5/17/2022

May 17, 2022

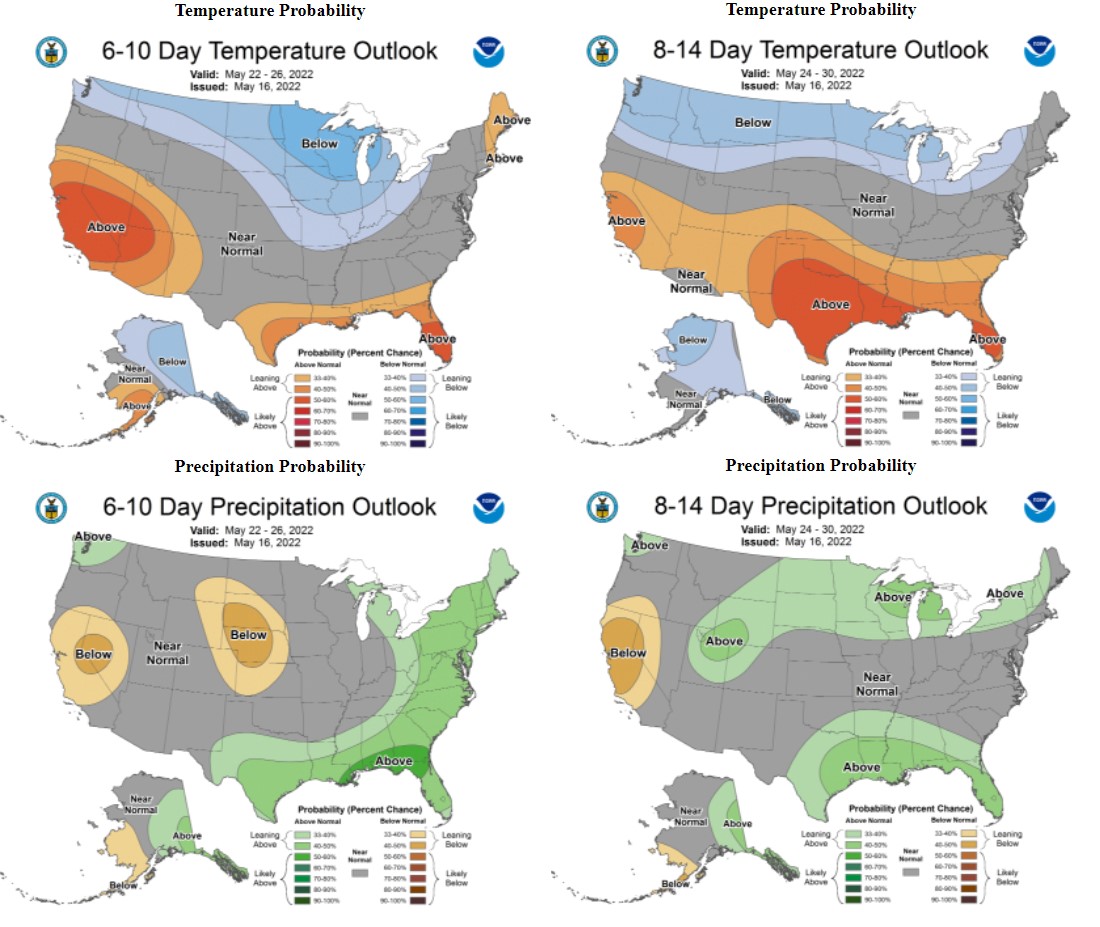

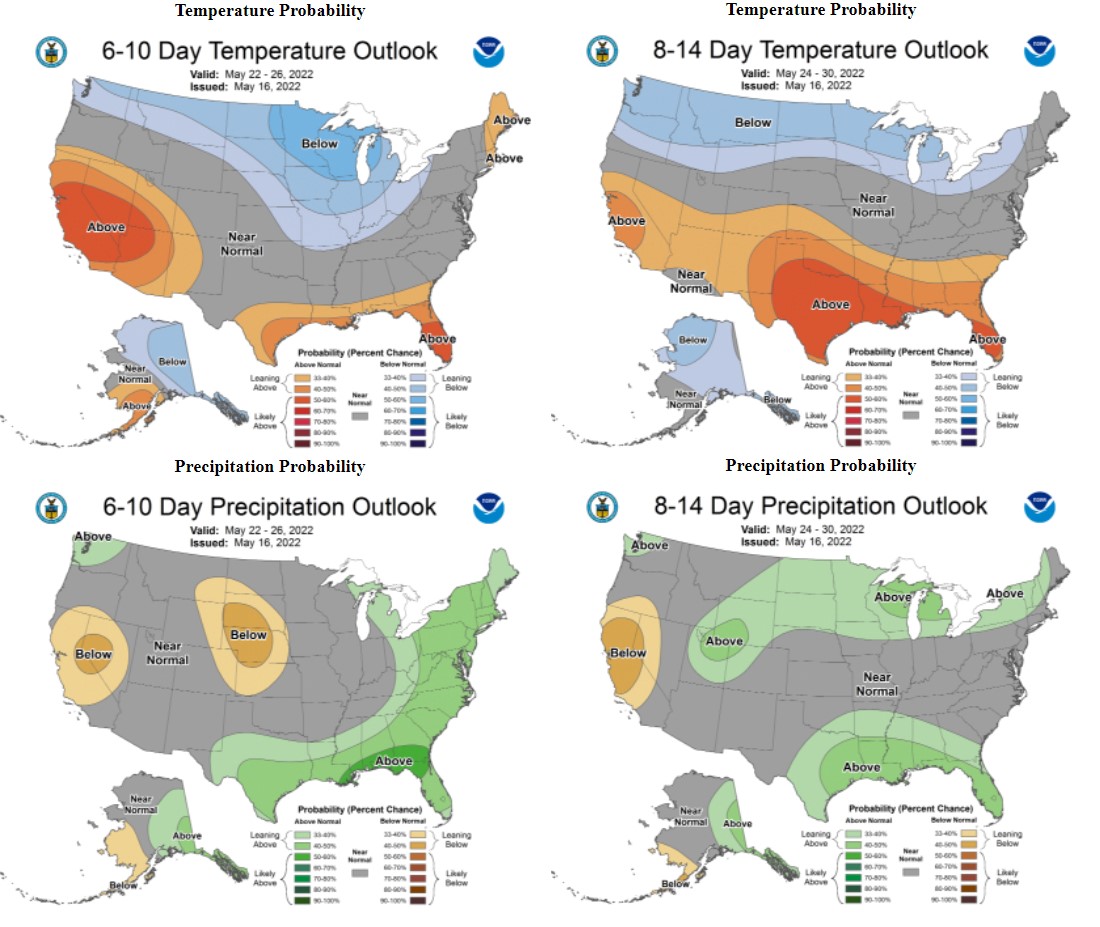

Corn and soybeans were both down sharply to start last night. The price action was definitely more technical than fundamental with the gap on the July soybean chart being filled and trade reversing higher. Corn managed to trade higher briefly following the morning break but was held down in the red for close to the entirety of the day. No new high in December corn today after setting fresh contract highs on Friday and Monday. The weekly crop progress report was right on target with the trade averages for corn and soybeans. Nationally, corn is viewed as 49% planted and soybeans 30% There were huge gains in the "I" states, highlighted by Iowa planting 43% of its corn and 27% of its soybeans last week. Illinois saw 40% gain in corn plantings and 27% advancement in soybeans. By the time we see these numbers, planters have been rolling for an additional 24 hours and there is that much more corn and soybeans in the ground. It looks like mother nature may be giving us an opportunity over the next 7 days. Most of the rain has vanished from the forecast for today and Thursday and we may finally have that window for field work we desperately need. Weather models are calling for a warm, dry June which means potential is still there for a good crop this year.