5/22/2023

May 22, 2023

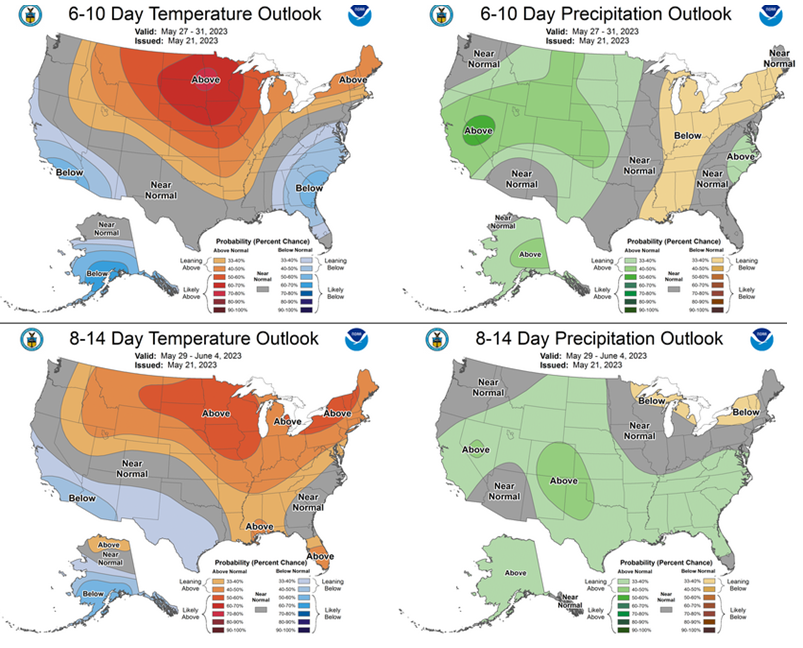

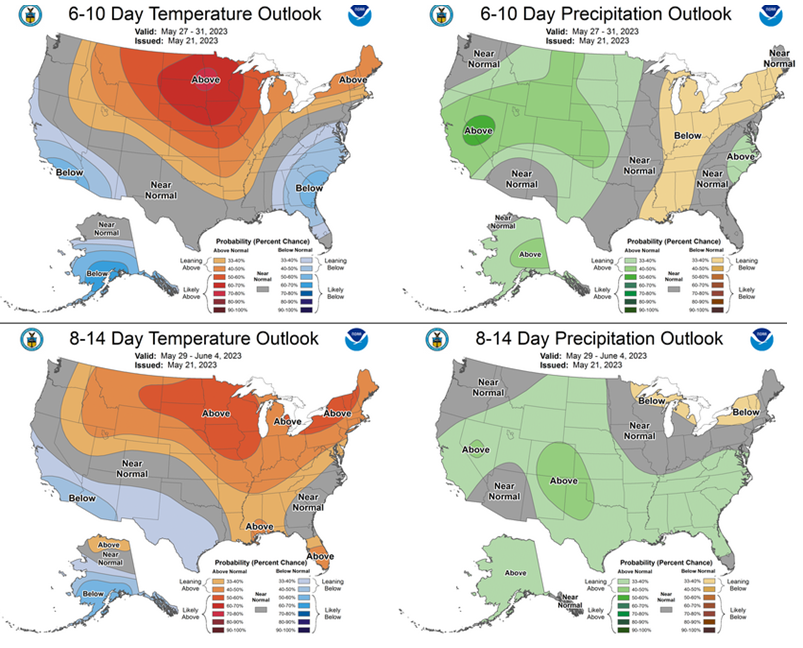

Corn and soybeans shoot higher to begin the week. On the charts, July corn was able to trade through Friday's high and closed the day near that mark. Dec corn, July soybeans, and Nov soybeans fell just short of taking out Friday's highs. It would have made for a nice technical indicator that a short-term low had been made. Regardless, we were able to stay well above Friday's lows for the entirety of the session. After setting fresh lows for the move, wheat completed a decent recovery through the day. Extended weather models and outlooks are showing an abnormally dry June and several comparisons to 2012 are being made. On the surface, drought areas are beginning the growing season in worse shape than 2012. There is very little, if any, weather premium priced into the market so if these models and forecasts hold, we could see a significant futures rally going into summer. Weekly export inspections showed a nice week for corn shipments at 1.323 million tonnes. Soybean inspections were a 7-year low for the week at 155k tonnes. For the marketing year, corn inspection pace is short of the USDA target by 107 million bushels, soybeans short by 50 million bushels.