5/11/2023

May 11, 2023

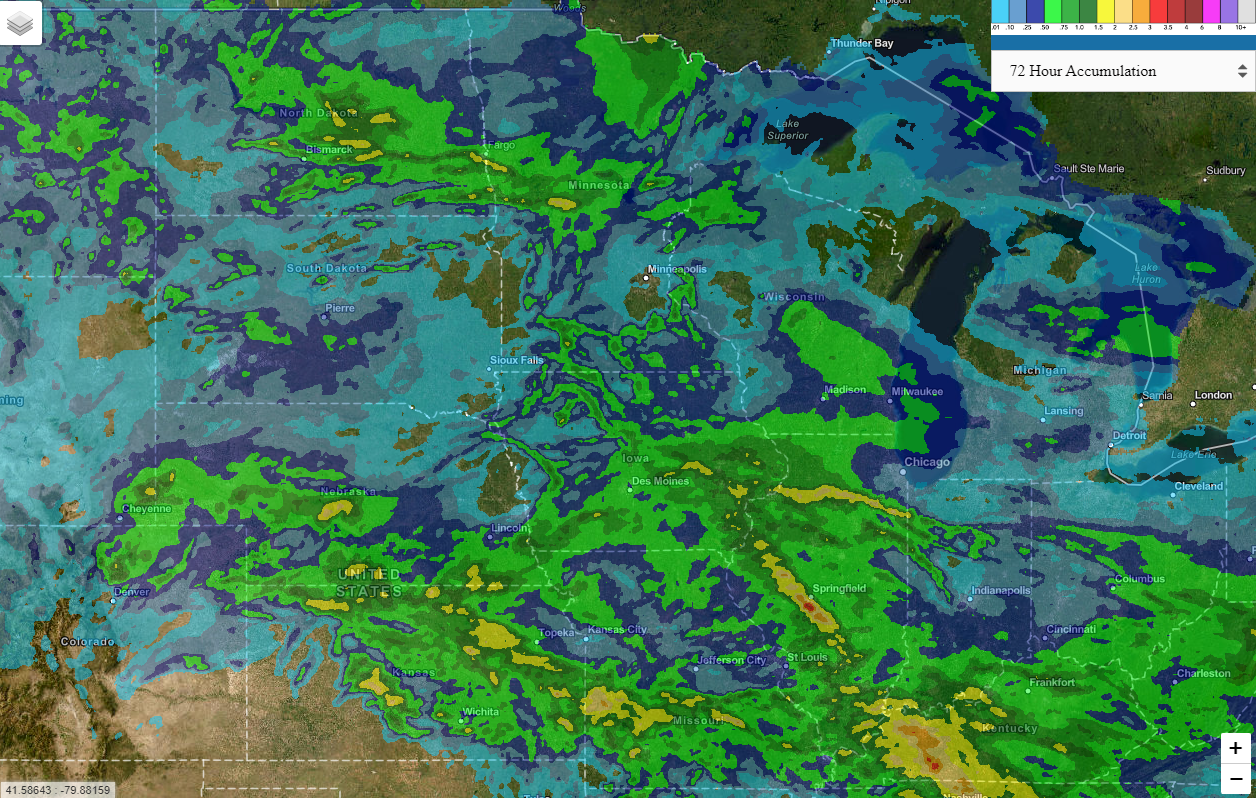

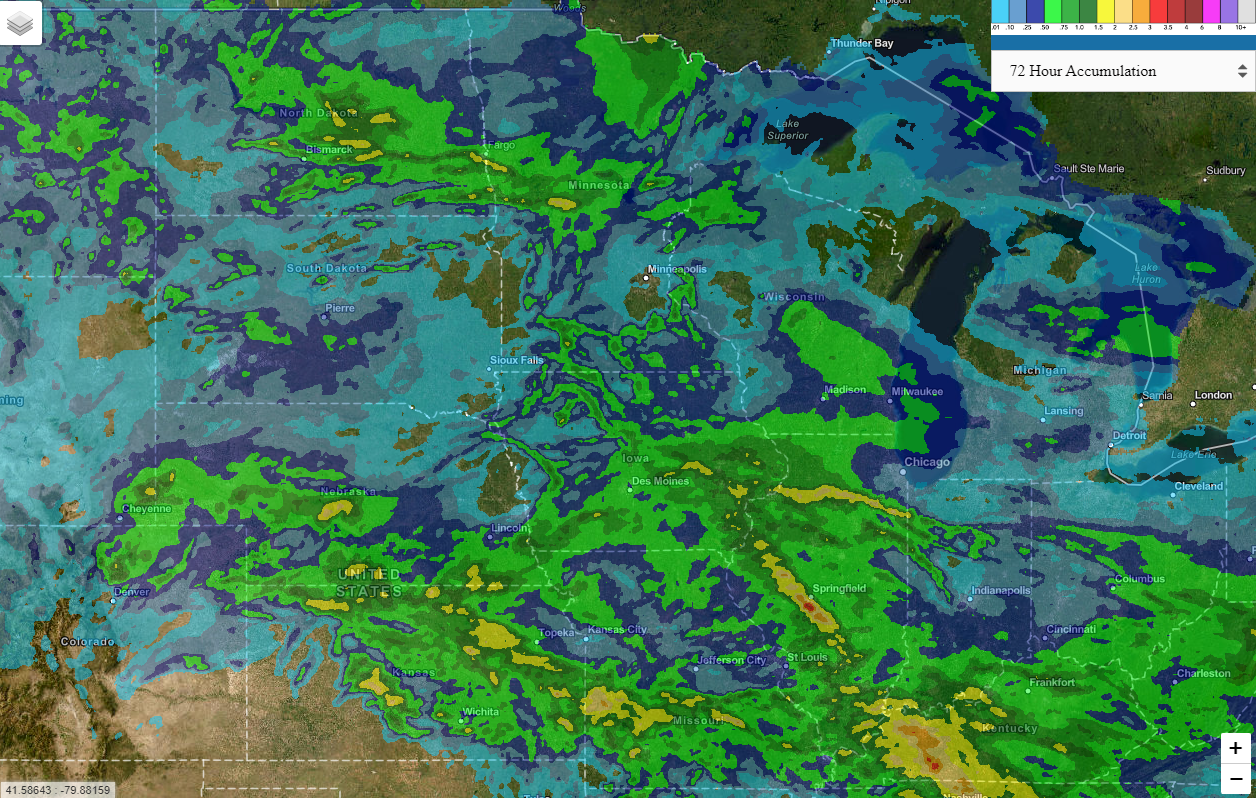

Pressure from several different angles held corn in the red for the entire session on Thursday. Russia had been the most stubborn, yet, about renewing the Black Sea corridor until today when they finally gave the green light to another 60-day window. Brazil's CONAB increased their production estimates for this year to 154.8 mln tonnes of soybeans (125.5 mln last year) and 125.5 mln tonnes of corn (113.1 mln last year). Some nice rains have also been observed this week in areas that have completed corn planting that include eastern Kansas, southern Nebraska, and most of Iowa and Illinois. Weekly export sales were mostly within expectations but lent no help to the market today, either. Wheat missed low at 26k tonnes of sales while corn and soybeans basically did just enough to avoid negative sales with 257k of corn and 62k tonnes of soybeans sold. This did not include the corn cancellation announcement from earlier this week. All this combined with an unrelenting planting pace held the market down today. Tomorrow, the USDA will give us our May WASDE numbers but we may have already priced a negative report into the market, at this point.