4/18/2022

Apr 18, 2022

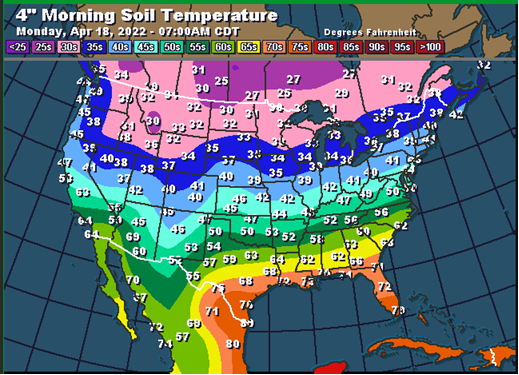

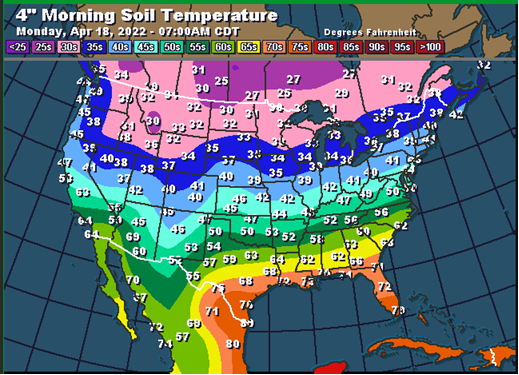

Most commodities were strongly higher to begin a new week following a 3-day break from the market. Money had new energy today with cold temps and winter like weather persisting across the grain belt, keeping planters parked. Also adding fuel to the fire was a fresh Russian offensive in Ukraine where it is now expected that 40% of the wheat will not be harvested and an estimated 36% of total corn production area is considered to be inside "dangerous" regions. Weekly export inspections were within their estimated ranges last week with 1.139 mln tonnes of corn, 973k tonnes of soybeans, and 432k tonnes of wheat inspected for shipment last week. Corn shipments are 12 million bushels behind the pace needed to reach the USDA target versus 9 million bushels short last week. Soybean shipments are 44 million bushels behind the pace needed to reach the USDA target versus 68 million bushels the previous week. Traders will look to see if corn planting advanced in this afternoon's progress report. More seasonal weather looks to finally make an appearance for many areas during the back half of this week but it also looks like the warmer temps will spark some consistent rain fall at the same time.