4/8/2022

Apr 08, 2022

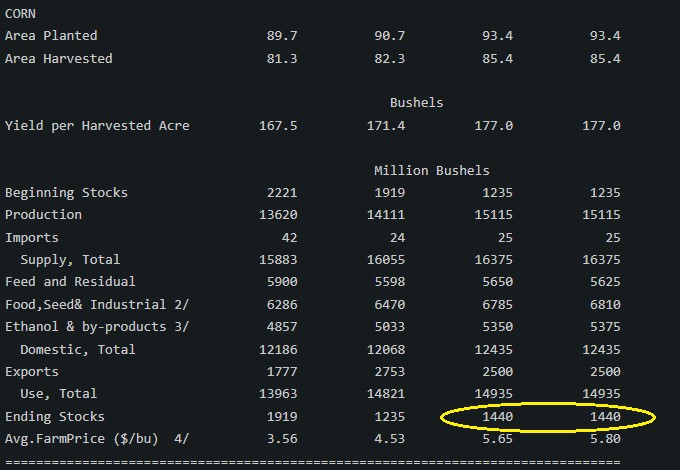

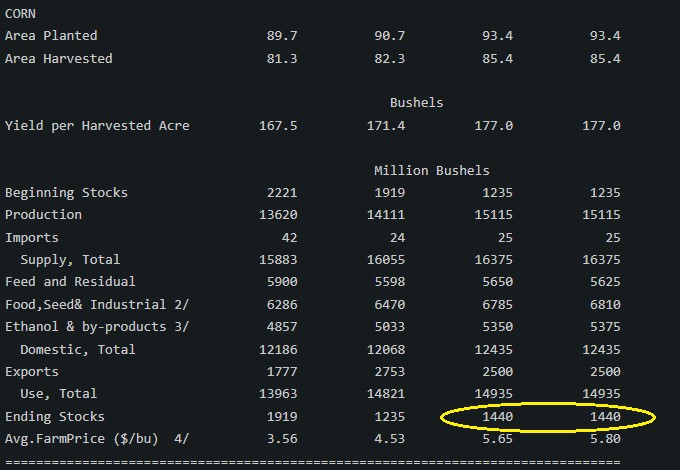

Managed money and funds just don't care about anything market neutral or bearish. The money is here until some uncertainty is removed. The USDA report came in with smaller cuts than trade was expecting but this somehow was received as positive. The biggest surprise was likely the bump up in world corn ending stocks to 305.5 million tonnes from 301.0 in March.

The report was neutral/slightly bearish for corn but trade shrugged it off.

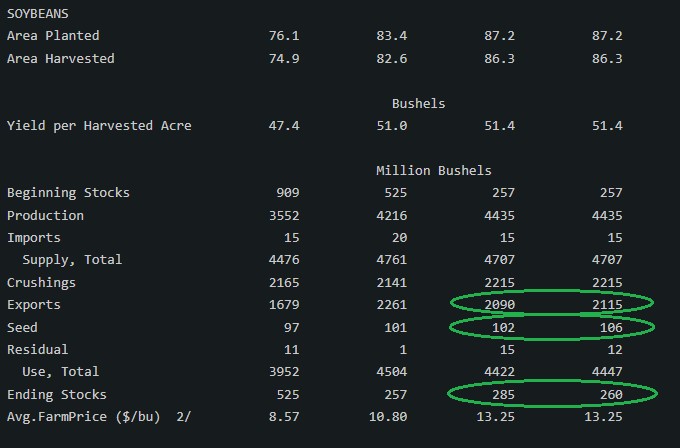

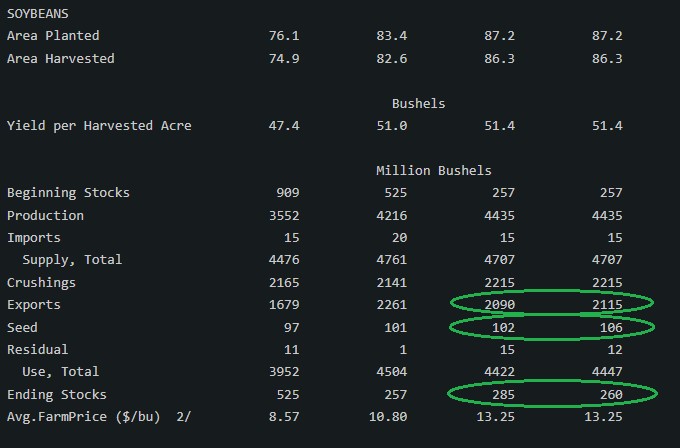

Soybeans received a boost from the report.

Soybeans received a boost from the report.

The report was neutral/slightly bearish for corn but trade shrugged it off.

Soybeans received a boost from the report.

Soybeans received a boost from the report.