5/12/2022

May 12, 2022

The USDA announced the sale of 612k tonnes of corn to China with 68k tonnes delivered in 2021/22 and 544k tonnes delivered in 2022/23. Weekly export sales for corn were well under target with 193k tonnes in sales vs 350k tonne minimum estimate. Soybean sales were on the low end but within range at 144k tonnes. The monthly update for Brazil's crop production showed increases in both soy and corn. Barring any sort of disaster, the world's current soybean supply is ample. Soybean meal values continue to drop, now trading back under $400/ton, and soybean oil is at the mercy of crude oil. The pressure to own soybeans (physical or on paper) is all but gone.

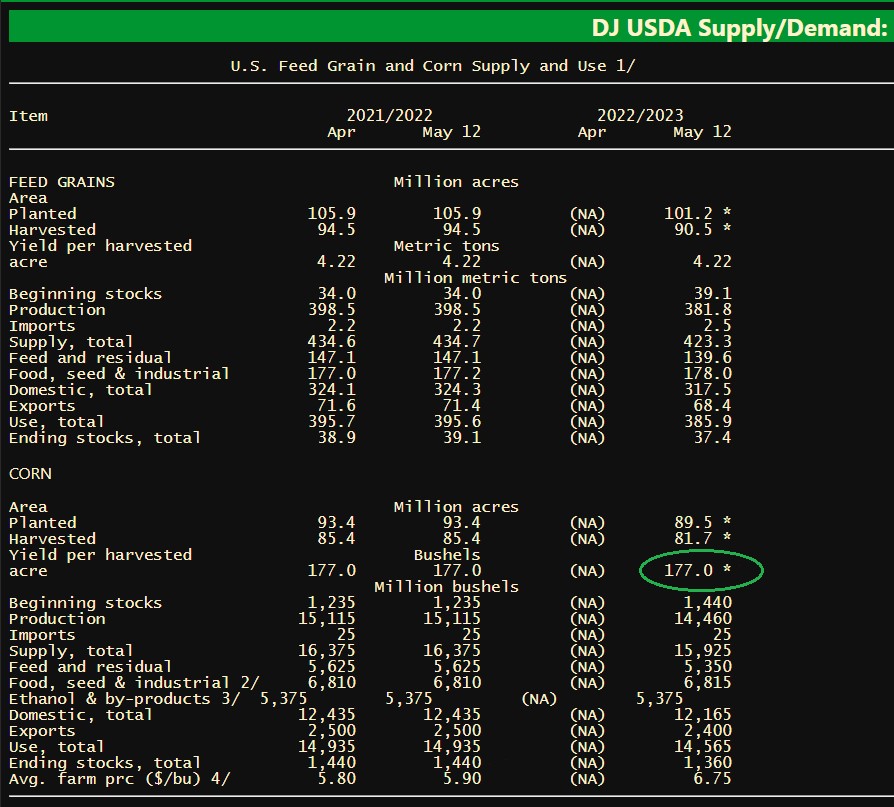

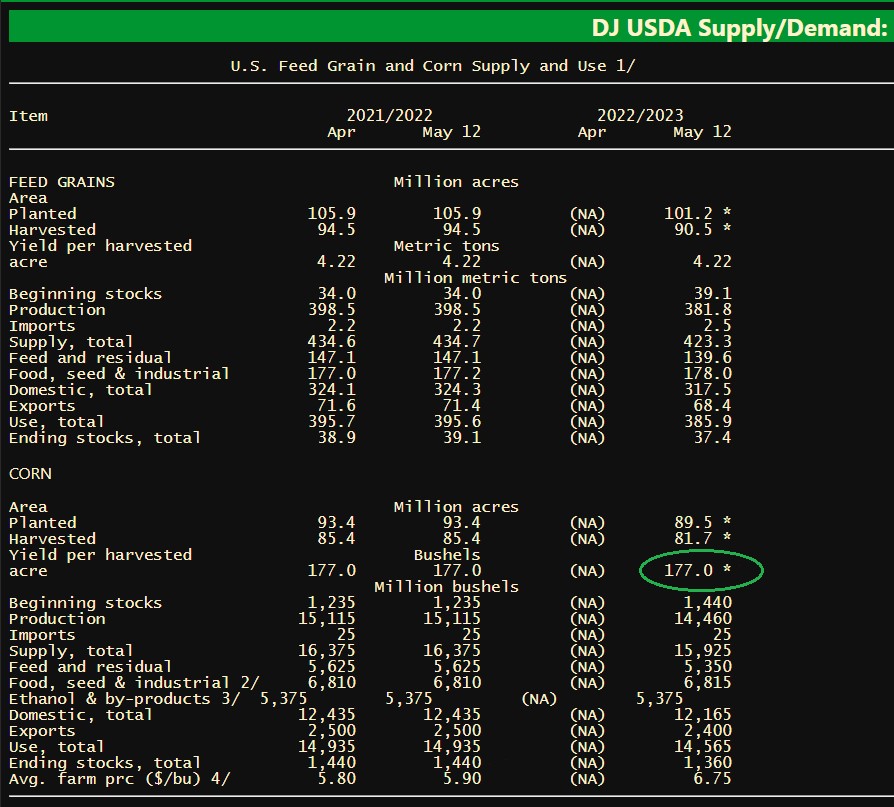

-Supply and demand for old crop corn was unchanged this month. The eye opener here is the USDA dropping their yield from 181.0 in the planting intentions.

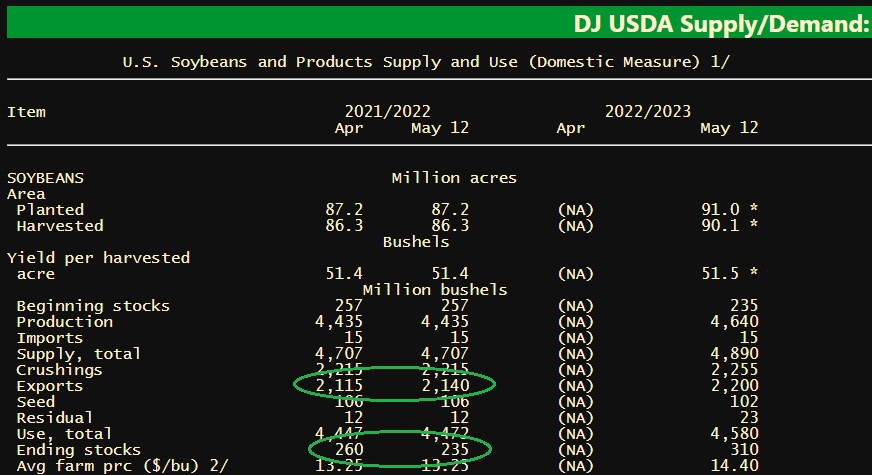

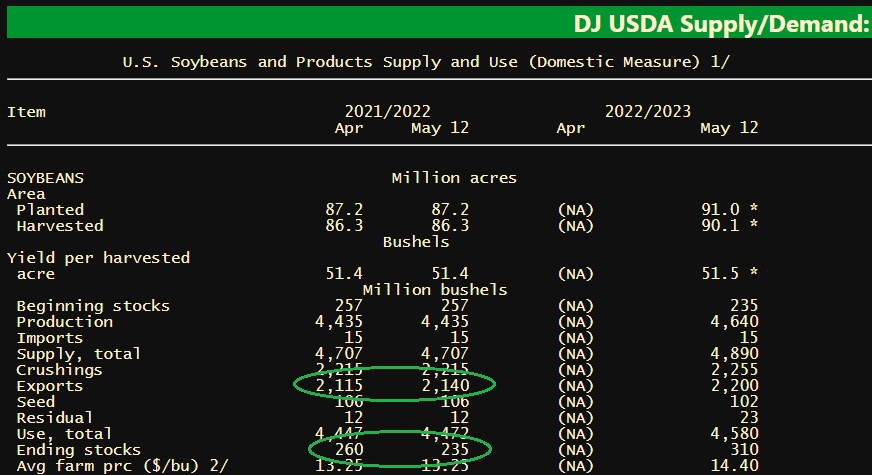

-A 25 million bushel cut in soybean ending stocks with an increase in exports. No changes for the 2022 crop from the planting intentions report.

-Supply and demand for old crop corn was unchanged this month. The eye opener here is the USDA dropping their yield from 181.0 in the planting intentions.

-A 25 million bushel cut in soybean ending stocks with an increase in exports. No changes for the 2022 crop from the planting intentions report.