5/19/2022

May 19, 2022

Corn traded 2-8 cents on either side of unchanged to finished mixed on the day from 4 lower to 2 higher after pulling itself off of intraday lows to capitalize off the strength in soybeans. Soybeans shook off the overnight weakness and held its large gains on the day with credit given to a good week of export sales and strength in meal. Old crop soybeans sales exceeded expectations with 753k tonnes sold vs 500k tonne high trade estimate. Corn sales were on the high end of the trading range at 435k tonnes. While many commodities and market spaces enjoyed somewhat of a "rebound" day after large sell-offs this week, the dark cloud hanging over everything right now is likelihood of economic recession. History shows us that commodities do not perform well during recessions and right now it’s not matter of "if," it's "when" the recession hits. The December 2022 corn contract is correlating extremely well with the Dec 2008 contract. That year, Dec corn peaked at 799'2 in late June and was trading below 350'0 by Thanksgiving. With farmers, end-users, and exporters all leaning very bullish, now is not the time to be complacent. Prevent plant is a popular topic right now but be realistic about the size of crop you will truly have.

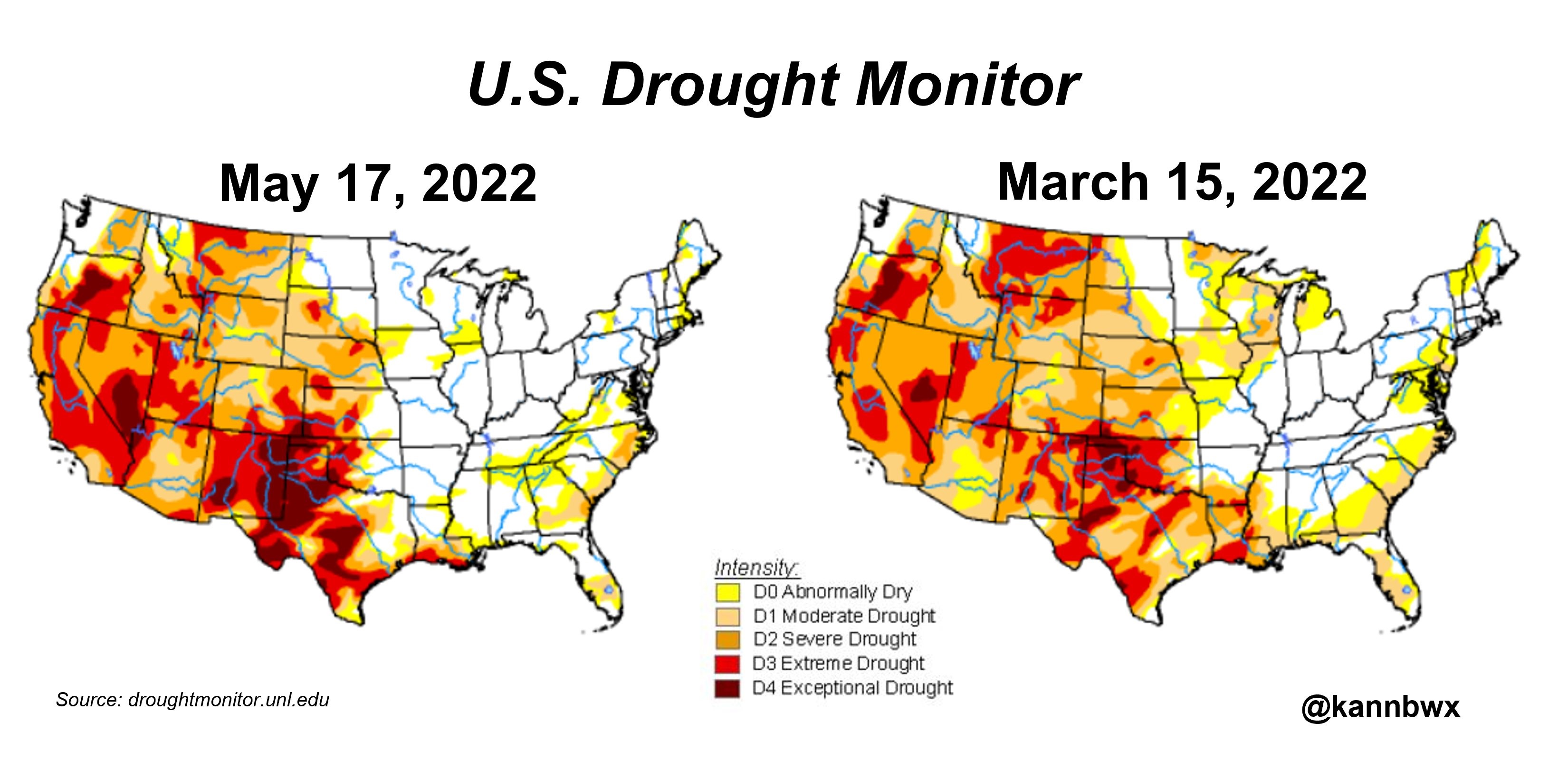

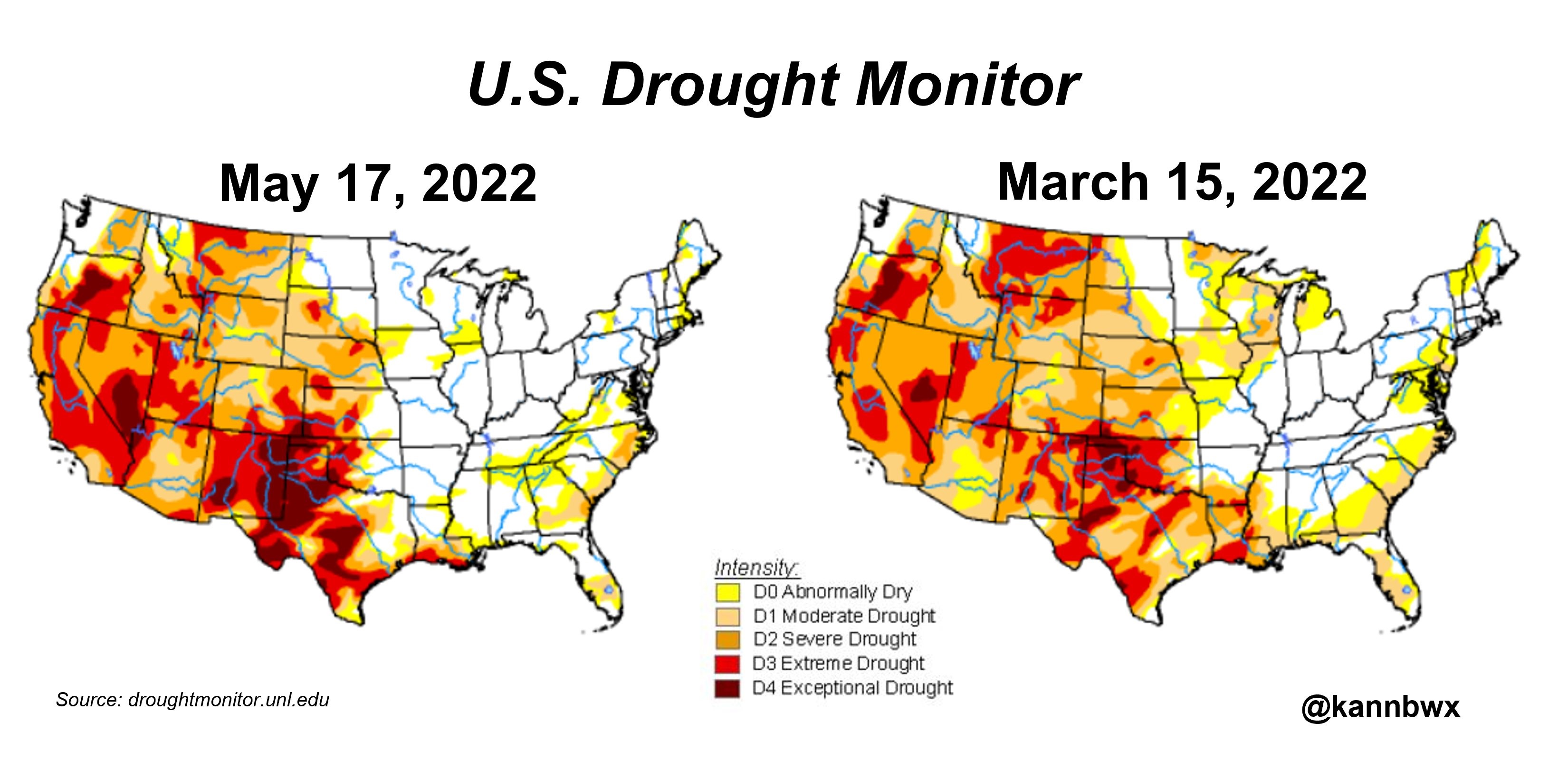

Big improvement in the grain belt over the past 2 months.

Big improvement in the grain belt over the past 2 months.