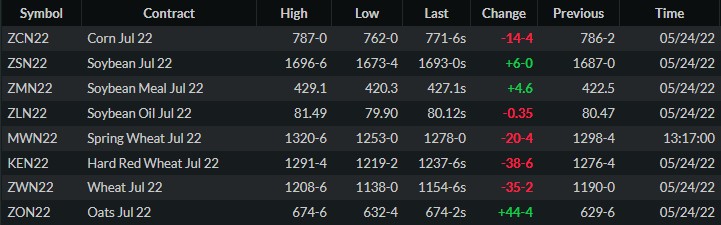

Corn and soybeans tried to trade higher overnight despite better-than-expected planting progress in the week's report but succumbed to the weakness in wheat. Corn was seen at 72% planted (68% trade, 79% avg) and soybeans at 50% (49% trade, 55% avg). Illinois, Indiana, Iowa are at or within 4 points of their 5-year average for corn planting pace with only Minnesota and North Dakota lagging severely. Illinois and Iowa are ahead of their 5-year averages for soybean planting and Illinois is within 3 points. Again, Minnesota and North Dakota are the outliers in planting pace here. At 49% complete, spring wheat seeding is the slowest on record back to 1981 but reports indicate that farmers are continuing to sow (83% avg). Steep board prices are likely the motivation. The corn market reeled today after being dealt a triple blow of a big bump in planting progress, the White House considering blending waivers, and Brazil finally getting an agreement to sell corn to China. Soybeans remain well supported. It is estimated that China has only 40% of its July/August soybean needs covered so more purchases for delivery in the current market year are expected.

Nice recoveries off of the lows today in grains.

Nice recoveries off of the lows today in grains.