4/4/2023

Apr 04, 2023

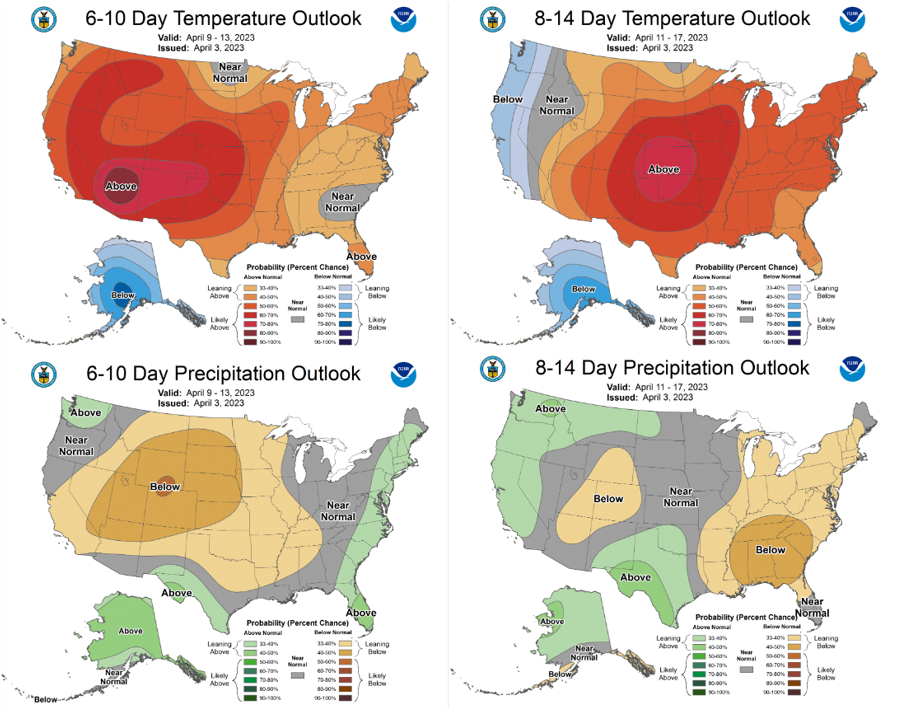

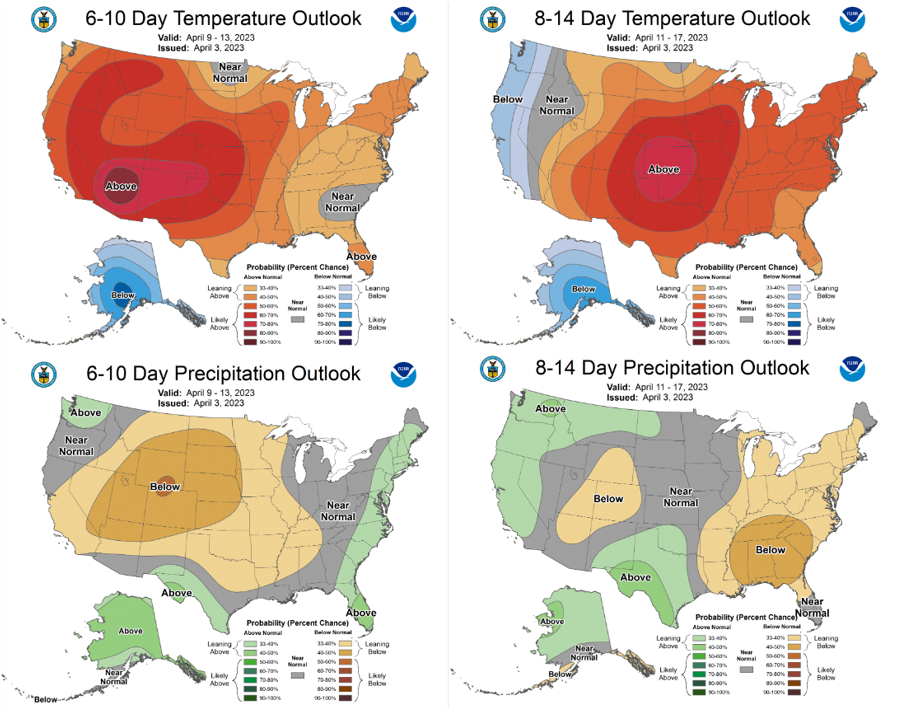

The bullish euphoria surrounding commodities yesterday failed to carry over into Tuesday's trade. News out of the energy sector helped support grains to begin the week but managed money is suddenly on edge, considering a potential pivot from the Fed. Corn and soybeans opened lower and were held in the red for the entirety of the trading session. The USDA did not make any sale announcements this morning. Following last week's prospective planting report, trade has turned some focus to the weather in the Dakotas where the USDA is expecting approximately 1,000,000 additional corn acres above what was planted in 2022. Practically all of the North Dakota and a majority of South Dakota is under an estimated 3 feet of snow pack. If we see a premium put into the market, it may be short lived with forecasts showing some great improvement for next week.