5/18/2023

May 18, 2023

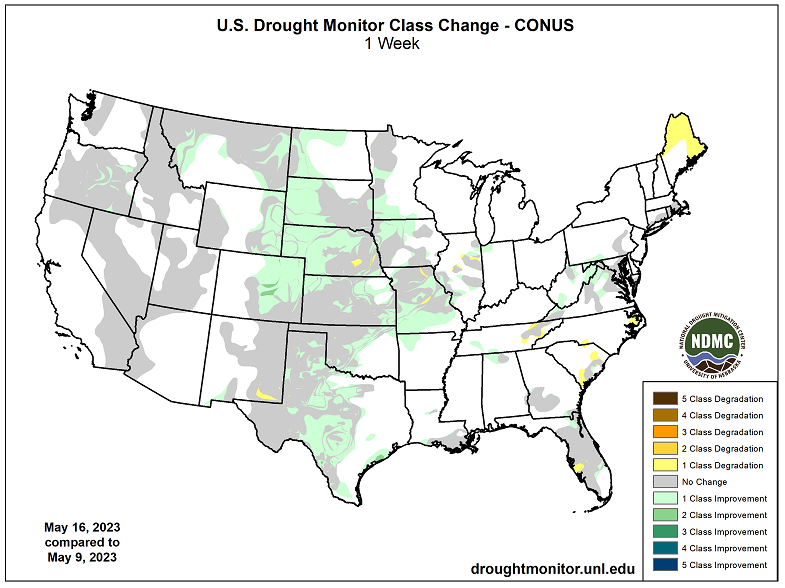

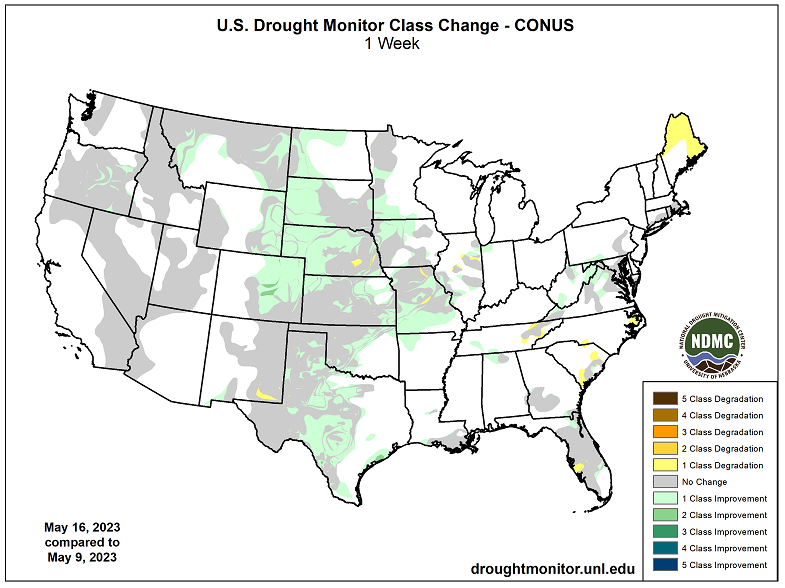

Corn and soybeans were lower during the overnight and part of the morning but had found a bid and built some momentum in an effort to turn back higher by mid-day. Trade spent most of the second half of the day flipping to either side of unchanged, resulting in a board that finished mixed in corn and lower in soybeans. The weekly net export sales report offered no support with a net cancellation of 336k tonnes of corn and only 17k tonnes of net sales in soybeans. The corn number is not a surprise after last week's string of cancellation announcements from the USDA. Also present in the net sales report was 4.4 million bushels of purchased soybeans cancelled by China. The USDA will likely have to adjust corn export and ethanol numbers lower as we go into the summer. The demand we need to sustain our markets at historically high levels just isn't there. On a positive note, drought-like conditions continue to persist in parts of Iowa, Missouri, and Nebraska and it appears the market is not pricing any type of drought premium into corn. We will be watching this area closely as the calendar progresses towards the June grain stocks and acres reports.