4/5/2022

Apr 05, 2022

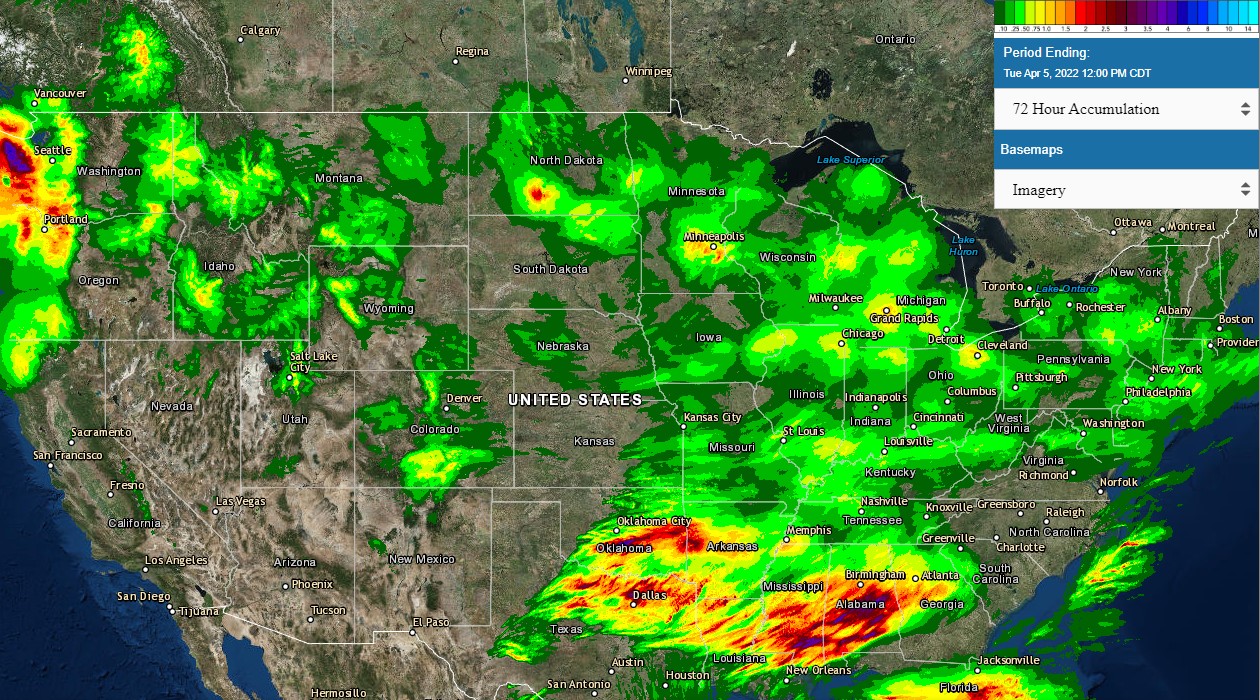

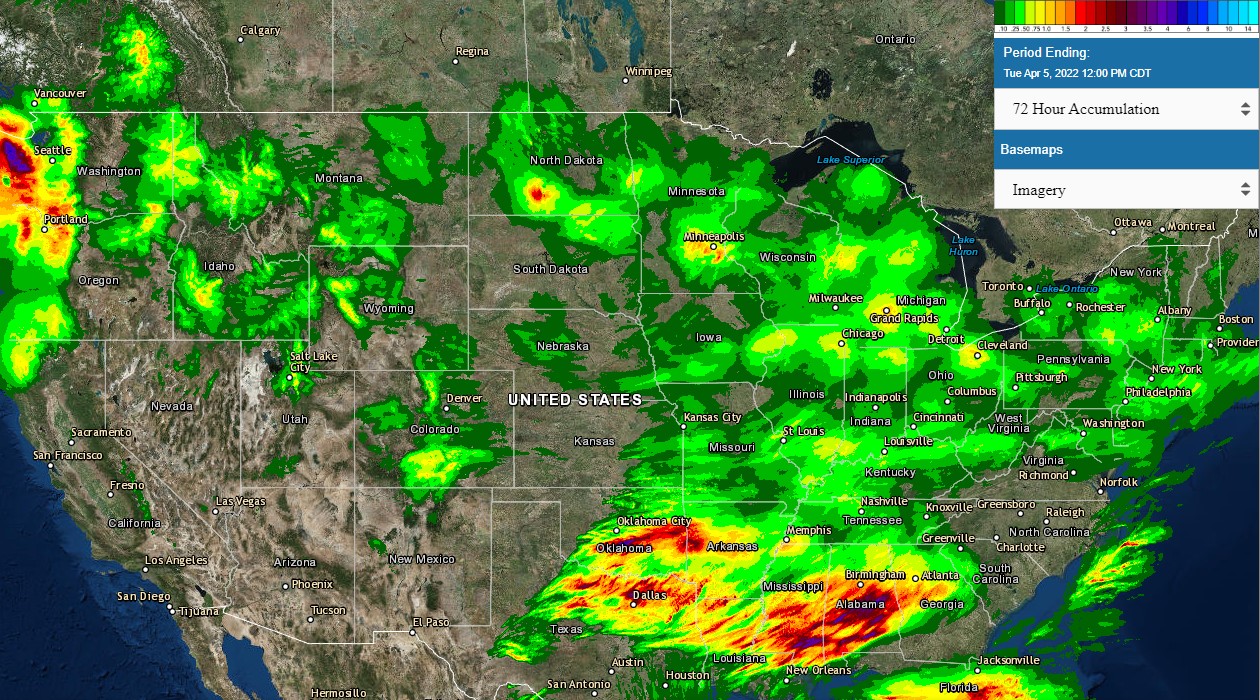

Corn and soybeans churn higher through both sessions. The July 22 corn contract set a fresh contract high of 755'4 and Dec 22 corn contract set a contract high for the 4th consecutive trading day. Today's close in corn appeared weak with old and new crop both giving up around 5 cents in the final 1/2 hour. Big double-digit gains in soybean meal helped drive soybeans to their own double digit move higher on the day. July soybeans have recovered 55 cents from their most recent low following the planting intentions report. New crop values are at extremely attractive levels but we need to be patient and pace our sales. $6.50 new crop corn orders filled overnight and new crop soybeans have climbed back to $14.00 delivered off of the combine. With the market buzz combining China's unknown demand, a smaller number of US corn acres, Ukraine/Russia showing no signs of stopping, and what appears to be a cool and wet start to spring, we have the real possibility at a shot of locking in $7.00 new crop corn. We likely get another try at $15.00 new crop soybeans, as well. Soybean futures have never set their highs this early in the year and are sure to play follower to the strength in corn. Continue to work sell orders with wide ranges between prices to allow yourself the opportunity to adjust them in this highly volatile market.