5/16/2022

May 16, 2022

Riding the coattails of limit higher trade in wheat, corn and soybeans posted large gains to start our week. After gapping higher on the open, corn finished the day 9-28 higher and soybeans 2-13 higher. Weekly export inspections for corn were on the lower side of the trade range at 1.037 million tonnes inspected and soybeans on the upper end of their range at 784k tonnes inspected. Corn export shipments exceed the pace needed to meet the USDA target by 57 million bushels, soybean shipments fall short by 35 million bushels but improved from a 48-million-bushel deficit the previous week. Trade will be anxious to see where the USDA puts corn planting percentage at in this afternoon's weekly progress report. Estimates range from 43-58% with an average of 49%. This would be a nice bump from last week's 22% and get us back within spitting distance of the 5-year average, which is 67% for this week. Estimates for soybean planting progress this week average 29% with a range of 25-36%. This would also be a nice increase from last week's progress report and keep us easily within reach of the 39% 5-year average. A lot of wheels turning in our territory today, let's hope the rain in the forecast stays away.

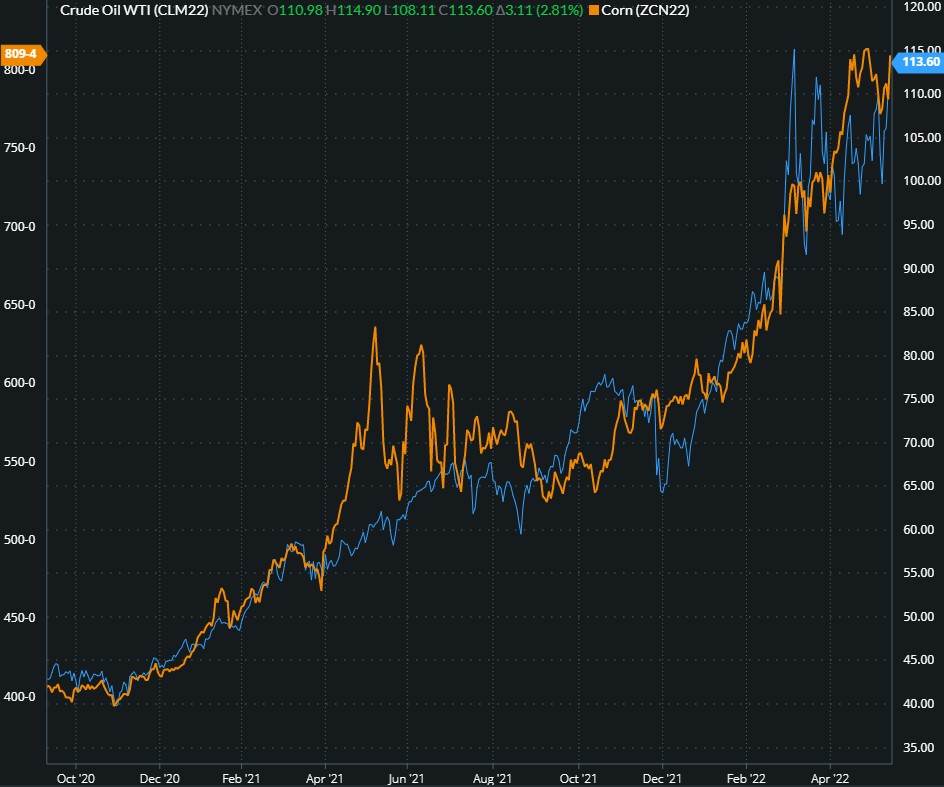

Crude Oil/Corn comparison

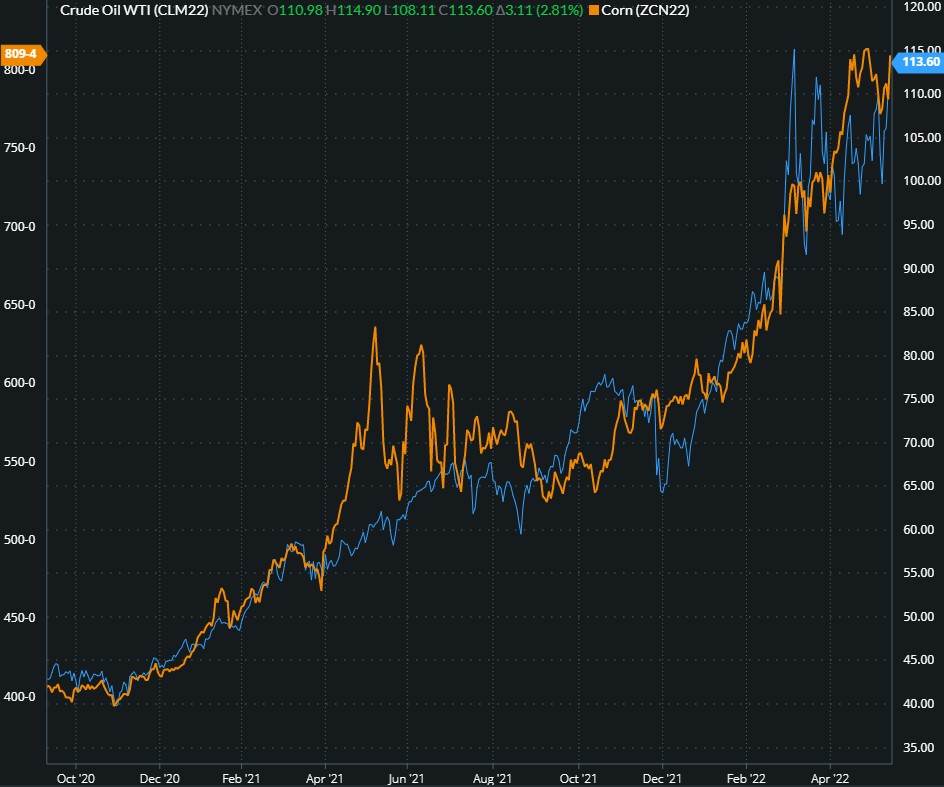

Crude Oil/Corn comparison