4/12/2023

Apr 12, 2023

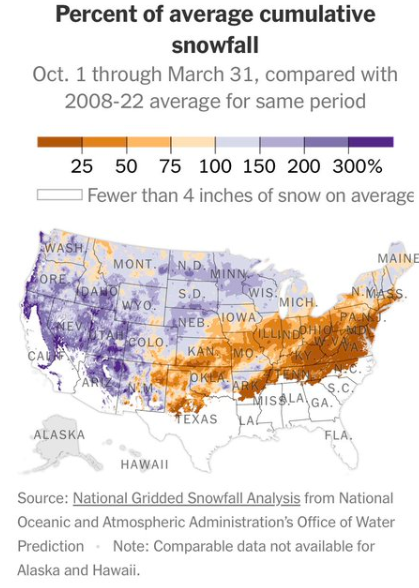

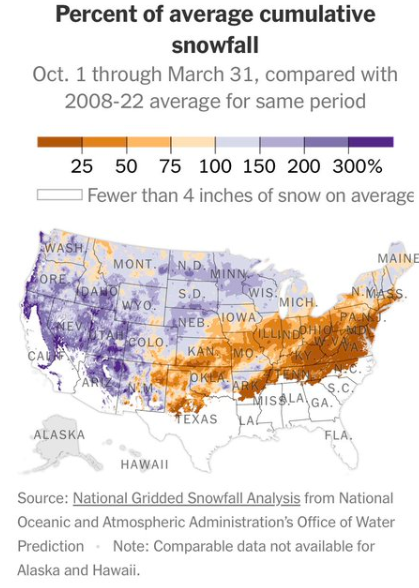

A quiet day overall for corn and soybeans with the front months stuck inside of 5 cents ranges for a majority of the session. One side of the market that continues to be active and volatile on a daily basis are spreads. If you still have basis-fixed against the May futures, we have some lucrative opportunity to be rolling those contracts at substantial gains. Weekly ethanol data showed production down 44,000 barrels per day to 959,000 bpd. Stocks were down by 8,000 barrels to 25.13 mln bbls. Estimated corn use for ethanol to date is down 5.3% from last year and 22 million bushels below the pace needed to meet the USDA target. Winter wheat country remains dry and the northern plains needs to melt a lot more snow which means we still have potential for a rally. Improvements in either of these areas will keep price gains mostly capped. The USDA will give us our first look at the 2023/24 crop balance sheets next month and they will likely show a growing supply.