4/28/2023

Apr 28, 2023

After seven days of hemorrhaging that resulted in the funds flipping short, a fresh 15 month low, and a total range of 75 cents traded, July corn appears to have finally stopped the bleeding. Corn reversed higher near the mid-day point of the session on Friday and traded steady 2-3 cents higher. Wheat was the first to lead the charge up the hill, followed by soybeans, then corn. The July soybean chart has a much friendlier look to it with today's reversal higher, trading outside of yesterday's range and finishing the day 15 cents higher in strong fashion. Overall, an excellent recovery today to end the week (and the month) and will provide a more optimistic perspective going into May. Other than some corrective technical trade, there was no fresh news or reports to move the market today. We are confident there will be chances to capture cash values of $6.25 corn and $14.25 soybeans in the near future.

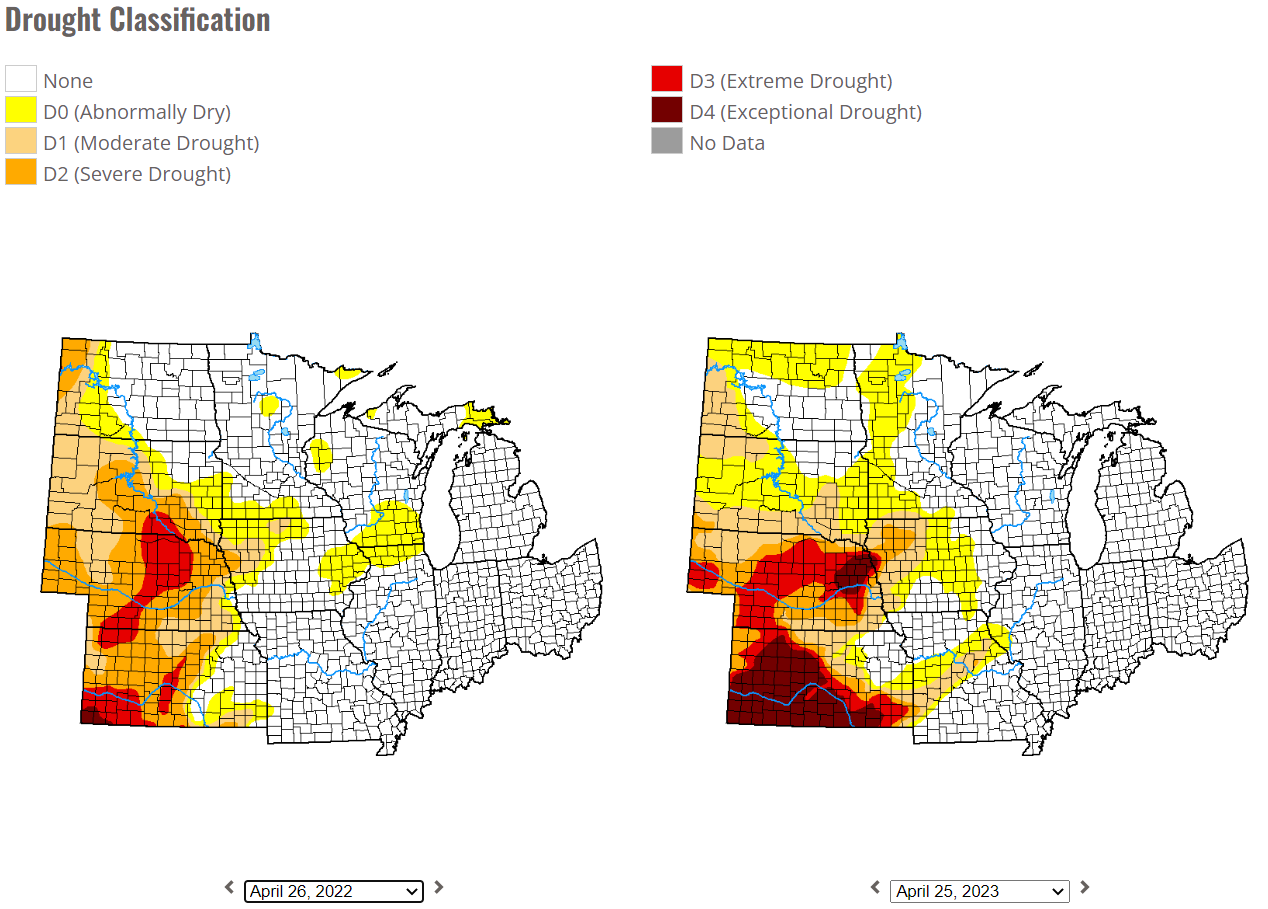

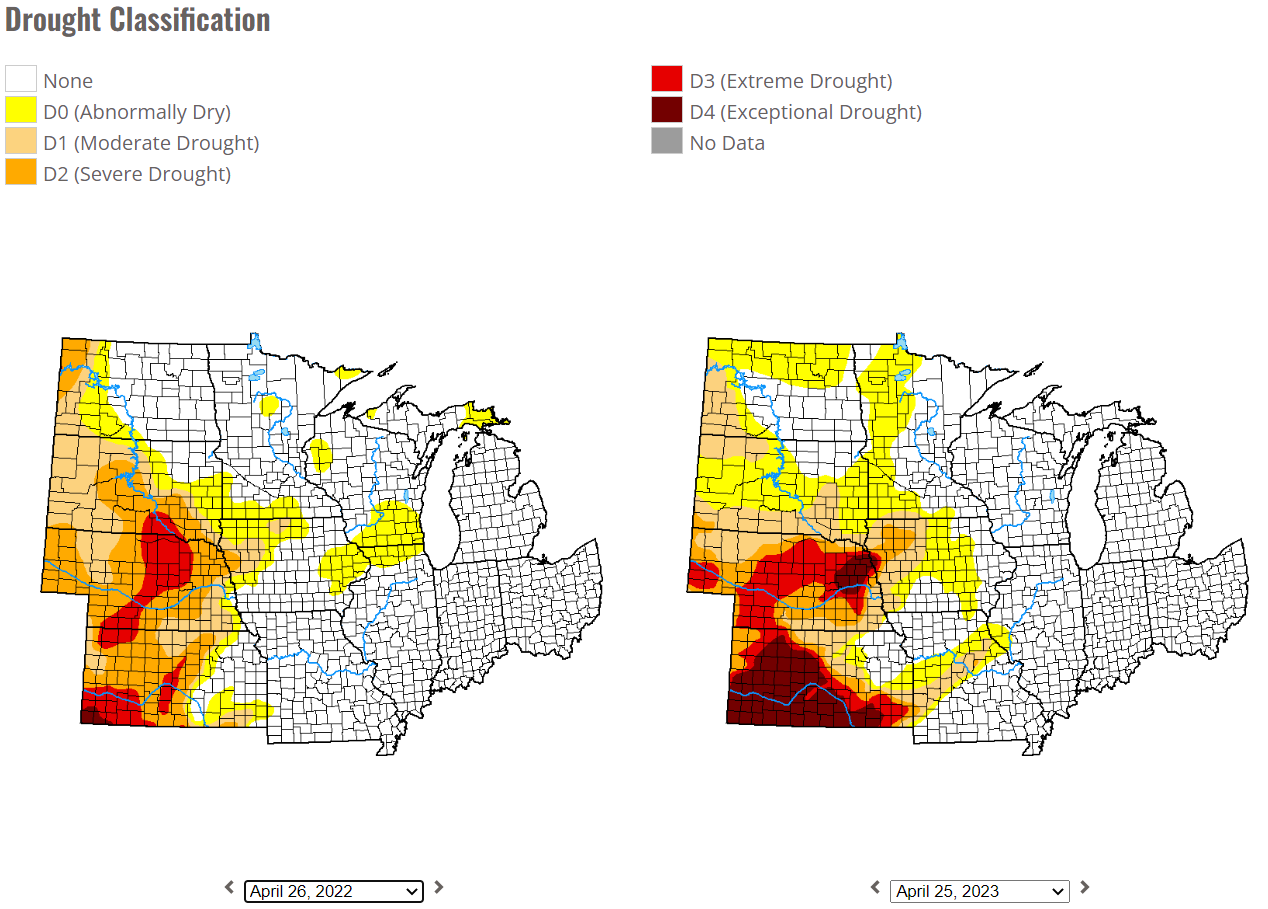

Going into May slightly drier than we did in 2022. Will need to monitor this close, funds like to trade headlines and that gives us marketing opportunities throughout the growing season.

Going into May slightly drier than we did in 2022. Will need to monitor this close, funds like to trade headlines and that gives us marketing opportunities throughout the growing season.